Get a Shot and Wear a Mask to Save Lives and Help the Job Market. Jabs and Jobs!

There are seemingly endless ways to compare the job markets during the recoveries following the Great Recession and the Global Pandemic, but we’ve reached a particularly noteworthy intersection following July’s jobs report from the BLS.

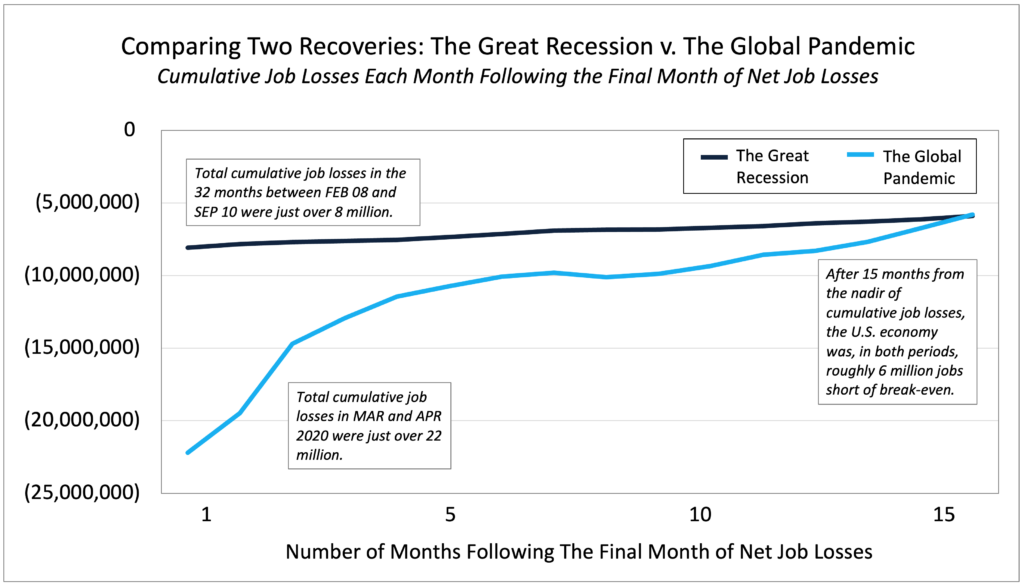

Last month marked the 15th month since April 2020, the 2nd and final month of net job losses in the U.S. following the lockdown of the economy in March of last year. Combined, the U.S. economy lost a horrifying 22.2 million jobs in just two months and has since, in the subsequent 15 months, recovered 16.4 million of those jobs, leaving a shortfall of 5.8 million jobs.

In oddly similar fashion, it took the exact same 15 months following the final month of job losses obliterated by the Great Recession roughly a decade ago to reach the same number of jobs away from getting back to break-even.

The difference, obviously, is the magnitude of the job losses from the pandemic and the fact that we have just recovered 14 million more jobs than we did in the same time-frame following the great recession. Equally of note is the fact that monthly job losses spanned 32 months from February 2008 to September 2010 and it took almost 4 years to climb back to break-even in July 2014.

In this recovery, if monthly job growth trends persist, we will get back to break-even somewhere in Q1 2022 – less than 2 years after losing 22 million jobs. So in this Global Pandemic, relative to the Great Recession, we lost 3x the number of jobs and will have recovered them in half the time. That concussion-inducing whiplash is jaw-dropping.

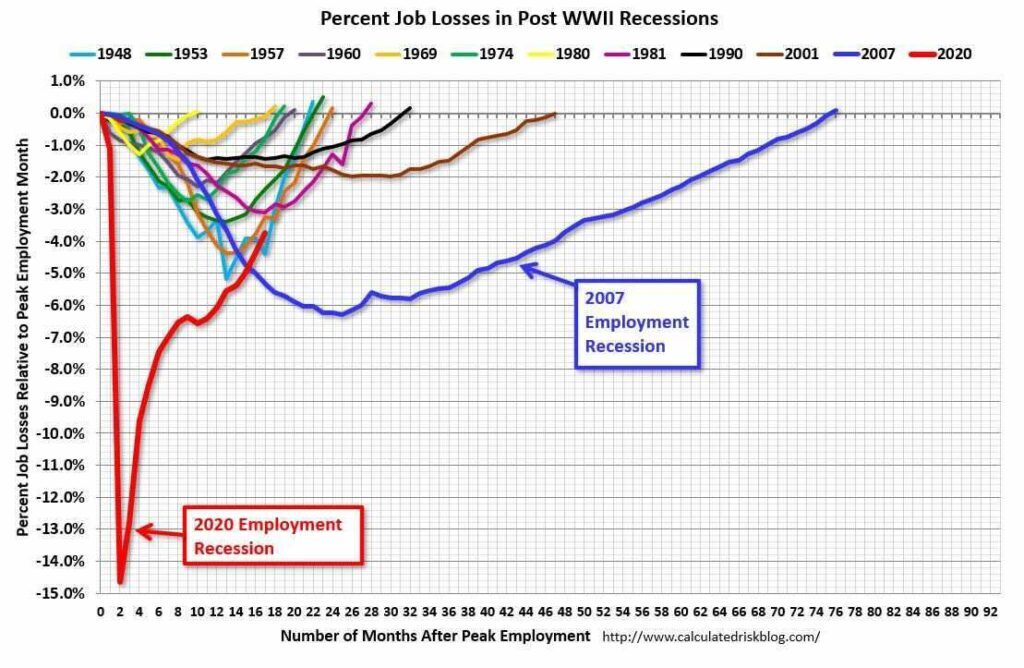

And because it’s the best jobs chart ever, the renowned ‘Scariest Job Chart’ published on the CalculatedRisk Blog does captures perfectly how rapidly we’ve recovered from the devastation of last spring.

This context is absolutely critical because it is the whiplash-inducing speed of the job losses and subsequent gains that is the crux of the issue behind the consternation at the Fed and intense debate going on these days around inflation.

For the past few months, we’ve been writing quite extensively about how different this recovery is from what the U.S. economy did and didn’t see during the jobless recovery following the Great Recession. A decade ago, it took 4 years to get the economy rolling again and during that excruciatingly painful stretch, the ‘Jobless Recovery,’ labor demand was scant and grew only gradually over years and years. During that seemingly endless period, there were millions and millions of Americans desperate for work.

As a result, there was virtually no wage inflation until way late in the process, well after employers had found it sufficiently difficult to fill positions and had exhausted every other trick in the book to avoid actually having to raise wages and pay people a market rate necessary to fill the role. After bitching and screaming for months and months about lazy, high-maintenance and overly-demanding millennials and the phantom bogey-man called the Skills Gap, employers deployed their standard bag of tricks that included things like worthless perks, fluffy office amenities, referral fees, and sign-on bonuses. Only as a last resort did employers begrudgingly raise wages and they did so in small increments very slowly over multiple stages of the recovery.

At a collective, aggregate level, what employers did not do, mostly because they didn’t have to, is thoroughly reassess their orientation towards the people in their companies and fundamentally transform and improve the way they operate their businesses in relationship to their employees.

Not only did employers fail to materially move the needle towards paying fair, living, and market-rate wages, they didn’t improve healthcare benefits, accommodate the changing needs and demands of families, invest in training and education, provide meaningful career opportunities, improve workplace conditions, or offer flex-time and remote work. In the broadest sense, and I fully recognize it’s a massive generalization but accurate nonetheless at a macro level, businesses have, for the past decade, worked aggressively to continue tilting the playing field in their favor at the expense of their employees.

And now, as a result of the Covid cataclysm, employers are starting to face some of the consequences of that egregiously tilted playing field as employees, pretty much across the entire economy, have essentially gone on strike and are demanding changes. A large number of people are refusing to go back to their old job under any circumstances and an even larger chunk of the workforce is unwilling to go back to the same job at the same level of pay and/or under the same working conditions.

Of course, too-low vaccination rates, the Delta variant, and the insanity of Republican governors are all exacerbating the situation in the short-term, but those are temporary (hopefully) and will eventually subside if and when the country gets its collective brain back. In the meantime, given the irrefutable correlation (as evidenced in the map below) between vaccination rates and labor demand, we can all expect to continue paying a red-state craziness tax in the form of inflation.

To be clear, that red-state craziness inflation tax is, at best, only partially responsible for the inflation we’re seeing of late, but it’s most definitely a contributing factor and one that’s not only easy to solve but, most critically, is also one that would save lives.

But underlying the top layer of temporary wage inflation is a broader set of issues previously mentioned that employers (and to a lesser extent Washington and state governments) need to address if they hope to fill the millions of job openings and keep growing the economy. These issues have created a massive bid-ask spread between employees and employers and it is that wide spread and not a lack of labor supply or a skills gap or extended unemployment benefits, that has resulted in companies being unable to fill job openings.

Addressing those issues absolutely means raising wages, strengthening benefits, helping families, embracing remote work and flex time, investing in education, training, and career development, and generally improving corporate culture. Broadly speaking, workers are demanding that the playing field gets less tilted in favor of employers, even if only just slightly.

Unfortunately, even an infinitesimal shift in favor of employees is a huge ask in the minds of employers, the markets, and half the policy-makers across the country as evidenced by the din that’s erupted over the past few months. It is, to say the least, an exceedingly complex set of issues that dramatically impact virtually everyone’s life directly or indirectly in myriad ways, and this collective, nation-wide, stealth strike won’t end until employers and employees bridge this bid-ask chasm.

As to how that resolution relates to inflation (and again we are mostly focused on wage inflation), we agree with the transitory camp in the short term – inflation in the short-term will be abnormally high but will subside to a large degree once Covid gets under control, supply bottlenecks gets addressed, and the world returns to some sort of new normal. But we also believe that that new normal will include an average rate of inflation above what we’ve been used to for a long time. And beyond that is anyone’s guess as the job market over the long-term is impacted by major tectonic forces including, among others, demographics, public policy, technology, immigration, globalization, and the long-term impact of the pandemic, to name just a handful.

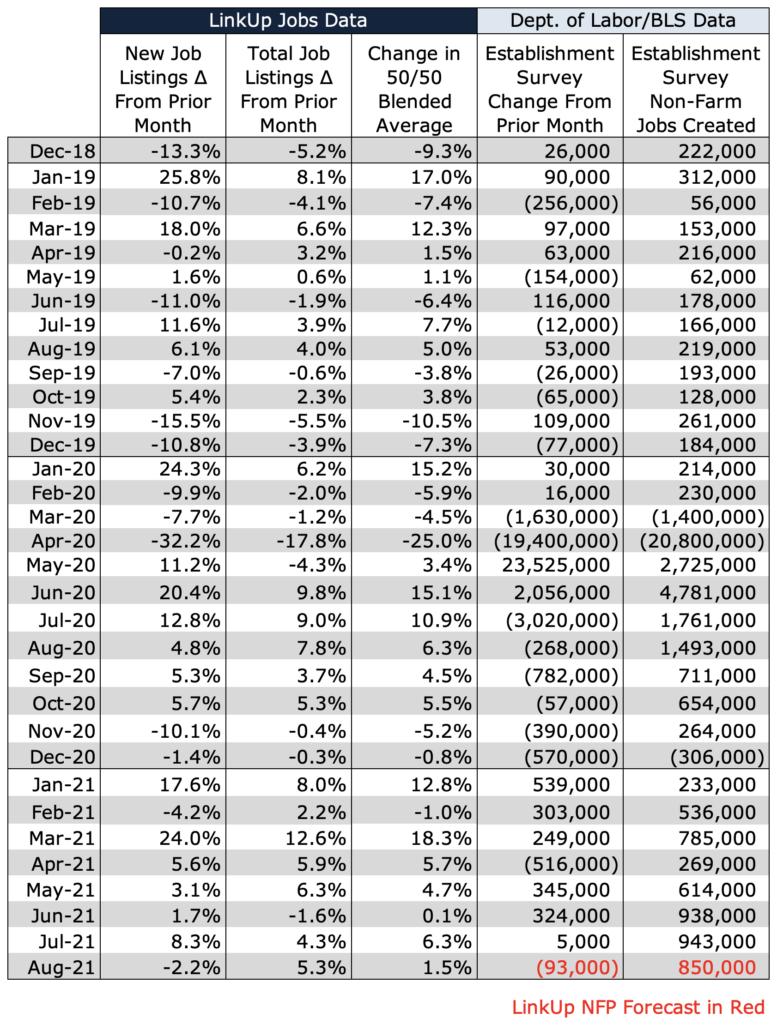

So returning to the immediate future and Friday’s jobs report (things that we are far more comfortable speculating about than long-term inflation rates), we are forecasting a net gain of 850,000 jobs for August.

As an aside, our non-farm payroll forecasts are based on LinkUp’s job market data – a global database of job openings indexed every day directly from company websites around the world. As a result of our unique approach, our high-frequency data is accurate, powerful, and insightful. And because a job opening posted on a company’s website signals the intent to make a hire, our data is predictive and highly correlated to job growth in future periods.

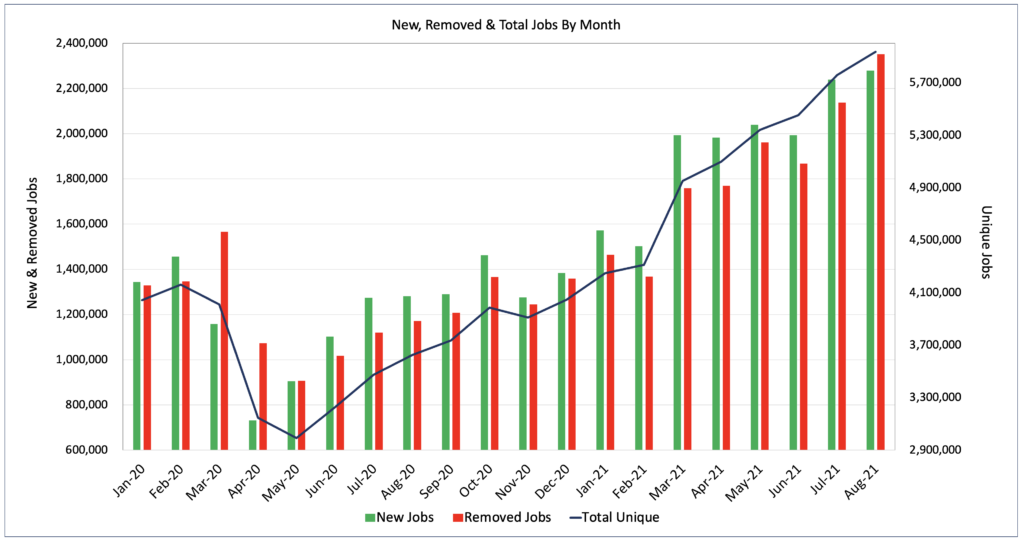

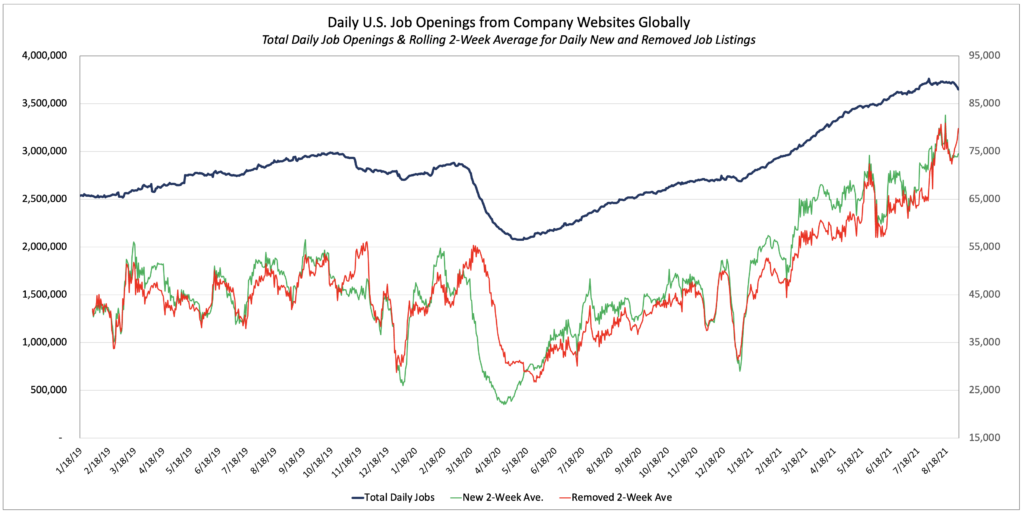

So looking at our data, total job openings in the U.S. rose 3% to 5.9 million and new and removed jobs rose 2% and 10% respectively. As we’ve noted over the past few months, jobs removed from a company’s corporate career portal a great proxy for that job having been filled, so it is equally as important a metric as new and total job openings.

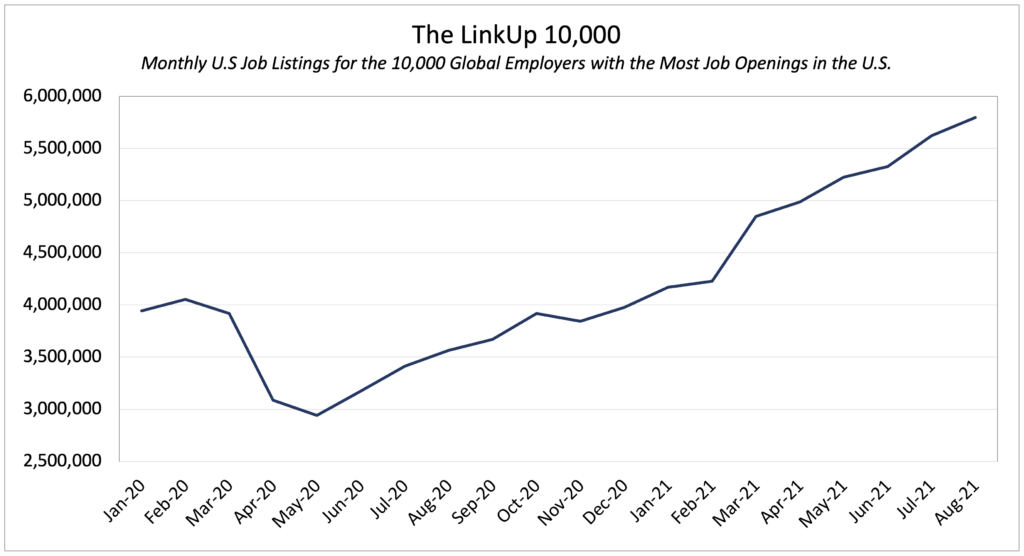

Similarly, The LinkUp 10,000 rose 3% to 5.8 million. The LinkUp 10,000 is an analytic we created to normalize our data and tracks the total job openings from the 10,000 global employers that have the most job openings in the U.S. Since January, The LinkUp 10,000 has risen 40% and since May of 2020, it’s up 97%.

Looking at the same data on a daily basis delivers a more real-time window into the job market, a facet of our data that has become highly relevant over the past 18 months and especially so in the past few months. As we highlighted in June and July, new and removed jobs are getting back in sync with one another, a strong signal that the job market is beginning to function more efficiently than it was in Q2. As a result, we expect hiring to remain strong in August and September.

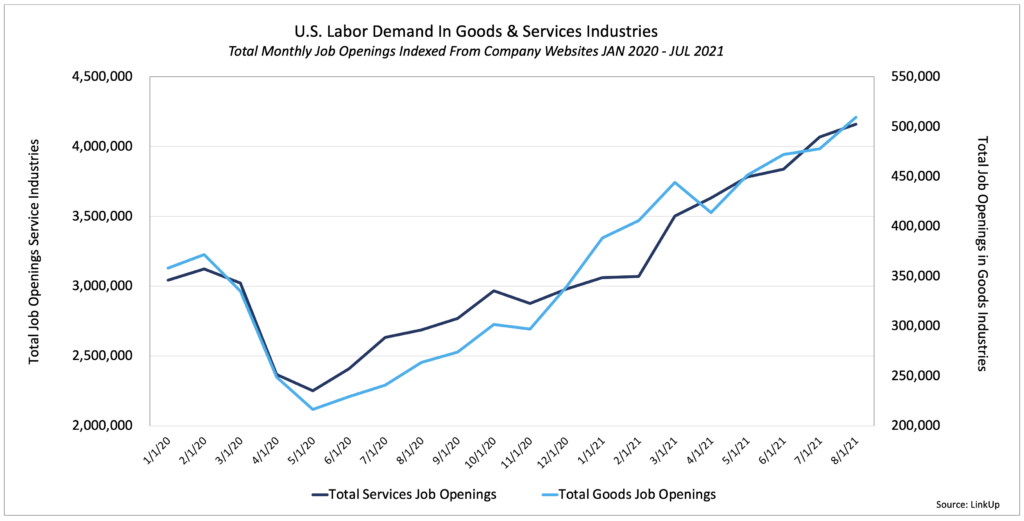

Also of note, growth in labor demand in services industries continues to track alongside the growth of labor demand in goods producing industries.

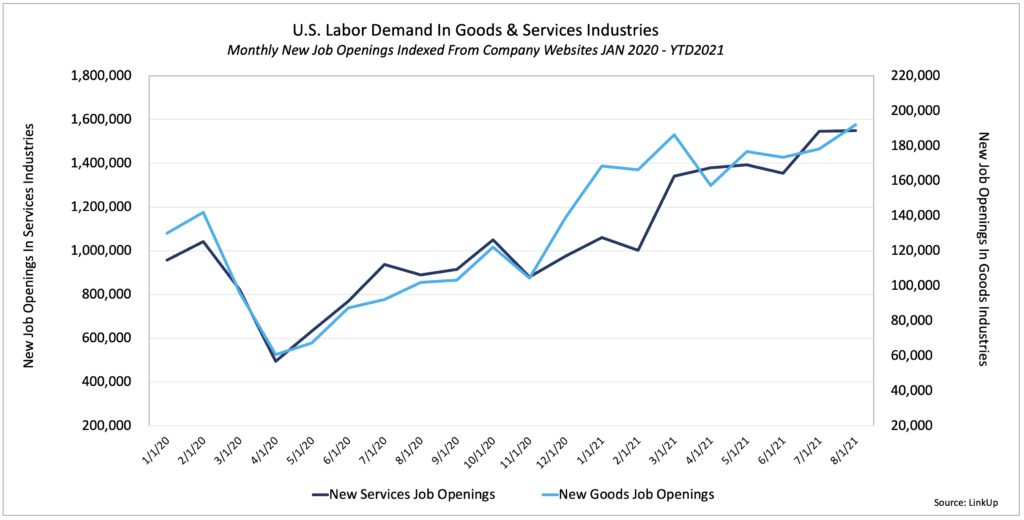

New job openings in services industries were flat in August while new job openings in goods producing industries picked up for the first time in 3 months.

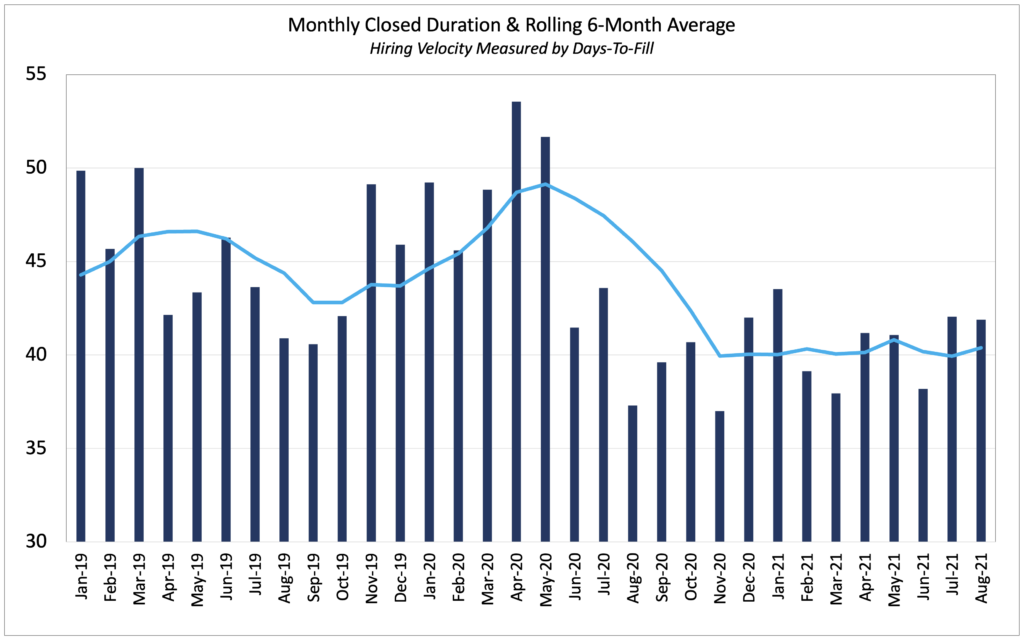

Job Duration, the average number of days that job openings are posted on company websites before they are removed – presumably because the job was filled, essentially measure of hiring velocity across the economy. And in August, hiring velocity held steady at 42 days and the 6-month average remained unchanged where it’s been since November.

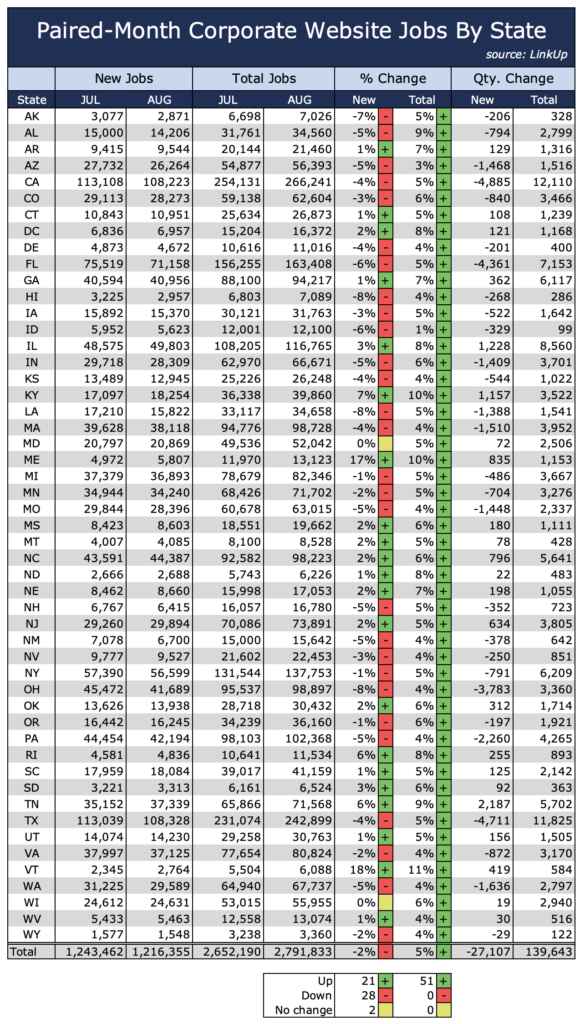

Looking at our paired month data which tracks job openings for a common set of companies that were hiring in both July and August, new job openings declined 2% while total job openings rose 5%.

So based on our data, we are forecasting a net gain of 850,000 jobs in August, somewhat above the 750,000 consensus estimate.

As always, get vaccinated and wear a mask – not only does it help save lives, you can do your part to strengthen the job market and fight short-term inflation – Jabs and Jobs!

Insights: Related insights and resources

-

Blog

09.02.2019

Despite Trump's Best Efforts, The U.S. Job Market Refuses To Cool Off

Read full article -

Blog

10.29.2018

Accelerating Hiring Velocity Means We Cannot Publish Our October NFP Forecast Until 10AM On Thursday, November 1st

Read full article -

Blog

04.04.2017

LinkUp Forecasting Net Job Growth of 260,000 in March

Read full article -

Blog

09.01.2016

LinkUp Forecasting Net Gain of 220,000 Jobs In August

Read full article -

Blog

07.07.2016

The Full Employment, Healthy Tortoise U.S. Economy Should Add 50,000 Jobs In June

Read full article -

Blog

03.03.2016

LinkUp Forecasting Decent Job Gains In February

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.