Higher Forever

Sell the house. Sell the Car. Forget it. Inflation and rates are never coming back.

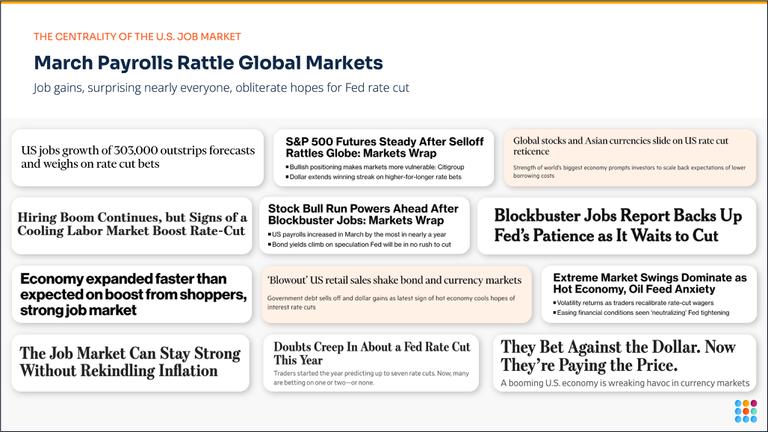

Bloomberg’s Evening Briefing this past Friday night delivered an ominous, chilling summary of where the markets sit as snow flurries descended upon Minneapolis:

US equities sold off sharply on Friday, sending tech stocks to their biggest weekly loss in 17 months. The S&P 500 closed down 0.9%, dropping for the third straight week and leaving it more than 5% below its closing high at the end of March. The Nasdaq 100 meanwhile declined 2.1%, recording its deepest weekly drop since November 2022. At the same time, the Cboe Volatility Index climbed close to 19. The market drop comes as the US Federal Reserve pushes back rate cuts, fear grows of a potential rate increase should inflation continue to stick, and the ramifications for oil prices amid further military escalation in the Middle East.

The bad news on Wall Street this week has some thinking the big boom of 2024 has come to an end. The rally looks close to unraveling as would-be bulls turn tail and run, and money is pulled out of equities and junk bonds at the fastest rate in more than a year. In some ways, investors face the same risks they chose to live previously thanks to resilient corporate earnings and fast economic growth. But this week the calculus seems to have shifted.

The calculus shift comes almost entirely from the persistent strength of the U.S. job market which has surprised most observers throughout the first quarter (if not the past 2 years), a 3-month timeline during which the market’s expectations in January for 6 or 7 rate cuts in 2024 were slowly decimated.

The tattered remnants of those fevered dreams were finally obliterated on April 5th when the March jobs report came in with a net gain of just over 300,000 jobs - well above consensus estimates and capping off a tumultuous 10 days that started with Fed Chair Powell, in a speech at Stanford, desperately trying to reassure the markets that he still expected 3 rate cuts in 2024 despite growing doubts that had been escalating since January. Powell’s ill-timed pronouncement was followed by various data releases, cacophonous commentary, plentiful Fed speak, and sharply rising volatility as markets whipsawed back and forth on a daily basis for over a week.

And then the March payrolls earthquake hit: significant job growth with broad gains across much of the economy, upwardly revised jobs data for January/February, a drop in unemployment, huge gains in the household survey, rising labor force participation, and healthy but moderating wage inflation.

Given the way that U.S. and global markets are still freaking out (and likely will continue to do so for some time), it’s abundantly clear that there is much about the U.S. job market and its singular impact on the U.S. economy (and therefore, global markets), that was confusing or unclear to most.

As readers of this blog know, there is not, nor has there ever been, anything perplexing about what’s been happening in the U.S. job market. I’ll spare everyone yet another summary of the pandemic-era job market narrative(s) replete with links to dozens and dozens of our posts over the past 4 years and summarize, instead, the present situation by stating simply that a perfectly balanced job market continues to power a robust U.S. economy and will do so indefinitely until such time as something, as yet undetermined, knocks it off its present course.

There are, of course, a few storm cloud risk-factors on the horizon, most notably wars in Europe, the Middle East, and the U.S. House, but the first two will likely be more impactful on global markets than the U.S. job market, and regarding the third, the U.S. economy seems to have become largely immune to the GOP gong show.

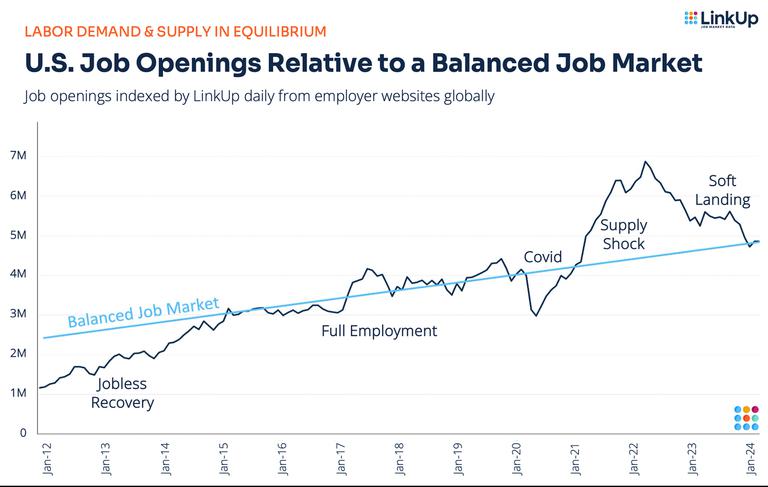

The chart below, which we first posted about a month ago just prior to issuing our March NFP forecast of 290,000 jobs (the highest on Wall Street), shows precisely how perfectly balanced the job market has become since the start of the year.

As the chart above shows, it’s been quite a rollercoaster ride to get to where we are at the moment, but here we are. The bid-ask spread between employees and employers that we first discussed back in June of 2021 has been eliminated and there is now perfect balance between labor demand and supply.

As we wrote nearly every month during that period, the gap between labor demand supply was bridged over time by employers capitulating to every single demand made by employees regarding wages, benefits, remote work, work-life balance, corporate culture, and, more broadly speaking, the obtainment of greater dignity and respect.

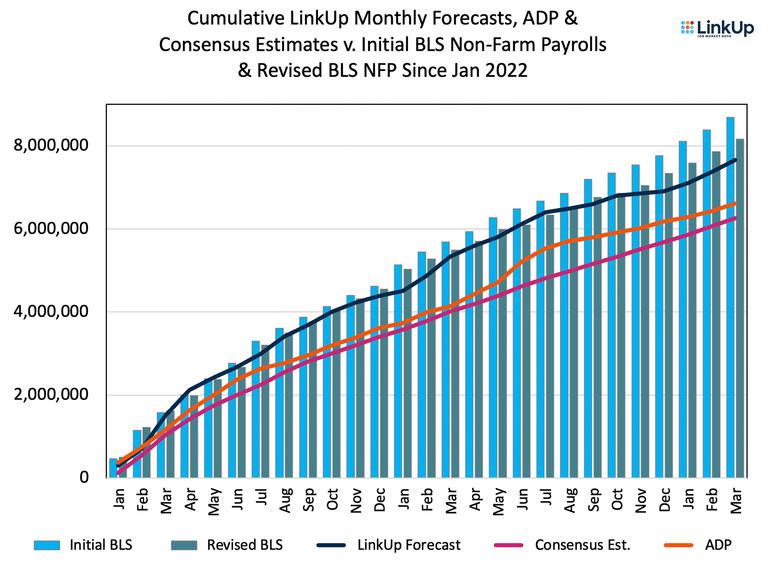

With employers repeatedly strengthening their bids, more and more people returned to work and cumulative job gains since 2022, totaling 8.2 million jobs, have surpassed consensus estimates by 30%.

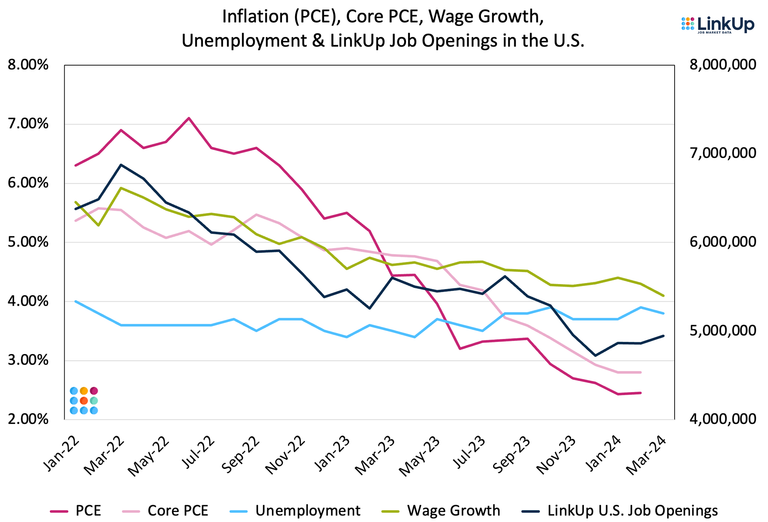

And as that gap between labor demand and supply narrowed, supply shocks around labor, goods, and services faded, wage inflation tapered, broader inflation dropped, and unemployment stayed below 4% throughout.

We’ve landed ever so softly.

We’ll see where inflation comes in Friday when the Bureau of Economic Analysis releases PCE numbers Friday, but at this point, it’s almost irrelevant. The phenomenal balance that’s been achieved in the job market and the economy as a whole has put us in a place where we’re essentially living amidst a whole series of neutral rates. Rounding a bit, those include the Fed Funds Rate (5%), labor demand growth (5%), unemployment (4%), wage inflation (4%), Core PCE inflation (3%), and GDP (2%).

Looking ahead, absent some significant external catalyst and allowing for a bit of movement up and down month to month, this is where we could very likely be for a long time. And to be sure, this is a really, really good place to park the U.S. economy for as long as we possibly can: the economy is solid, wages remain elevated, wage inflation is flat but above broader inflation, monthly job gains are strong, consumer confidence is rising, and core inflation has dropped ~65% since the Fed started raising rates in March of 2022.

So from our perspective, this is the new, post-pandemic normal. The soft landing has occurred (arguably, it did so nearly a year ago) and we’ve most assuredly arrived at the final destination. There is nowhere else to go.

Inflation has come down as far as it’s going to for a whole host of reasons and every other aspect of the economy is operating at a level where ~3% inflation is (or least should be) totally acceptable. Consumers are adjusting, businesses are adjusting, and even the markets are adjusting (albeit with some pain and serious gnashing of teeth).

Eventually the Fed, too, will adjust, make no mistake.

Inflation is going to stay at roughly 3%, plus or minus .5% (and maybe occasionally even +/- 1%). It will bounce around month to month and, of course, the incessant debates will continue around PCE v. CPI, exclusions and core, lags, the actual measurability of true inflation, perceptions and vibes and expectations, stimulative fiscal policy, why 2% was ever even the target anyway, whether or not a range with more latitude for the Fed makes infinitely more sense, deficits and the national debt, and possibly the end of capitalism as we know it.

But all of these sub-narratives are just noise. Ignore them. They’re beside the point.

Like we said in January when the debate at the time was centered around how many cuts (6 or 7?) and how soon they were going to start (March?), we noted that the only thing that mattered was a balanced juggernaut of a job market that was going to power consumers, businesses, and the economy indefinitely. Based on job growth, elevated wages, low unemployment, and a rock solid economy, those debates completely missed the only thing that mattered - the job market.

Based on that recognition, we noted in our 10 predictions for 2024 that rates would most certainly be higher for longer. As rate cut expectations dropped to 3 cuts, we said we’d happily take the under. And now that expectations call for 1-2 cuts yet this year, a sentiment that will inevitably migrate to no cuts this year when March PCE and April jobs numbers come out, our view is that rates will be higher forever.

They are never returning to where they were.

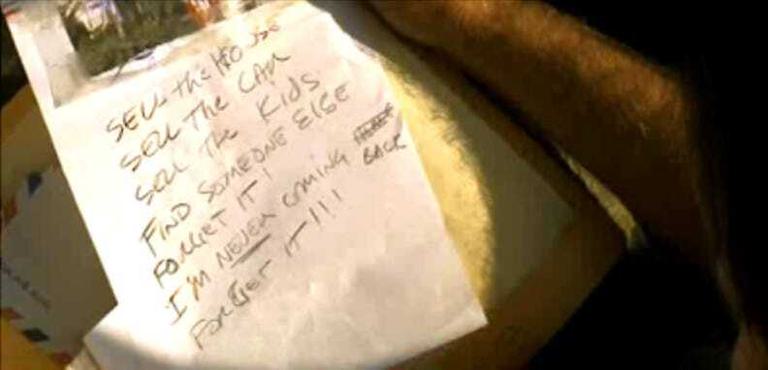

Like Colby wrote in the note to his wife from Col. Kurtz’ camp in the jungle in Apocalypse Now, “Sell the house. Sell the car. Sell the kids. Find someone else. Forget it! I’m never coming back. Forget it!!!”

And regardless of what persistently higher rates mean to the U.S. and global markets, they’re likely a good thing. The last time we had a balanced, full employment environment, and it was not that long ago, was January 2015 to February 2020 - a stretch of 62 months of consecutive monthly job gains totaling 12 million jobs that took a catastrophic, global pandemic to bring to an end.

So far, we’re in month 3 with a gain of 830,000 jobs. Let’s hope this doesn’t end anytime soon.

Insights: Related insights and resources

-

Blog

04.17.2024

LinkUp Launches Compass, a Visual Multitool for Job Market Insight

Read full article -

Blog

04.10.2024

LinkUp Forecast: March JOLTS report by the BLS

Read full article -

Blog

04.09.2024

Q1 2024 Economic Indicator Report

Read full article -

Blog

04.03.2024

March 2024 Jobs Recap: Labor demand ticks up steadily with all eyes on Fed

Read full article -

Blog

04.01.2024

LinkUp Forecasting Net Gain of 290,000 Jobs In March as Job Market Continues To Show Extraordinary Resilience

Read full article -

Blog

03.25.2024

Both the Job Market and the Economy Are In Near-Perfect Balance; The Fed Will Sit Tight Until Forced To Do Otherwise

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.