ESG investing on the rise

Escalating urgency behind the ongoing climate crisis continues to drive many facets of the economy forward.

From growing technologies like electric vehicles to areas of potential job creation like infrastructure, opportunities to benefit from our collective problem solving abilities abound. But now we’re witnessing an interesting shift among investors, toward funds with more sustainable stocks. Those new to the market and seasoned investors are both showing interest in companies making measurable impact in addressing important environmental issues, as well as the social issues that fuel them, and abandoning companies that fund traditional fossil fuel initiatives.

Growth of ESG (Environmental, Social, and Governance) investing over recent years has been staggering. The dollars invested in ESG increased tenfold from 2018 to 2020, and 25-fold from 1995 to 2020. In 2021 alone an estimated $120 billion was invested in sustainable funds, more than double the $51 billion total in 2020. By the close of 2021, roughly one-third of all assets contained sustainable investments.

The pandemic has helped to bolster interest in ESG funds by highlighting their potential resilience. Sustainable funds suffered less than traditional funds in the early stages of the economic downturn, giving investors confidence in their stability in the face of future crises.

There has also been speculation as to whether new generations of investors have been driving some of the interest in ESG funds, though their role may be more of a ‘cultural catalyst’ than influencing with actual dollars. Though there has been considerable growth in the market participation of Millennials and Gen Z, they still comprise a very small set of all investors (as low as 2% by some calculations). Though these generations may not currently possess the wealth to invest their values, large banks and institutional investors seem to recognize their potential for future impact.

As interest in ESG grows, so does the need for accurate ESG reporting. Regulation in the U.S. has remained relatively lax, leaving much to the discretion of institutional investors. While BlackRock committed to increasing their ESG assets from $90 billion to $1 trillion by 2029, many funds it claims qualify as sustainable still invest in carbon-intensive companies.

But with analysts forecasting ESG to exceed $50 trillion in the next two decades, there is no sign of this move toward sustainable stocks slowing down. So we decided to look at recent job listings and share prices at a few standout energy companies to showcase some signs we’re seeing that ESG is worth the buzz.

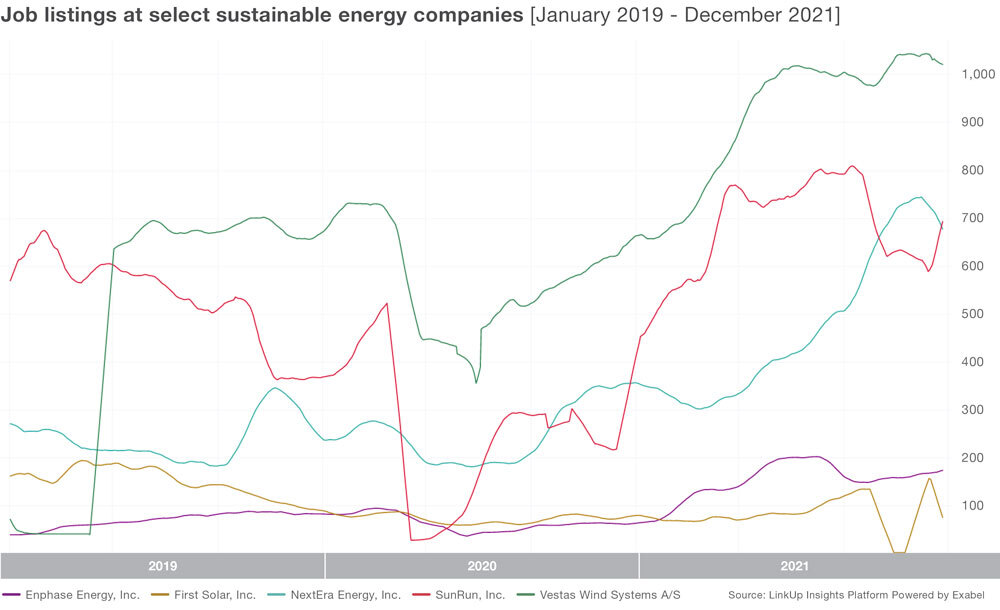

Vestas Wind Systems, a Danish manufacturer, seller, installer, and servicer of wind turbines across the globe, sits at the top of the list for job growth since the onset of the pandemic. Job listings for the company have grown a whopping 2,393% over the last three years. Vestas share price soared early during the pandemic, up 165% from March 1, 2020 through Oct 1, 2021, yet it sunk 36% overall in 2021, leaving some questioning their green investments.

NextEra Energy (NEE), the world’s largest utility company, as well as the world’s largest producer of wind and solar energy, also showed significant job growth recently. The company’s jobs were up 82% in 2021, and share price for NextEra has shown substantial and steady increases in recent years as well, up 24% in 2021.

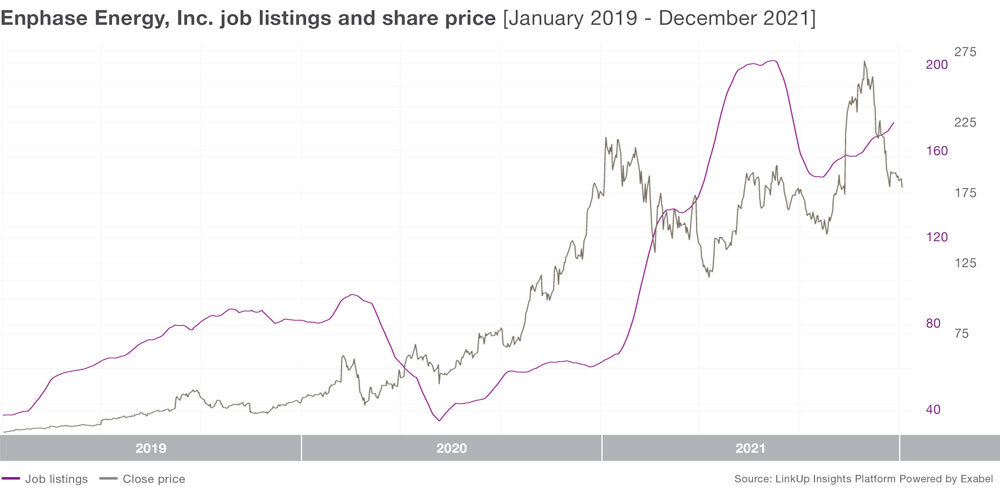

The clear standout in 2021, is Enphase Energy (ENPH), who saw big stock growth following big job listings growth earlier in the year. The company says it started production shipments of its IQ8 Microinverters for customers in North America in late December. This technology allows the operation of solar technology without grid connection—increasing accessibility and usability. Enphase also completed their eagerly anticipated acquisition of ClipperCreek, a company that produces electric vehicle (EV) charging solutions for residential and commercial customers. Enphase will now be able to sell their solar and battery systems alongside these EV charging systems.

Though active job listings at Enphase were impacted by the COVID cliff witnessed by most companies in the first half of 2020, their trajectory has been a steep uphill climb since that time with 466% growth since June 1, 2020. Shares have risen 206% over the same time period.

Overall, job growth for these energy companies looks strong–and share prices show promise for investors as well. As the call to action on the climate crisis will only become louder in the coming months and years, the focus on ESG stands to grow exponentially. We’ll continue to monitor labor trends in the energy sector to see what they can tell us about this emerging area of opportunity.

Interested in the job data powering this post? Contact us if you’d like to learn more.

Insights: Related insights and resources

-

Blog

10.11.2021

EVs steering Ford’s future

Read full article -

Blog

04.07.2021

March 2021 Jobs Recap: Job demand is back; returning to pre-covid levels

Read full article -

Blog

04.01.2021

Answering sustainability questions with employment data

Read full article -

Blog

08.08.2019

How do banks & investments in tech talent differ?

Read full article -

Blog

05.06.2019

The S&P 500 LinkUp Jobs Index

Read full article -

Blog

11.29.2017

Fast-Growing Unicorns are Slow to Fill Jobs, Slower to Go Public

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.