Despite Trump's Best Efforts, The U.S. Job Market Refuses To Cool Off

Before we jump into our Non-Farm Payroll Forecast (NFP) for August, it is worth noting that on August 21st, the Bureau of Labor Statistics announced its preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. …

Before we jump into our Non-Farm Payroll Forecast (NFP) for August, it is worth noting that on August 21st, the Bureau of Labor Statistics announced its preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The revisions, which are being made after benchmarking BLS data to unemployment insurance tax records at the individual state level, will not be finalized until February, but the initial adjustment is a decrease of 500,000 jobs in March, 2019.

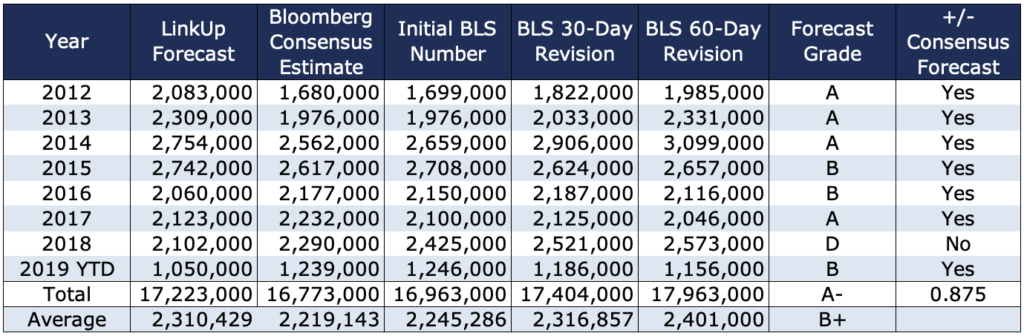

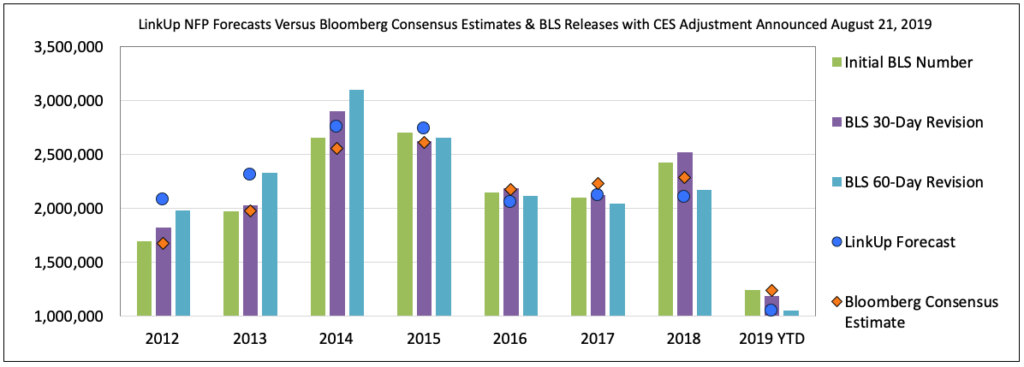

With the announcement, we of course wanted to see how the change impacted our NFP forecast track-record. Below is the aggregated data since 2012 comparing our NFP forecasts with Bloomberg consensus estimates and the BLS data which includes the initial release as well as 30 and 60-day revisions. Our annual forecast data in the ‘LinkUp Forecast’ column is the sum of each of our individual monthly NFP forecasts from that year that are all made prior to the BLS release for each month. The grade and the corresponding ‘Yes’ or ‘No’ in the ‘+/- Consensus Forecast’ column is based on whether or not we accurately predicted whether or not the final BLS numbers came in above or below consensus estimates.

As the table indicates, we’ve had a very solid track-record over the past 7+ years, with the only missed year being 2018 when we predicted that job growth would be lower than consensus estimates for the year (you had to know where this was going, right?).

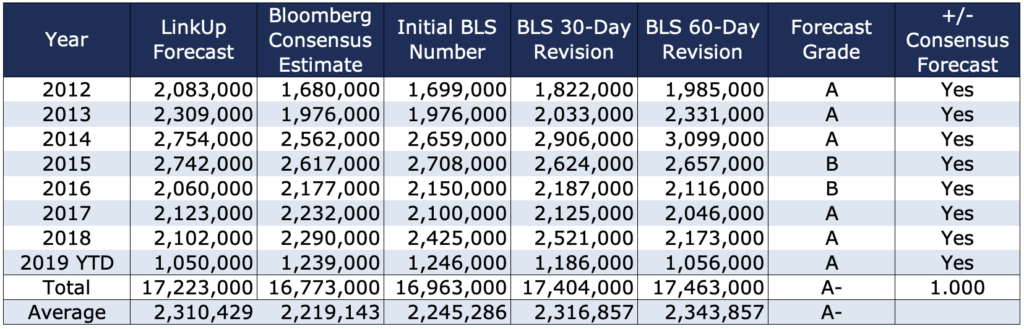

With the assumption that the downward adjustment of 500,000 jobs was approximately evenly distributed over the prior 12 months ending March 2019, we reduced the BLS data by 400,000 jobs in 2018 and 100,000 jobs in Q1 2019. Such an adjustment results in the following revision to our annual data:

Not a bad track-record, to say the least. We’ll see what happens with the final revisions in February, but for now we’d hold up our job market data, the predictive macro signals within it, and our NFP forecasting model against anything else available.

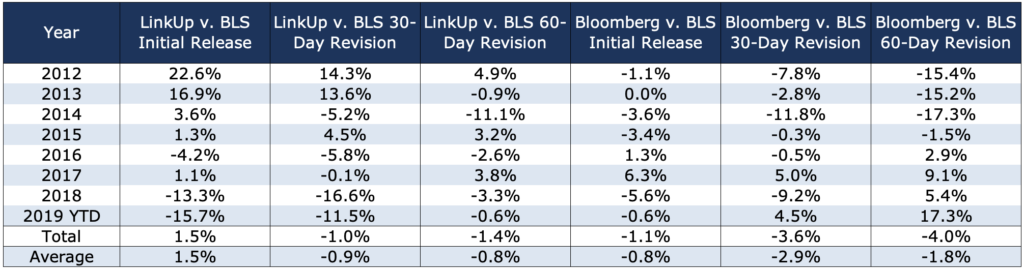

And from a % variance standpoint, it is clear that our average forecast gets better with subsequent revisions while Bloomberg’s data gets worse.

So with that gratuitous, self-administered pat on the back out of the way, we turn our attention to August’s NFP forecast. And in spite of the inverted yield curve, trade wars, a broad global slowdown, warning signs from U.S. businesses, and Trump’s best efforts to drive a glorious economy off a cliff, the U.S. job market just keeps humming along, seemingly oblivious to the chaos, destruction, and havoc being inflicted on the economy and the world in general by the President.

On the business side of the ledger, to begin with, the Commerce Department just revised downward its estimate of GDP growth in Q2.

“U.S. industrial output fell in July, as the manufacturing sector continued to struggle with trade-related headwinds. Industrial production, a measure of factory, mining and utility output, declined a seasonally adjusted 0.2% in July from the prior month, the Federal Reserve said Thursday. That fell short of economists’ expectations for a slight increase.”

That weakness has continued into August…

“IHS Markit reported last week an index of factory activity in August fell in the U.S., Japan, Germany and the eurozone. The U.S. decline marked the first manufacturing contraction since September 2009, according to the firm’s surveys of purchasing managers.”

And what makes the current state of the global economy even more frustrating and distressing is the fact that just 18 months or so ago, the outlook couldn’t have been more positive. As Steve Rattner points out in a New York Times editorial entitled “How World Leaders Ruined The Global Economy”

Why are so many key global leaders pursuing so many stupid economic policies?

As recently as January 2018, the International Monetary Fund issued one of its most upbeat economic forecasts in recent years, extolling “broad based” growth, with “notable upside surprises.”

By last month, the fund had sliced its forecast for expansion this year to 3.2 percent — a significant falloff from the 3.9 percent projection reiterated just six months earlier — and had pronounced the economic picture “sluggish.” American investors are more concerned; the bond market is sounding its loudest recessionary alarm since April 2007.

The deterioration in the economic picture is not the consequence of irresponsible behavior by banks or a natural disaster or an unanticipated economic shock; it’s completely self-inflicted by major world leaders who have delivered almost universally poor economic stewardship.

The trade war initiated by President Trump sits firmly atop the list of bad policies. But Brexit has tipped Britain into economic contraction. With European governments unwilling to pursue structural reforms, the continent is barely growing. President Xi Jinping of China has focused on standing up to Mr. Trump and solidifying his own power. After a promising start reforming the economy, India’s prime minister, Narendra Modi, has turned instead to oppressing his country’s Muslim minority.

And while the world burns (literally and figuratively), U.S. consumer spending continues to prop up the U.S. economy. As the Journal points out in an article entitled “Strength in U.S. Consumer Spending Drives Economy”

“Personal-consumption expenditures, a measure of household spending, increased a seasonally adjusted 0.6% in July from June, a pickup from the previous two months, the Commerce Department said Friday, continuing a solid performance by the economy’s main driving force.”

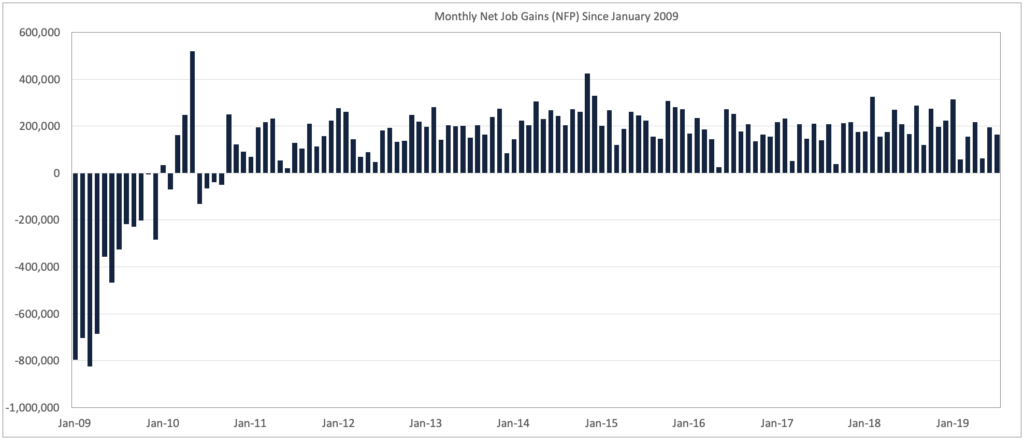

Consumer confidence has undoubtedly been driven in large part, if not entirely, by a record-setting job market that is finally starting to drive up wages across the entire economy on a consistent (albeit still somewhat underwhelming) basis. With unemployment at 3.7% and no end in sight to the record-setting 106 consecutive months of monthly job gains, it’s no wonder that consumers have felt confident about the economy.

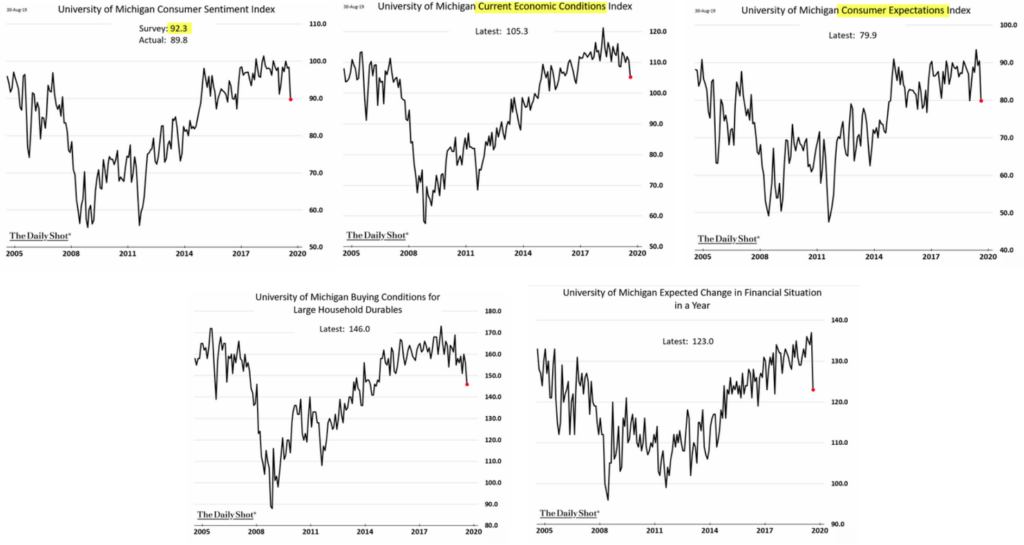

But as Trump’s insanely irrational and ineptly executed trade war with China starts to impact businesses and the economy in general and the U.S. consumer in particular (combined to some extent with a slowing global economy), it is not surprising that consumer confidence has started to erode.

As Lev Borodovsky points out (and asks) with the charts below in his Daily Shot post for September 2nd entitled “Sudden Dip in Confidence Poses Risks to Consumer Spending,”

“The updated U. Michigan survey confirmed that we had some deterioration in consumer sentiment in August. Will it drag consumer spending lower?”

We would propose that the answer to Borodovsky’s question rests entirely with the job market and what happens with hiring and wages going forward. And as we pointed out at the start of this post, we are fortunate to have the benefit of an extremely large, incredibly powerful alternative dataset, updated every day, comprised of job openings indexed entirely from company websites around the world that consistently delivers accurate and predictive signals about labor demand that correlate highly with job growth in future periods. So we know where to look for an answer to Borodovsky’s question, and LinkUp’s data indicates that the job market will remain strong for at least the next few months.

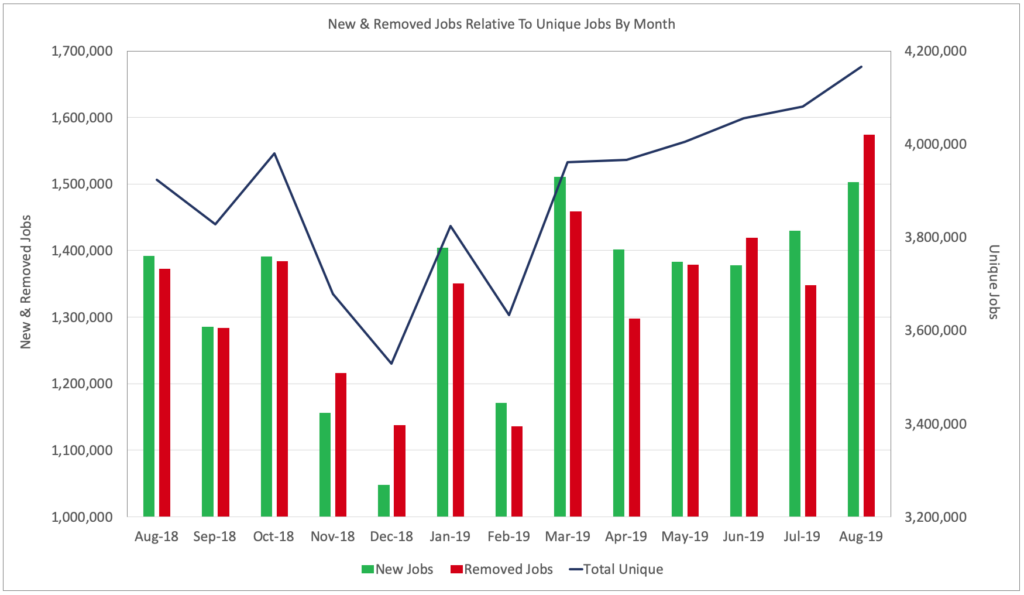

In August, total U.S. jobs in LinkUp’s search engine rose 2.1%, while new and removed jobs rose 5.1% and 16.8% respectively. Because removed jobs are strongly correlated to filled jobs (companies typically remove job openings from their corporate website once they are filled with a new hire), the removed jobs is particularly noteworthy.

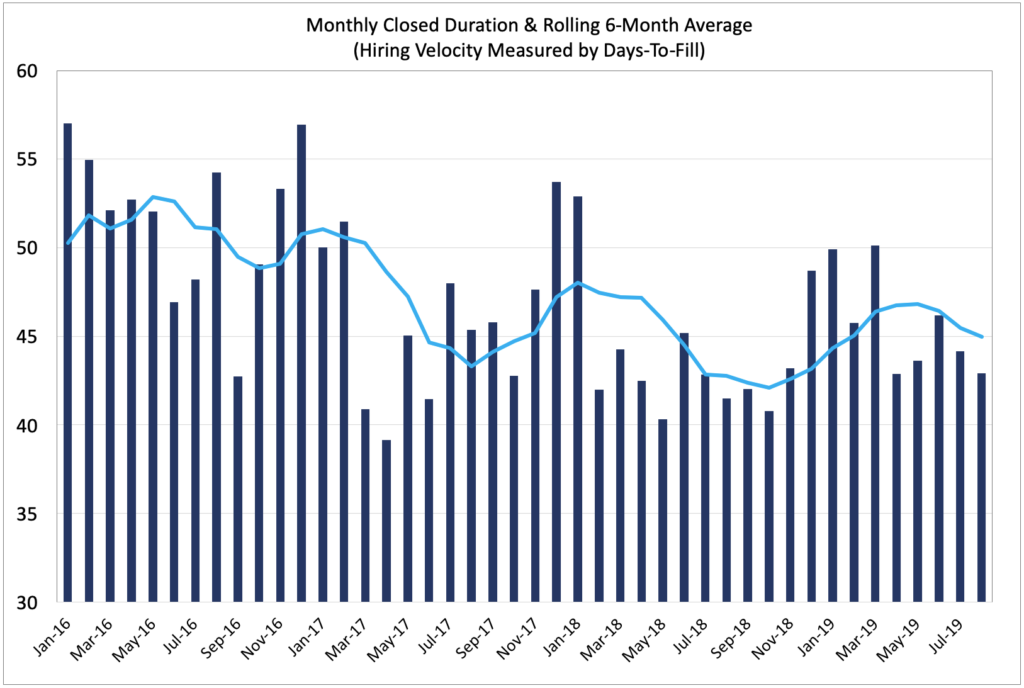

Hiring velocity accelerated in August, as Job Duration fell from 44 days to 43 days. LinkUp’s Job Duration measures the average number of days that jobs were posted before they were removed, what is commonly referred to in the talent acquisition industry as time-to-fill.

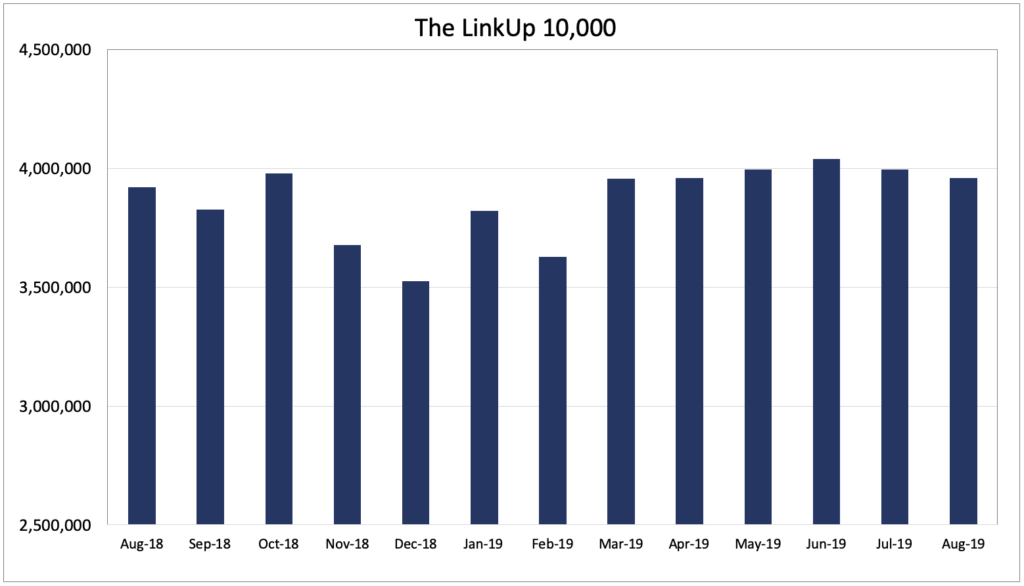

The LinkUp 10,000, which measures the number of job openings posted by the 10,000 employers in LinkUp’s dataset with the most job openings each month, fell 0.9% in August – the only negative indicator among all the macro analytics for August.

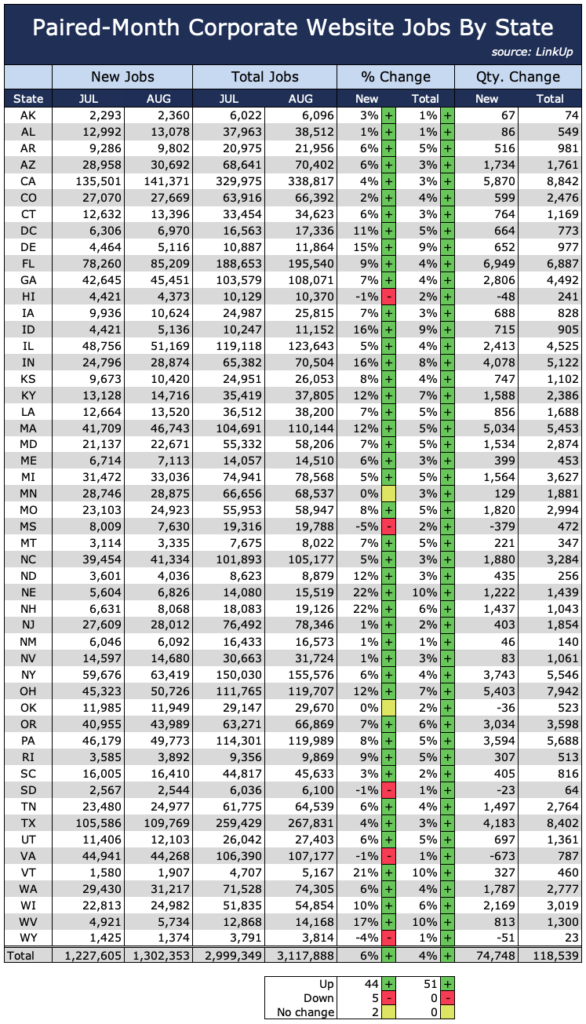

Another macro analytic we use to account for the fact that we are continuously adding new companies to the dataset is our paired-month data which measures new and total job gains for only those companies that were actively hiring in two consecutive months. In August, our paired-month data comparing July and August job postings showed solid gains with new and total jobs rising 6% and 4% respectively. Equally as positive is the fact that new jobs rose in 44 states and total job gains rose in all states including Washington, D.C.

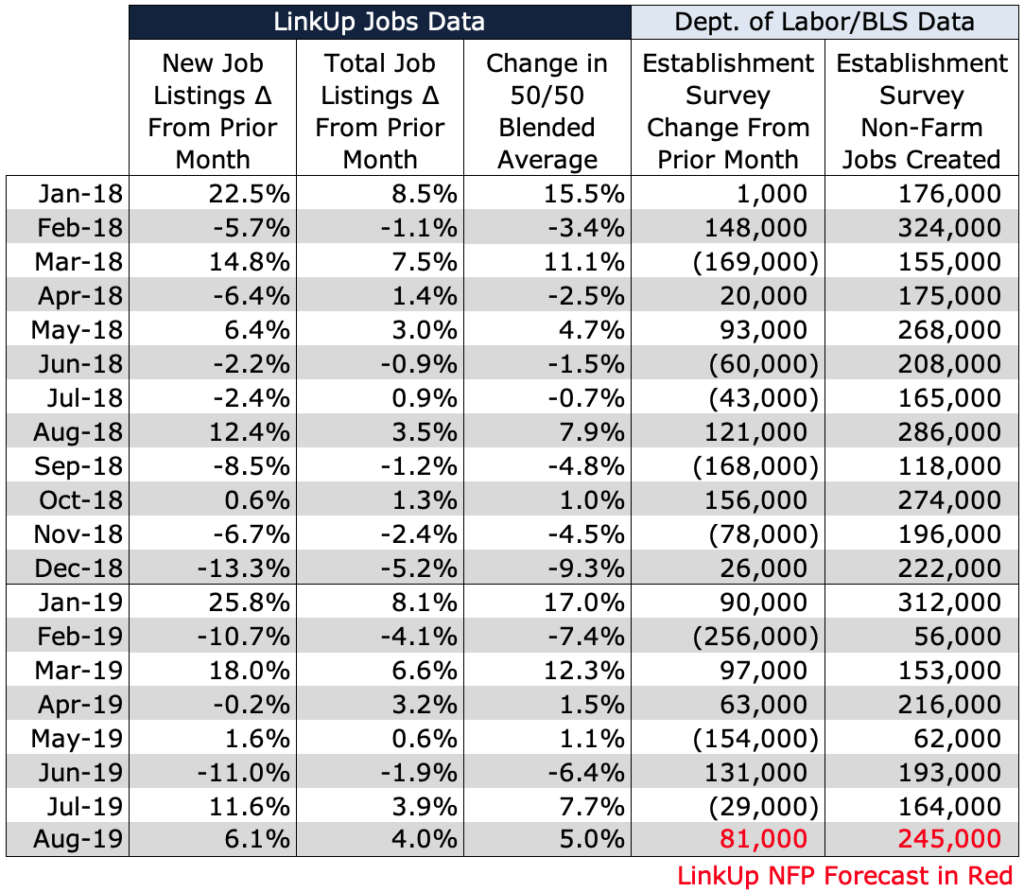

August’s Paired-Month gains follow even larger gains seen in July, when new and total jobs rose 12% and 4% respectively. And it is July’s job posting activity that serves as the basis for our August NFP forecast due to the fact that the best indicator of a new job being added to the U.S. economy is when an employer posts an opening on their corporate career portal, combined with the fact that there is typically a lag between when that job is posted and when it is filled with a new hire. That lag has recently ticked up because companies are increasingly struggling to find applicants for their openings, so it is July’s LinkUp data job posting activity that best indicates August hiring.

With July’s robust gains in new and total job openings, we are forecasting job gains of 245,000 jobs in August, well above consensus estimates.

And with the gains seen in our data for August, we expect a solid jobs report for September as well. Having said that, it is certainly worth stating the obvious fact that continued strength in the job market by no means guarantees that consumer confidence will remain sufficiently high to continue propping up the economy, especially given the chaos being inflicted on the country and the economy by the President.

As Neil Irwin states in his ‘The Upshot’ column entitled “How The Recession of 2020 Could Happen”,

“How would a 2020 recession happen? The trade wars and a breakdown in international economic diplomacy cause businesses around the world to pull back. This leads to further tumbles in markets and job losses, prompting American consumers to become more cautious. High corporate debt loads create a wave of bankruptcies. And central bank policy proves impotent, combined with fiscal policy that is nonexistent.”

Not at all hard to imagine, but for the time being, we’ll look forward to solid job gains for August and September.

Happy Labor Day.

Insights: Related insights and resources

-

Blog

10.26.2017

The New Abnormal Is Wreaking Havoc on Job Market Forecasts; LinkUp Predicting Net Gain of 120,000 Jobs In October

Read full article -

Blog

09.28.2017

August Non-Farm Payrolls A Surprise To Some But Not All

Read full article -

Blog

06.01.2017

LinkUp's May Jobs Data Points To Slowing Job Market

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.