February 2024 Jobs Recap: Job Market To Stay Hot Despite Slight Dip

After a jaw-dropping jobs report for January that had the BLS add 353,000 to NFP rolls, February will seem cooler by comparison. But LinkUp is still projecting better-than-consensus job growth.

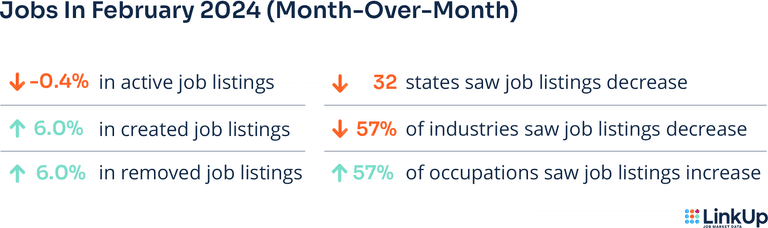

Key Takeaways:

Active listings are down slightly in February, with a .4% reduction in active listings compared to the show-stopper month of January. Despite the dip, our data indicates a job market that remains resilient and robust: we’re still forecasting a higher-than-consensus 275K job adds for February.

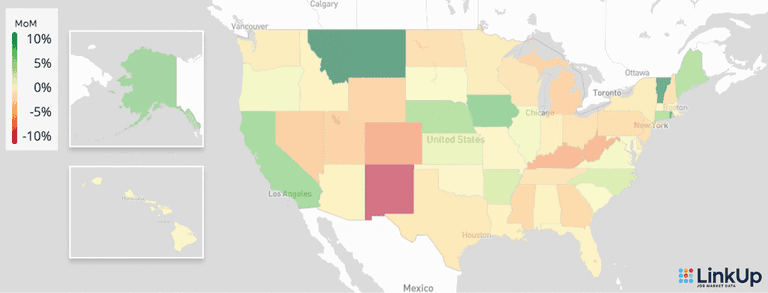

Listings are down in 32 states, but up considerably in several others, including: Montana (+12.4%), Vermont (+9.2%), Rhode Island (+7.7%), Iowa (+6.4%), and Alaska (+6.0%)

Hiring velocity sped up after four months of slowdown. The average time to hire decreased from ~51 to ~46 days, indicating increased liquidity in the job market even as hiring remains impacted by high interest rates.

57% of occupations experienced increased demand, demonstrating a diverse economy that continues to grow. The big winners were Arts/Design/Entertainment/Media (+9.8%); Legal (+8.4%); Business and Financial Ops (+7.8%); and Community/Social Service (+5.4%).

After the blockbuster month of January ‘24, when the BLS reported 353,000 job adds—dropping jaws and heightening expectations of a labor market at full bore—it would be hard for any version of February ‘24 to measure up. And, indeed, job listings are down across most of the economy compared to last month–but only slightly.

Consensus estimates of the forthcoming BLS payroll report project ~195,000 new jobs for February. This somewhat conservative estimate may be, in part, an exercise in wishful thinking, as analysts hope for some cooling in the labor market to herald rate cuts from Mount Fed. As LinkUp CEO Toby Dayton reiterated this week: we read the data as a continuing signal of a full-employment environment led by bullish employers flush with stock market optimism and a belief that rate cuts are coming—even if not as soon as we’d like. And if our forecast of 275,000 job adds in February bears out, the cuts will likely be pushed back even further.

LinkUp job data provides advance insight and context around sudden surges and dips in the job market—stay ahead of official economic reports with LinkUp. Read on for a full breakdown of job market data for the month of February.

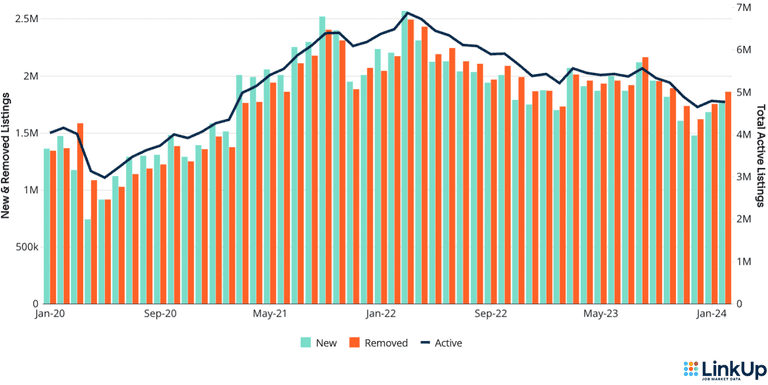

U.S. Job Listings by Month | January 2020 - February 2024

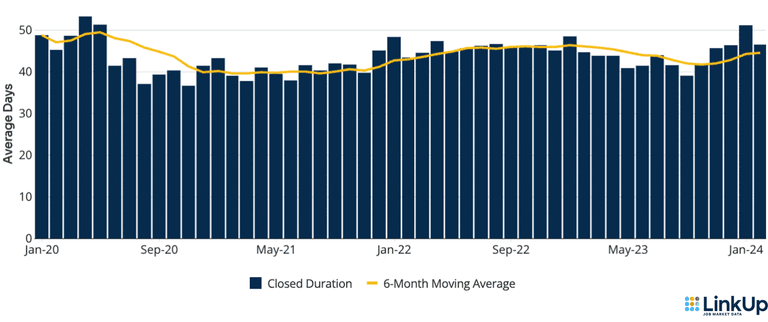

CLOSED DURATION

The entire U.S. economy tracks hiring velocity by measuring closed duration, or the average number of days that companies post job listings on their websites before removing them. As the average number of days a job listing remains live increases, hiring velocity slows.

In February 2024, the time to fill open positions declined compared to January 2024. Closed duration decreased from 51.1 days to 46.4 days. This represents a 9.2% reduction in the average time to fill open positions and suggests a more streamlined hiring process.

Closed Duration of U.S. Jobs | January 2020 - February 2024

JOBS DATA BY STATE

32 states experienced a decline in labor demand in February. However many states did see an increase in active job listings. The top five states were:

Montana (+12.4%)

Vermont (+9.2%)

Rhode Island (+7.7%)

Iowa (+6.4%)

Alaska (+6.0%)

The top five states with the largest drop in demand were:

New Mexico (-9.2%)

Colorado (-5.5%)

Kentucky (-5.0%)

West Virginia (-4.9%)

Nevada (-3.8%)

Percent Change in Active Job Listings by State (Month-Over-Month) | February 2024

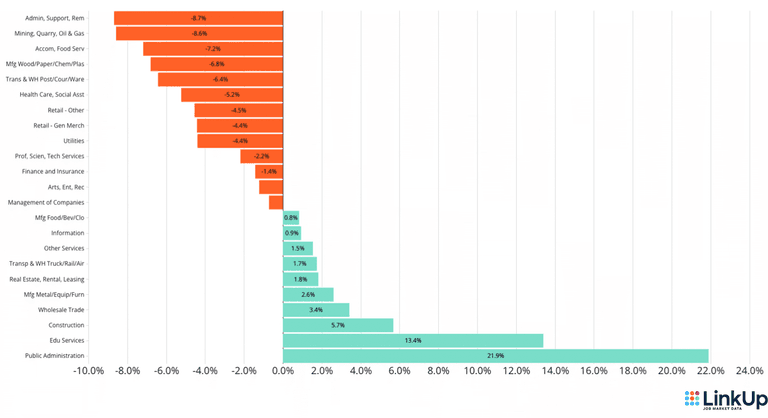

JOBS DATA BY INDUSTRY (NAICS)

Labor demand across 57% of U.S. industries experienced a decline, reflecting recent shifts in economic activity and employment trends. The five industries with the largest decline were:

Administrative, Support, Remediation Services (-8.7%)

Mining, Quarry, Oil & Gas (-8.6%)

Accommodations, Food Services (-7.2%)

Manufacturing Wood/Paper/Chemicals/Plastic (-6.8%)

Transportation & Warehousing (Postal/Couriers/Warehousing) (-6.4%)

As far as industries with the most growth, Public Administration and Educational Services had the most growth due to LinkUp indexing more job listings from public school websites. With that in mind, the five industries with the most growth were:

Public Administration (+21.9%)

Educational Services (+13.4%)

Construction (+5.7%)

Wholesale Trade (+3.4%)

Manufacturing Metal/Equipment/Furniture (+2.6%)

Job Listings by Industry (NAICS) | February 2024

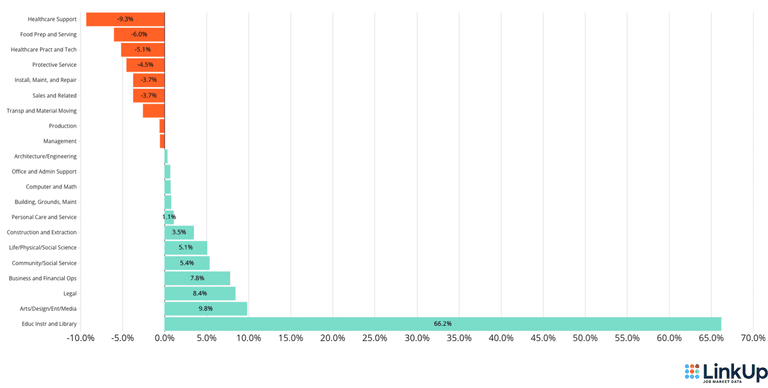

JOBS DATA BY OCCUPATION (O*NET)

In contrast to U.S. industries, 57% of U.S. occupations saw an increase in labor demand. *You’ll notice that Educational Instruction and Library had an especially huge increase–this is because of the higher volume of public schools we started indexing in February, not because the government is suddenly hiring 66% more teachers!

The growing occupations were:

Educational Instruction and Library (+66.2%)*

Arts/Design/Entertainment/Media (+9.8%)

Legal (+8.4%)

Business and Financial Ops (+7.8%)

Community/Social Service (+5.4%)

The occupations with a decline in demand included:

Healthcare Support (-9.3%)

Food Prep and Serving (-6.0%)

Healthcare Practitioner and Tech (-5.1%)

Protective Service (-4.5%)

Installation/Maintenance/Repair (-3.7%)

Job Listings by Occupation (O*NET) | February 2024

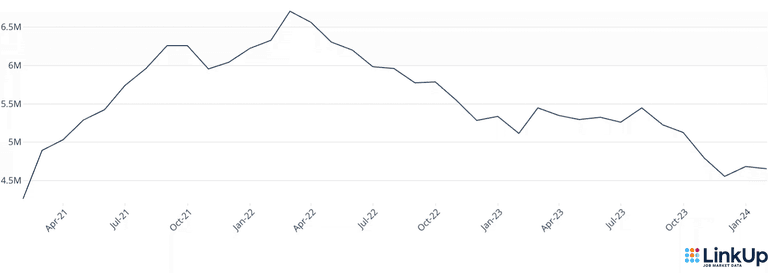

LINKUP 10,000

The LinkUp 10,000 is a daily and monthly analysis that shows the number of job openings from 10,000 global employers with the most U.S. job openings in LinkUp’s dataset.

From January 2024 to February 2024, the LinkUp 10,000 has barely changed (-0.7%). Also compared to this time last year, the LinkUp 10,000 has declined by 9.1%.

Monthly LinkUp 10,000 | January 2021 - February 2024

If you’d like more granular economic data or would like to look deeper into specific industries, occupations or companies, trial our job data or request a sample.

COMPANIES ADDED

Every month we index new companies to our database and during the month of February 2024, LinkUp collected job listings on 834 new employer websites.

Contact us if you are interested in obtaining the complete list of recently added companies.

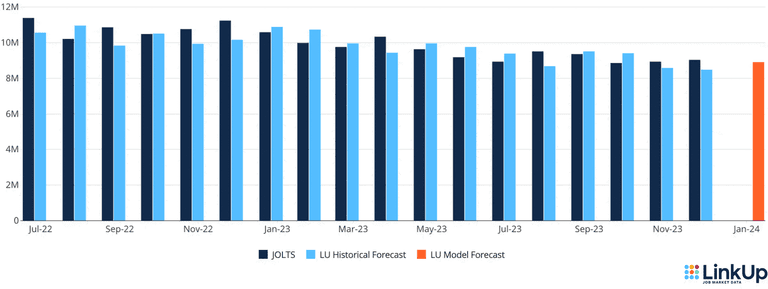

LINKUP MONTHLY FORECASTS

Stay tuned for our monthly forecast of the BLS JOLTS report which drops next Wednesday, ahead of the release of JOLTS data from the Bureau of Labor Statistics (BLS). The data includes estimates of the number and rate of job openings, hires, and separations for total jobs from private employers, by industry and by establishment size class.

Also, each month we publish a nonfarm payroll report forecast ahead of the BLS release, which is based on our RAW LinkUp job listing data. The NFP report is based on total U.S. job vacancies and provides insight into anticipated growth or decline in job listings.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

02.02.2024

Mapping the AI Revolution with LinkUp (Part I)

Read full article -

Blog

02.01.2024

LinkUp Forecasting a Net Gain of 195,000 Jobs In January

Read full article -

Blog

01.31.2024

10 Predictions Around the Job Market and the U.S. Economy for the Coming Year

Read full article -

Research

01.30.2024

AI Maps | Rise of the Rest: The Changing Geography of AI Jobs in America

Read full article -

Research

01.24.2024

Where Did the Workers Go?

Read full article -

Blog

01.24.2024

Where’s My AI Revolution?

Read full article -

Blog

01.10.2024

LinkUp's December 2023 JOLTS Forecast

Read full article -

Blog

01.04.2024

December 2023 Jobs Recap: Continued Labor Cooling

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.