How do banks & investments in tech talent differ?

There is a clear evolution happening around the technologies used in banks and financial companies today, which you can see both in the financial products they offer, but also the type of talent in which they invest. Our analytics team …

There is a clear evolution happening around the technologies used in banks and financial companies today, which you can see both in the financial products they offer, but also the type of talent in which they invest.

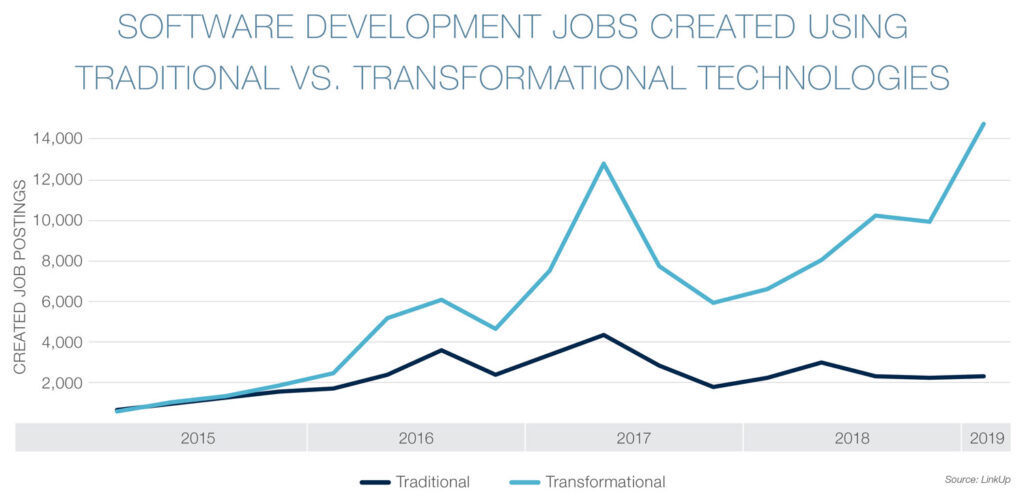

Our analytics team explored the hiring data of select relevant companies in this space to learn about their future strategy and priorities. We found that traditional software development jobs are on the decline, while transformational technology jobs have risen more than 700% since 2015.

Transformational technology jobs leverage modern computer development, and require skills such as Agile, Cloud, data & analytics, data science, Python, and software as a service.

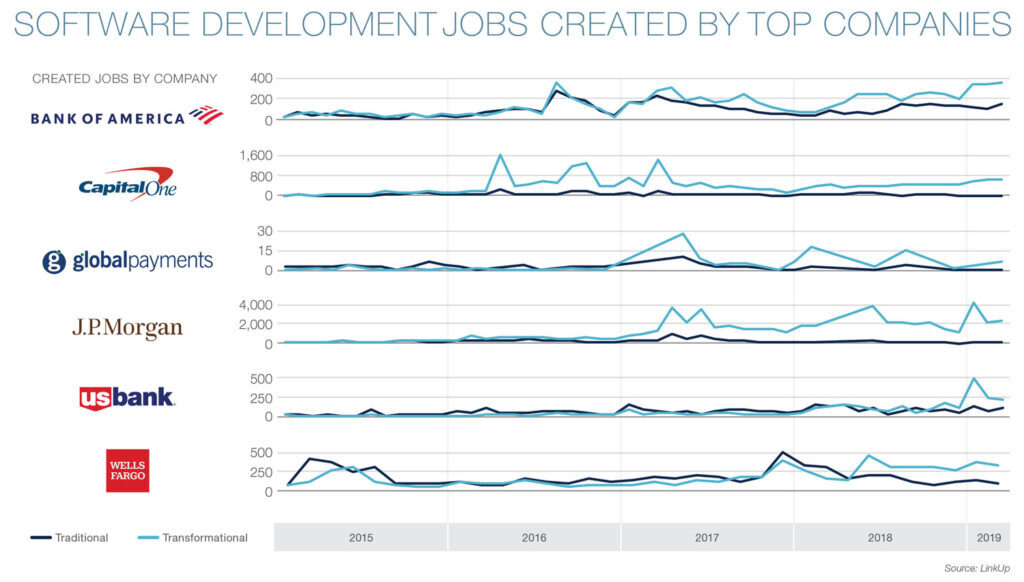

According to LinkUp’s job data (jobs sourced exclusively from company career sites), all of the finance and banking companies we looked at have greatly increased their transformational technology hiring, yet each company’s timeline for transition is different and provides clues as to its unique strategy and priorities.

The slowest movers to make the transition away from traditional technology jobs have the strongest brick and mortar presence (US Bank and Wells Fargo), while Capital One and Global Payments began sourcing for this talent much earlier.

And while JP Morgan and Bank of America weren’t the first to hire, they are seen as currently winning Wall Street’s technological arms race, as smaller firms try to catch up.

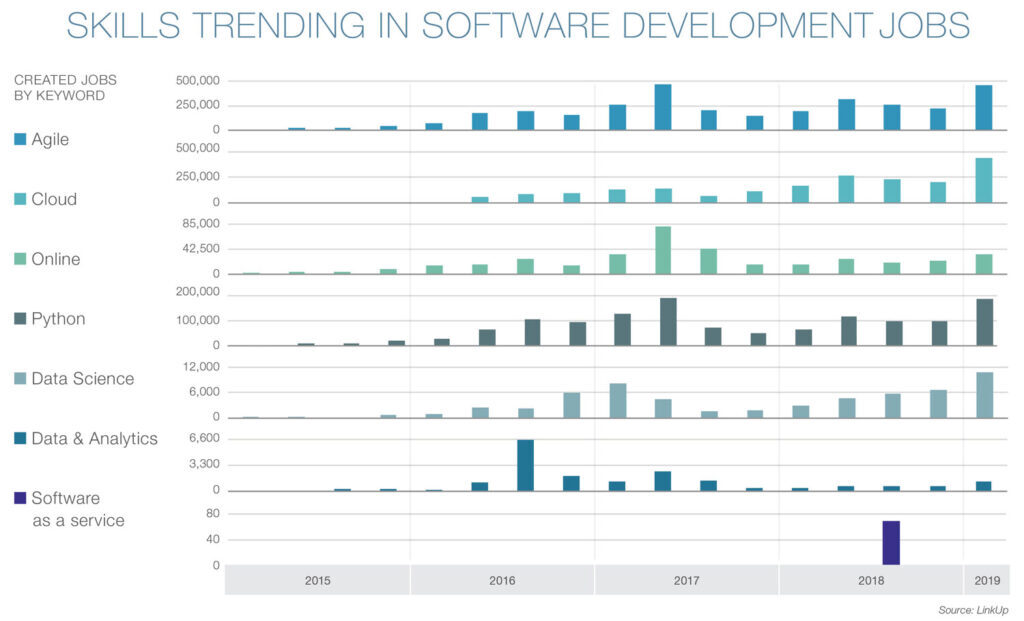

In terms of skills trending across key financial institutions, we found Agile development, Cloud, Python, and online development to be on the rise, while data and analytics skills are seeing a decline as these companies transition to more modern data science approaches.

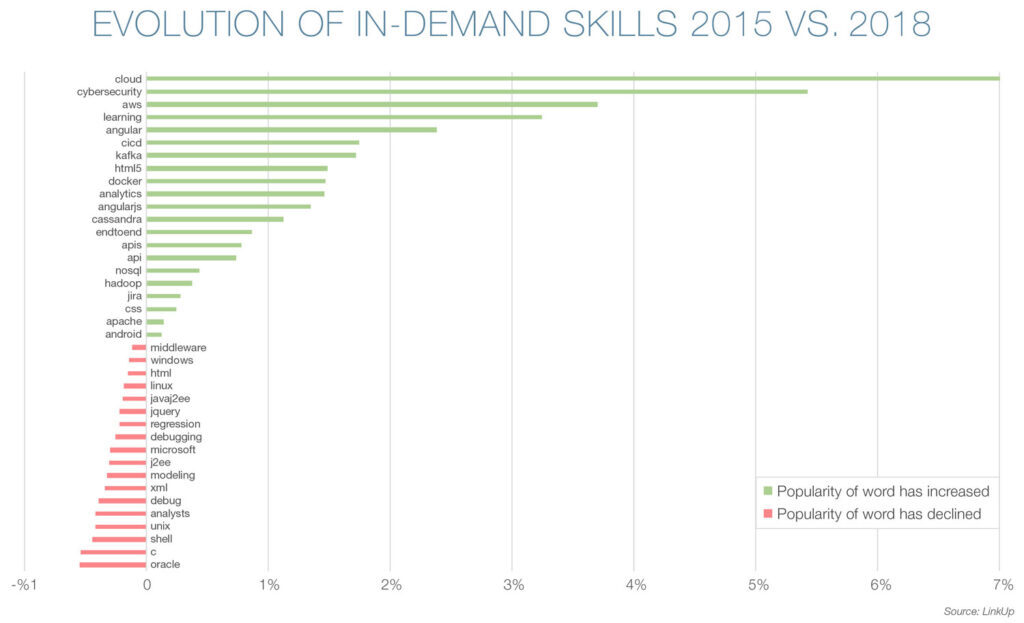

An even more detailed look at trending skills shows that the most increasingly in-demand tech skills include Cloud, cyber security, and AWS, while Oracle, Shell, and Unix are decreasing most in popularity. That might in part be due to the financial sector specifically leveraging languages like

We also looked at firms investing specifically in their payments business. While some companies like Global Payments and Square focus primarily on payment technology, traditional banks are also working to secure market share.

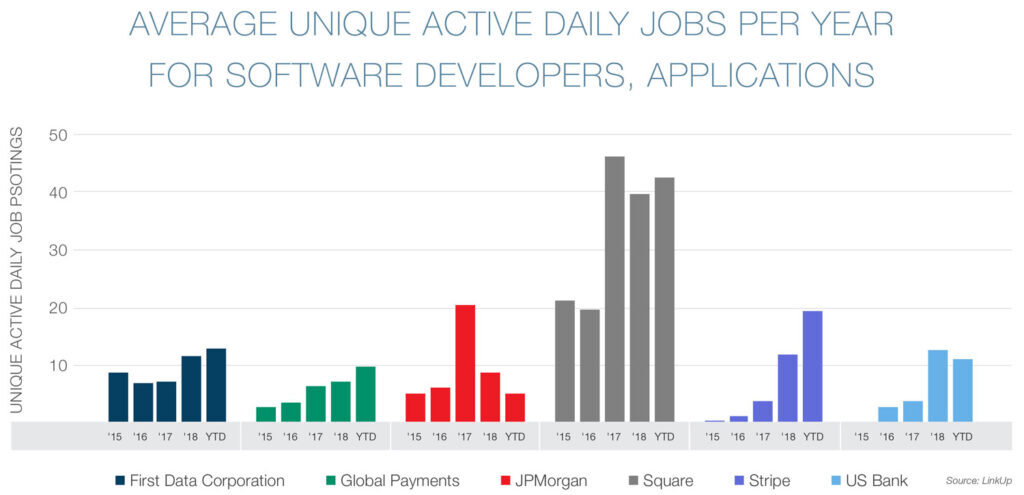

The average unique active daily job count for “Software Developers, Applications” at select relevant companies show that while square leads the pack in terms of application developers, JP Morgan is investing as much in this talent as companies like Stripe and Global Payments.

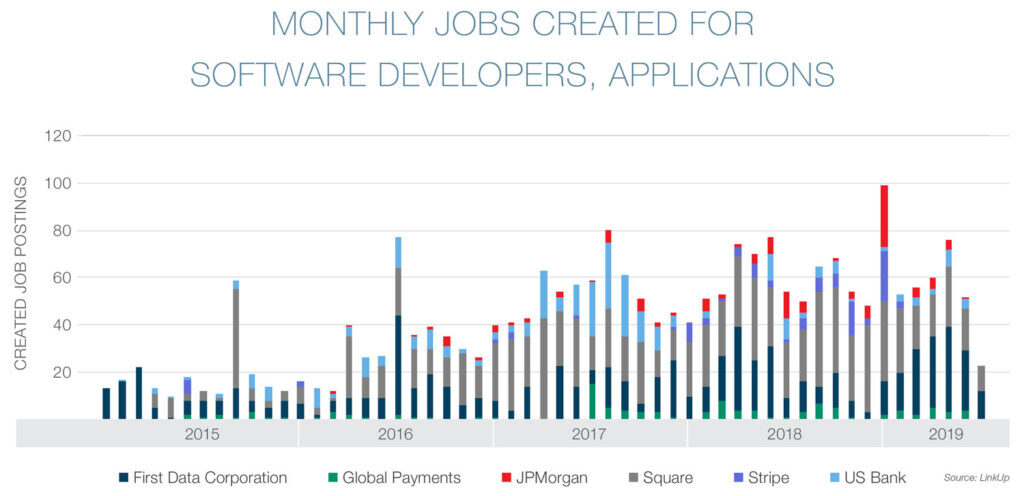

A consolidated look at this in-demand position shows an increase in hiring collectively, but also shows Square and First Data leading the pack most recently.

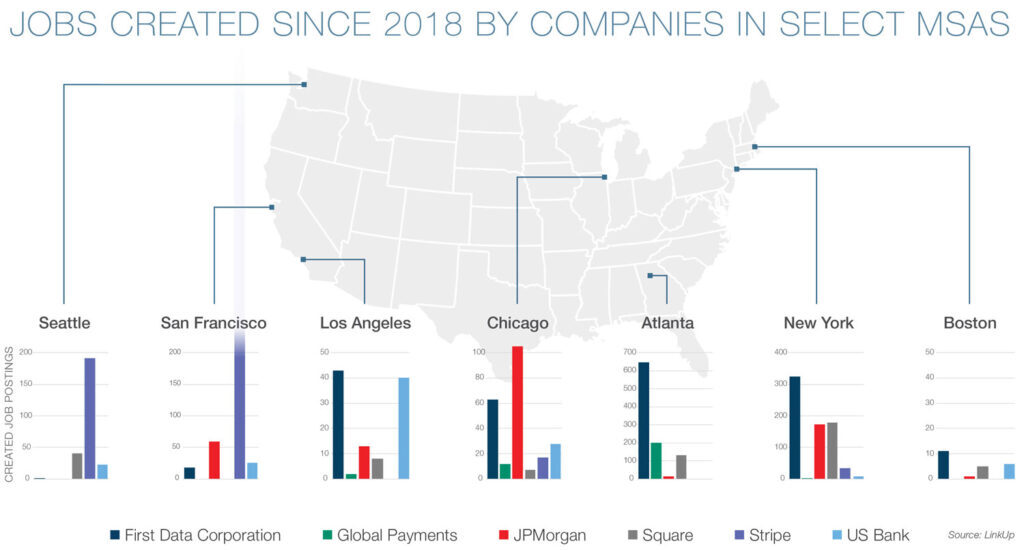

It’s also interesting to note where hiring at these companies is taking place. Stripe’s hiring has been focused on West Coast hot spots such as San Francisco and Seattle, while Square has clearly been investing in more East Coast talent located in New York, Atlanta, and Boston.

In terms of traditional institutions US Bank is headquartered here in Minneapolis, but has significant hiring activity in Los Angeles. Similarly, one might associate JP Morgan with their Wall Street headquarters in New York, but it has been looking for nearly as much talent in Chicago as in New York.

Interested in the job market data behind this post? Contact us to learn more.

Insights: Related insights and resources

-

Blog

06.25.2020

What job listings tell us about big banks

Read full article -

Blog

06.01.2018

2018 ATS Market Share Report

Read full article -

Blog

05.24.2018

Beyond Silicon Valley: Where the tech jobs are

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.