Good news, bad news

In a recent piece, we discussed how the job market in the United States is tight, and people are leaving their current jobs for more favorable ones, also known as the ‘Great Resignation.’ From the most recent LinkUp job market statistics, we can see the U.S. employment market remained robust at the start of February, with high demand from the Health Care, Retail Trade, and Accommodation and Food Service sector.

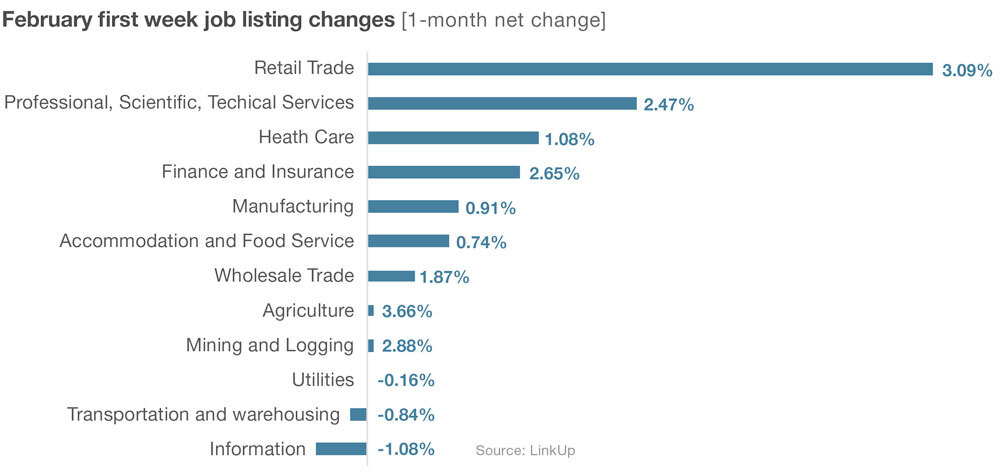

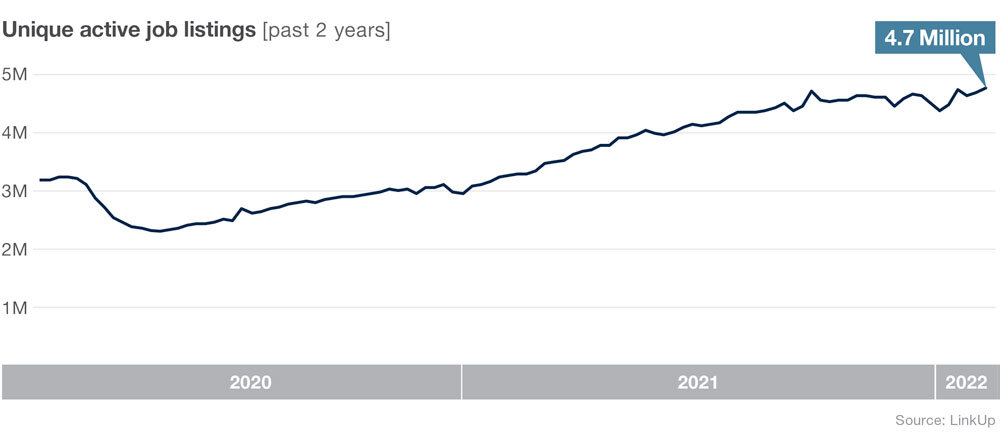

The number of active job listings in the first week of February climbed by 8% over the previous month, reaching 4.7 million–the greatest level since the onset of Covid.The Retail sector has seen the most job growth, followed by the Professional, Scientific, and Technical Services and Health Care sectors.

There’s good news and bad news when it comes to a strong job market. On the plus side, the hiring boom shows no signs of slowing down, with businesses having to work harder than ever to attract top talent. Companies are increasing wages to compete for workers in a labor market where there are more available opportunities than job seekers.

However, on an overall basis, real wages are declining due to rapidly increasing inflation. The Bureau of Labor Statistics reported on February 10 that inflation in January increased by 7.5 percent over the previous year and reached its highest level since February 1982. As the cost of living crisis begins to really bite, many people are finding themselves with less money than they expected. According to the Labor Department, real average hourly wages for all employees grew by only 0.1 percent from December to January after adjusting for inflation.

This begs the question: will the current situation deteriorate into a wage-price spiral? A wage-price spiral is an upward cycle in which greater wages cause prices to rise, promoting employees to demand even higher pay, and so on. When workers earn a raise in pay, they want more goods and services, and this, in turn, causes prices to rise. The salary rise raises general business expenses, which are then passed on to consumers in the form of increased pricing and result in an upward loop.

So far, many economists think such a situation can be kept at bay. As supply chain bottlenecks ease and congressional expenditure declines, we still see the likelihood of inflation starting to decrease on its own. If that’s the case, the Fed may raise rates from their current ultra-low levels without having to constrain the economy too much. However, if the central bank needs to intervene more directly in inflation, the labor market would most certainly suffer, perhaps resulting in layoffs and wage cutbacks. The Fed, in a more pessimistic scenario, may trigger a recession.

Let’s see what will happen…

Insights: Related insights and resources

-

Blog

11.12.2021

October 2021 Jobs Recap: Autumn brings falling job listings

Read full article -

Blog

04.10.2020

Job data highlights from a historic month | March 2020 Recap

Read full article -

Blog

03.05.2019

LinkUp Job Market Data Points To Softening Labor Demand & Below-Consensus Job Gains In February

Read full article -

Blog

10.12.2018

Health Care jobs trending down from 2016

Read full article -

Blog

12.20.2017

Monthly Industry Spotlight: Retail

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.