Expect To Soon See The Full Impact of Full Employment

In a blog post in May, 2016, we declared for the first time that the U.S. labor market had reached Full Employment. At the time, unemployment was 5% and we outlined the complete case for having achieved Full Employment.

In a blog post in May, 2016, we declared for the first time that the U.S. labor market had reached Full Employment.

At the time, unemployment was 5% and we outlined the complete case for having achieved Full Employment. Despite a few nagging aspects of the labor market that hinted at some remaining weakness and further slack, we confidently concluded that there was no longer sufficient evidence to argue against Full Employment. As a side note, we also summarized in that post the most compelling reasons behind sluggish productivity gains (low corporate investment, historically low government investment, low competition, etc.) – a summary well worth revisiting again as productivity gains remain frustratingly elusive to this day.

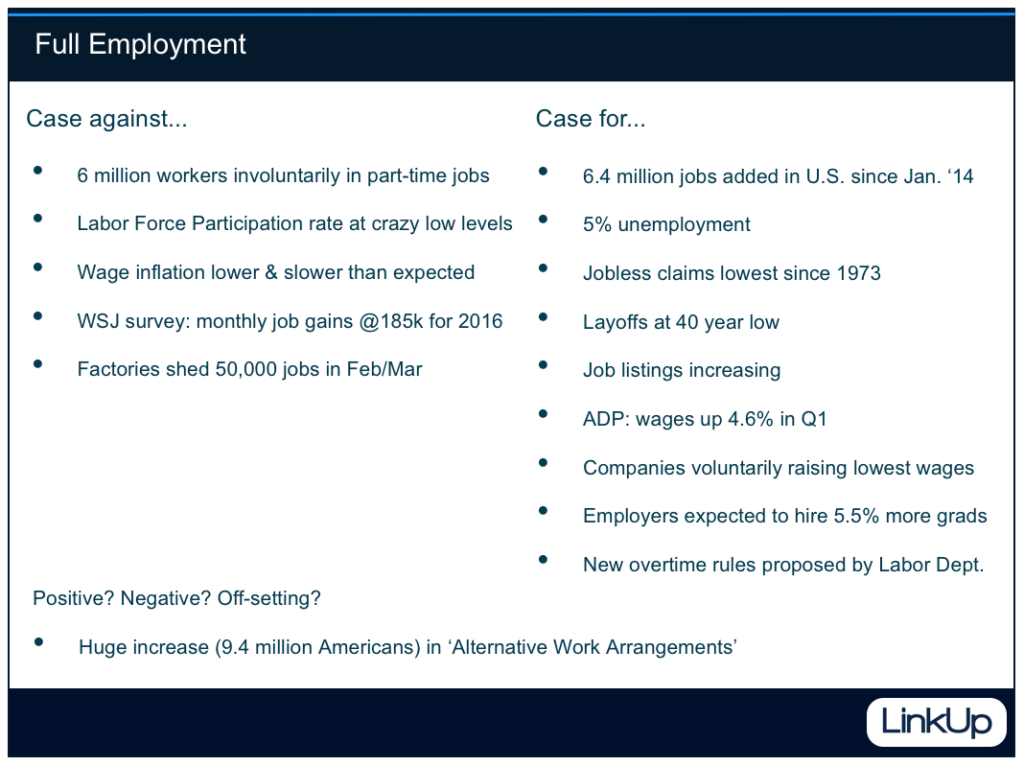

The case for and against Full Employment back in May, 2016, included the following points:

While one could reasonably argue that we were early in our Full Employment call, I would point out that whether or not that is true depends almost entirely on one’s definition of Full Employment. Each of the following are commonly used definitions of Full Employment:

• Level of employment rate where there is no cyclical or deficient-demand unemployment

• ‘Acceptable’ level of unemployment greater than 0% due to frictional unemployment (quits, seasonal jobs, people looking, etc.) and structural unemployment (mismatch between worker skills and job requirements

• NAIRU – non-accelerating inflation rate of unemployment

The 2nd definition in the list above is entirely subjective and can therefore be tossed out immediately due to it being virtually useless (acceptable to who?). Because broad-based wage inflation has only just recently materialized in the official numbers and has yet to materially impact broader inflation measures, the 3rd definition in the list above is more debatable. Although we’d argue that wage inflation was evident well before it was reported in the official numbers, there is no doubt that by the strictest definition of NAIRU, we didn’t reach Full Employment until somewhere between mid/late 2016 and mid/late 2017. But using the 1st definition above, we’d argue, convincingly we believe, that we were, at a minimum, quite close regarding the timing of our Full Employment call.

And in any event, it’s now a moot point because the Fed has officially confirmed that not only are we presently in a Full Employment Environment, but that we have been for some period of time. In its Monetary Policy Report submitted to Congress on February 23rd, the Board of Governors of the Federal Reserve System stated, “Although there is no way to know with precision, the labor market appears to be near or a little beyond full employment at present.”

Translating Fed-speak, that amounts to a clear admission that the labor market crossed over into full employment at some point in the past, and precisely how far back is unknowable (at least to the Board of Governors). In some bizarre economic courtroom, we’d be more than happy to stipulate that May of 2016 was somewhat premature, as long as opposing counsel were likewise willing to stipulate that it was far closer to the actual cross-over date than January 2018.

And lest anyone want to take the case to trial rather than settle out of court (this analogy is proving, in equal measure, useful, garbled, and overused), we remain exceedingly confident that the evidence will continue to support our argument as the year progresses. The early hints of wage inflation that we saw in 2016 broadened across the economy throughout 2017 and have become pervasive and irrefutable, as the Fed acknowledged last week. And while the official wage growth numbers have remained smaller than everyone would expect, we have absolutely no doubt that rapidly accelerating wage growth will be the dominant labor market story in 2018. Correspondingly, the impact of rising labor costs on corporate earnings will be a pervasive story on Wall Street.

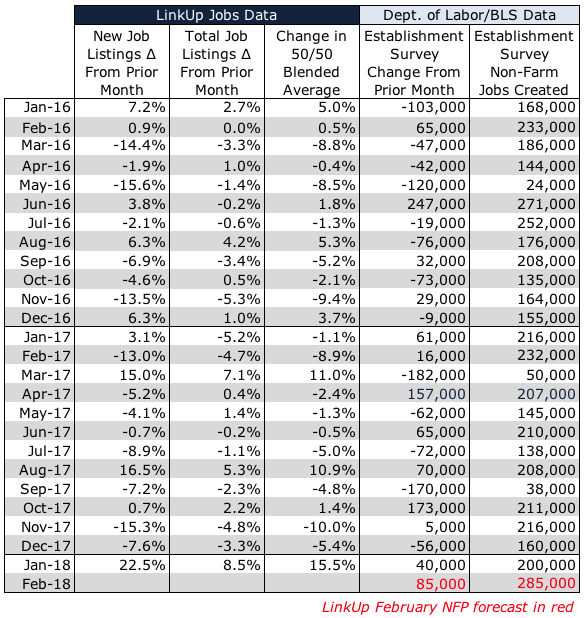

In fact, we’d even speculate that the most likely trigger for the long-anticipated market correction will be a ‘shockingly’ high wage growth number that surprises everyone but us. The 2nd most likely trigger is a series of consecutive jobs reports with net job gains well above consensus estimates. Either scenario would significantly raise the likelihood of more than the 3 rate hikes expected in 2018. While we would not be surprised in the least to see that wage growth accelerated in February, we have a high degree of confidence that job gains in the February Employment Situation Report will be far higher than consensus estimates.

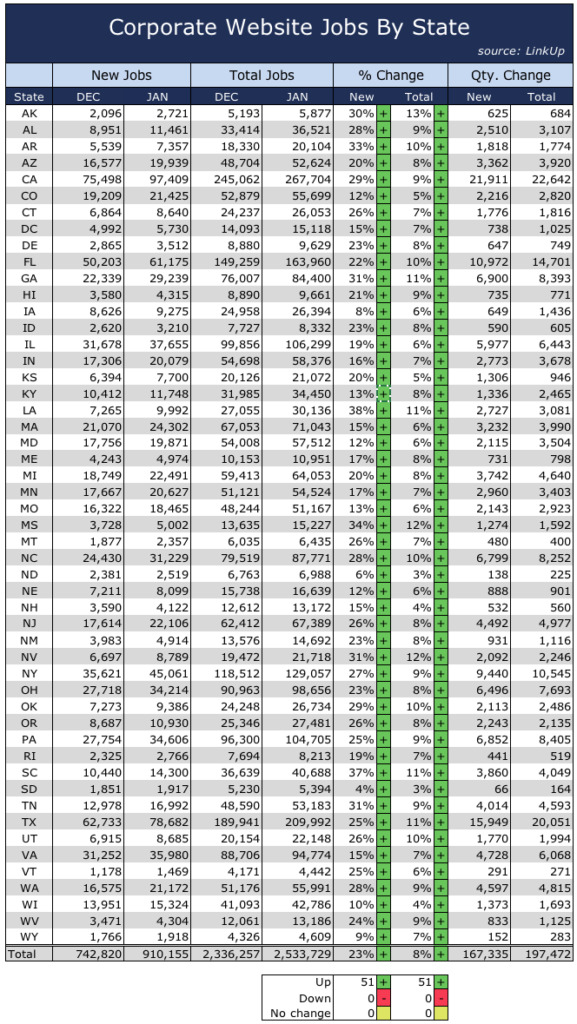

In January, new job listings in LinkUp’s job search engine rose 23% and total job listings rose 8%. Not only did new and total job openings rise significantly in January, but gains were seen in every single state in the country.

As background, LinkUp only indexes jobs directly from company websites – currently about 4.5 million jobs indexed daily from 50,000 company websites. Our search engine is updated daily, so there are no expired or stale jobs, and there are no duplicate jobs because we only index jobs from a single source – the employer’s website itself. Equally as significant, we don’t aggregate jobs from job boards, we have completely eliminated job board pollution (scams, fraud, lead-gen, phishing jobs, etc.) from our job market data.

And because the best indicator of a job being added to the U.S. economy in the future is when an employer posts a job opening on its corporate career portal, we can be reasonably assured that significant job listing growth in January will lead to strong job gains in February. Based on our model, we are forecasting a net gain of 285,000 jobs in February, well above consensus estimates.

As was the case in the Spring of 2016, I cannot possibly guarantee that we will get the timing precisely right, but rest assured that one way or another, in a single jobs report or over a few consecutive jobs reports, we will soon see the full impact of Full Employment. And that impact will likely shock the markets and could very well serve as the proverbial straw that breaks the camel’s back and triggers a market correction.

And with that, we rest our case and leave it to you, the judge, to render your verdict as the case unfolds.

Insights: Related insights and resources

-

Blog

03.05.2019

LinkUp Job Market Data Points To Softening Labor Demand & Below-Consensus Job Gains In February

Read full article -

Blog

10.23.2018

As unemployment falls, time to fill jobs gets shorter

Read full article -

Blog

03.26.2018

LinkUp Forecasting Net Gain of 235,000 Jobs In March; Wage Inflation Will Accelerate in Months Ahead

Read full article -

Blog

08.17.2016

Full Employment

Read full article -

Blog

06.01.2016

Solid May Jobs Report & Full Employment Environment Will Push Fed To Raise Rates In June

Read full article -

Blog

05.03.2016

We Are Definitely In a Full Employment Environment

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.