How quickly do top career sites fill job their openings?

Job searches today begin online. Whether via a PC, smartphone, tablet or other device, digital recruiting is essential for world-class HR departments. A company’s online presence can often make—or break—that critical first impression.

Job searches today begin online. Whether via a PC, smartphone, tablet or other device, digital recruiting is essential for world-class HR departments.

A company’s online presence can often make—or break—that critical first impression. If your career website is easy to use and engaging, you’re likely to make a positive impression on hire-worthy candidates. Considering it’s a job-seeker’s market, this is more important than ever.

Every year LinkUp releases the Top Rated Career Websites report that weighs numerous factors such as visibility, user experience, and mobile friendliness. In 2017’s report, there were a few surprises. This year we had six newcomers to the top 25 of Fortune’s 100 Best Companies to Work for 2017. Two of the new arrivals, KPMG and Publix Super Markets, made top three, with KPMG edging out employment all-star Google for the top spot.

This report has a ton of useful data, but I wanted to dig a little deeper. I wondered: If you’re the best of the best, how does it really impact job duration? One would hope that a top-rated career website would lend itself to an efficient recruiting process and ability to get top talent for open positions.

A breakdown for the analytical geeks and number nerds like those of us at LinkUp: Job duration is a measurement we use to indicate how long a job stays posted online before it is removed from an employer’s job site. At this point we presume it has been filled. At LinkUp, we can analyze data for both the closed duration (that is, the average online “lifespan” of a given job on the day it is taken down) and open duration, which measures the age of existing jobs on a given day.

Why is this data important? Because both can tell us how quickly or slowly jobs are being filled within companies, industries and geographic areas. From there we can make inferences about supply and demand for sectors, companies, or regions.

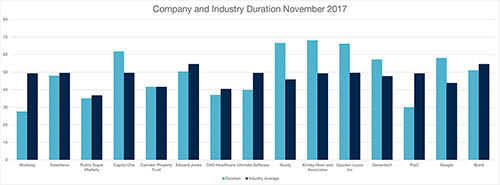

I started by comparing the top sites’ closed duration numbers for the months of July and November with that of their respective industries by NAICS code. I found that these sites typically have a similar or longer duration compared with the averages.

This means that the length of time these jobs are posted before they are taken down (assuming they have been filled) is right in line with their industries. This makes sense. A much longer-than-average duration would indicate that they struggle to fill openings, and a shorter-than-average duration could mean unusually high turnover.

This data speaks to the caliber of these companies that have clearly put a lot of focus on their career web pages and online recruiting efforts. The jobs posted on their sites stay up for a good amount of time considering industry averages, which should make their HR leadership very happy.

To learn more about the components of a 2017 top-rated career website, including which companies made the cut, download the full whitepaper. To learn more about job market data indexed from more than 45,000 companies, visit the LinkUp Data Seekers webpage.

Insights: Related insights and resources

-

Blog

07.28.2022

Q2 2022 Economic Indicator Report: Labor market slowdown

Read full article -

Blog

04.25.2022

Released: Q1 2022 Economic Indicators Report

Read full article -

Blog

02.04.2021

U.S. Labor Demand Is Growing But January Jobs Numbers Will Disappoint Tomorrow

Read full article -

Blog

02.06.2020

LinkUp Forecasting Strong Job Gains of 225,000 in January

Read full article -

Blog

06.01.2018

2018 ATS Market Share Report

Read full article -

Blog

12.23.2017

The Grinch and Scrooge Are Conspiring To Ruin Christmas With a Terrible December Jobs Report

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.