Despite the Chaos Syndrome, LinkUp Is Forecasting That The U.S. Added 215,000 Jobs In July

Chaos syndrome: a chronic decline in the political system’s capacity for self-organization.

In a great article in The Atlantic this month entitled How American Politics Went Insane, Jonathan Rauch posits that the insanity afflicting Washington and the country these days, and especially the GOP, is the result of what he terms Chaos Syndrome, which he describes as follows:

Chaos syndrome is a chronic decline in the political system’s capacity for self-organization. It begins with the weakening of the institutions and brokers—political parties, career politicians, and congressional leaders and committees—that have historically held politicians accountable to one another and prevented everyone in the system from pursuing naked self-interest all the time. As these intermediaries’ influence fades, politicians, activists, and voters all become more individualistic and unaccountable. The system atomizes. Chaos becomes the new normal—both in campaigns and in the government itself.

I’d add a few other significant contributing factors, including gerrymandered districts, Citizens United, and the decades-long fiction that the GOP cares about anything other than the richest 1% of the country, a fairy tale that apparently is going to have a fiery, apocalyptic ending, but Rauch presents a very compelling argument as to the havoc that chaos syndrome has wreaked upon the nation.

Unfortunately, predictability around monthly net gains in non-farm payrolls (NFP) seems to be dealing with its own bout of chaos syndrome lately. I’d posit that the chaos around forecasting monthly jobs reports these days is caused, first and foremost, by the fact that the U.S. labor market is most definitely in a state of Full Employment, defined as that level of unemployment below which wage inflation is triggered. It is a fact that wage inflation has become quite evident across multiple segments of the labor market and there is mounting evidence that it is becoming increasingly pervasive throughout the entire economy in nearly every region of the country.

The challenge for economists, the Fed, and forecasters, however, is that there is tremendous uncertainty as to how much slack there is in the labor force, the rate at which the underemployed and ‘marginally attached’ will return to the workforce, the impact of rising wages on the gig economy, the structural impact of technological changes to the U.S. workforce, the rate of baby-boomer retirement, and the persistently low labor force participation rate. All of these factors are wreaking havoc in trying to assess what type of job gains we can expect each month given the continued strength of the job market.

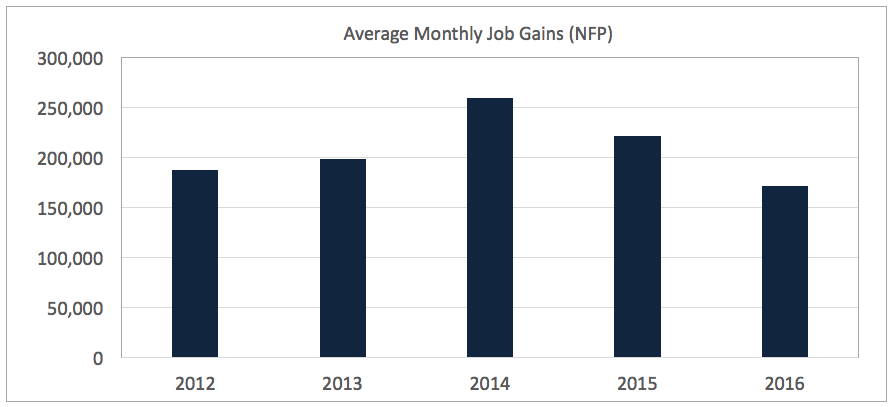

While it’s not surprising that average monthly job gains have declined in the past two years…

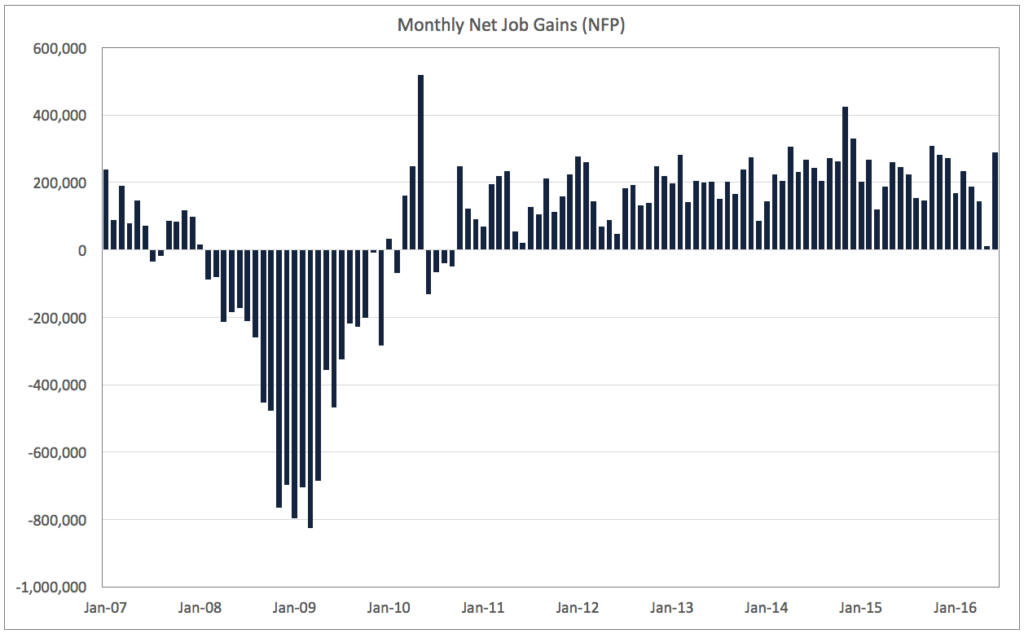

given the 69 consecutive months of positive net job growth since October 2010 that have added 13.3 million jobs to the U.S. economy….

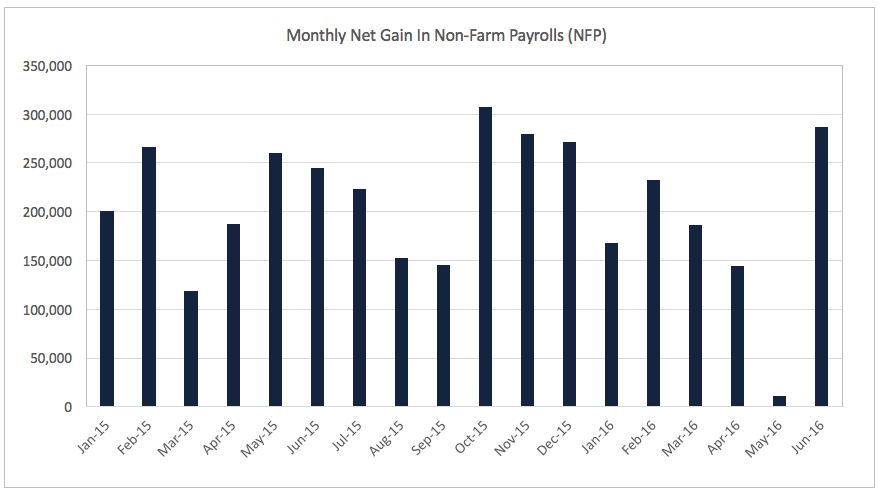

no one expected to see the kind of volatility that we saw in Q2, when net job gains fell to 11,000 in May and then took a dramatic jump to 287,000 jobs in June.

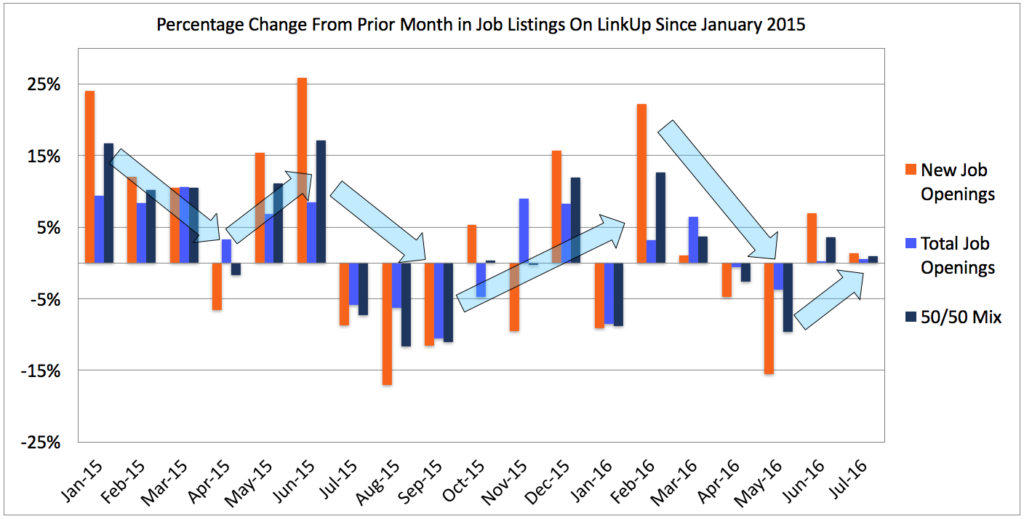

Unfortunately, LinkUp’s job openings data has been equally as chaotic of late. Despite the fact that our search engine indexes 3.4 million jobs directly from corporate websites (which means the data is highly accurate because the jobs are always current and contain no duplicate listings or job board pollution), the correlations between our data and monthly NFP data have not been nearly as precise as they were in the previous few years.

To be sure, correlations remain quite strong over a timeframe of roughly 90 days or so and contain strong predictive attributes around the broader trends in the labor market, but the model we developed that is overlaid on top of our data has not generated the month to month predictive signals with the same degree of accuracy as in previous years.

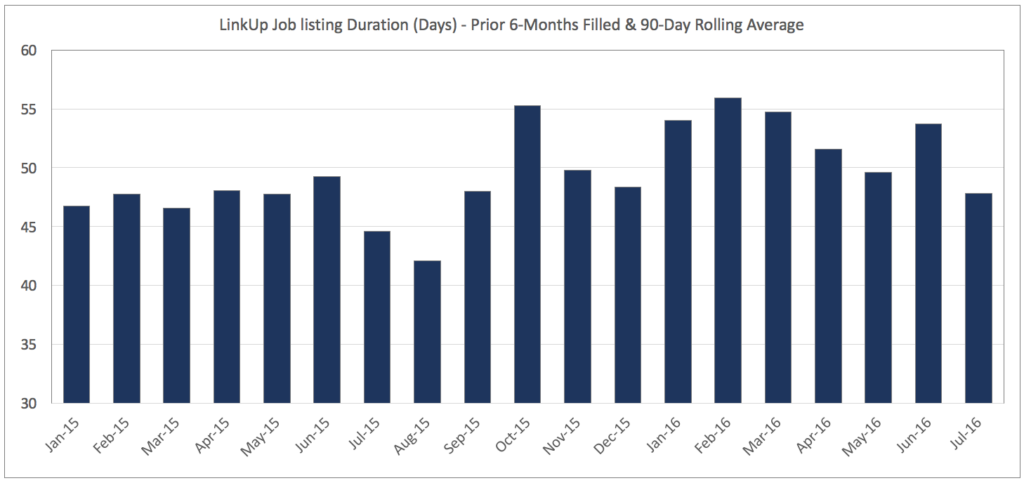

One of the other conundrums in our data has been our job duration report. We calculate job duration in multiple ways but the primary methodology has been to look at all the jobs that were taken off corporate websites over the prior 6 months (presumably because they were filled) and measure how long they had been posted by employers on their corporate career portal. The increase in duration from August last year to February this year makes sense given that companies were finding it harder and harder to fill positions in a strong labor market. But duration has trended down this year just as job gains have decreased, pretty much the opposite of what one would expect.

The most likely explanation is that companies are making job offers more quickly in a tight labor market to reduce the risk of positions remaining unfilled for overly extended periods of time. It could also be the case that as companies are having to raise wage and salaries to attract sufficiently qualified applicants in a full employment environment, the strategy is paying off and jobs are getting filled quickly with the higher level of compensation. If one or both of those explanations are accurate, that certainly bodes well for continued strength in the labor market and strong jobs reports in the months ahead, not to mention continued strength in the overall economy.

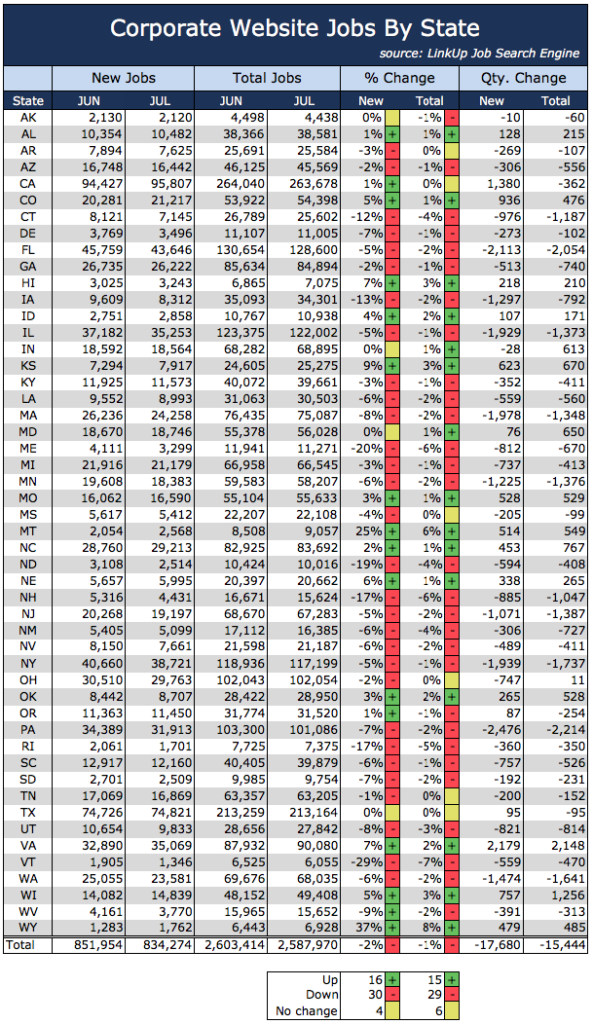

So in any event, looking at July’s jobs data by state, new and total job listings on company websites ticked down slightly.

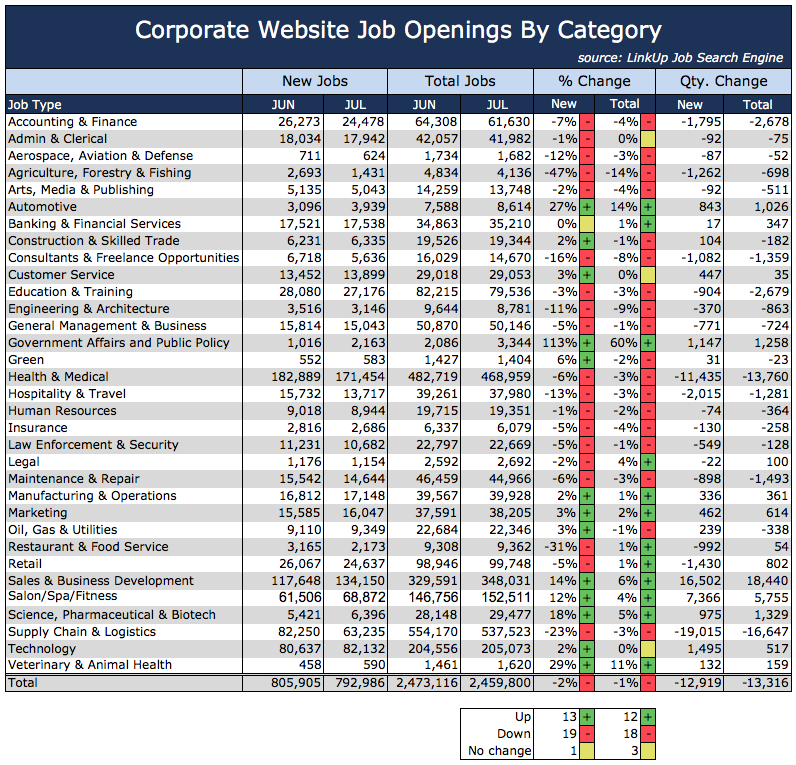

Not surprisingly, new and total jobs by category shows similarly modest declines.

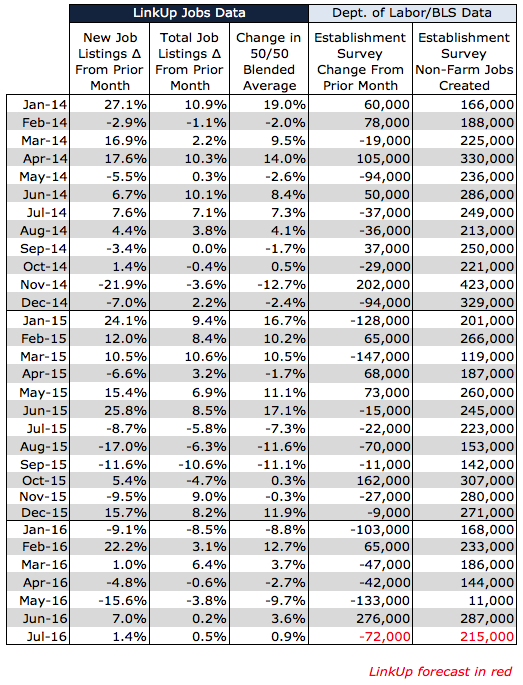

When we put the July data into our model, which uses the average of each month’s two data points from our paired-month methodology (which we use to account for a perpetually growing dataset as we add more companies to the search engine), the result is a slight uptick in new and total jobs for July. And based on our data over the past few months, we are forecasting net job gains of 215,000 in tomorrow’s jobs report – somewhat below the significant job gains in June but slightly above consensus estimates of roughly 180,000 jobs.

With all that said, our forecast is most certainly subject to the chaos syndrome swirling around the globe these days, and the confidence level in our forecast is not dissimilar to the confidence that sanity is going to be return to U.S. politics anytime soon.

Insights: Related insights and resources

-

Blog

08.04.2022

Heads I Win, Tails You Lose; Reflections on the Still-Cooling But Strong Job Market

Read full article -

Blog

09.28.2017

LinkUp Forecasting Net Gain of 260,000 Jobs For September

Read full article -

Blog

08.17.2016

Full Employment

Read full article -

Blog

08.07.2016

LinkUp Data Versus Conference Board's HWOL Data Series & Help Wanted Analytics/CEB Data

Read full article -

Blog

03.30.2016

March NFP Of Just 100,000 Jobs Will Be Well Below Consensus Estimates

Read full article -

Blog

09.02.2015

Amidst An Abundance Of Uncertainty, The U.S. Labor Market Is Flashing Some Serious Warning Signs

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.