DeepMind innovates on Google’s dime

Groundbreaking work in protein structure prediction has landed U.K.-based AI technology company, DeepMind, in the news.

Groundbreaking work in protein structure prediction has landed U.K.-based AI technology company, DeepMind, in the news. In late November, the company announced that its AlphaFold system had made a breakthrough using AI to solve a protein folding challenge that has stumped the scientific community for the past 50 years. DeepMind’s advances in this area could lead to significant progress in our understanding and treatment of diseases, a particularly exciting proposition as we continue to grapple with the impact of the COVID-19 pandemic.

Despite these promising innovations, DeepMind is reportedly costing their parent company Alphabet hundreds of millions of dollars each year. Alphabet, which is also Google’s parent company, has provided DeepMind with a steady stream of capital as they had over $600 million in annual losses in both 2018 and 2019. And the company’s latest annual report shows losses increased 1.5% in 2020. Even with these jaw dropping figures, Alphabet seems content to continue footing the bill–at least for the moment.

DeepMind was acquired by Google in 2014 for around $600 million. In 2016 the company rode a wave of publicity from their AlphaGo program into the collective consciousness, when the company’s AI faced off against the best player in the world at the ancient Asian board game Go and won. DeepMind has since expanded upon this work with their latest MuZero robot, which features machine-learning AI that masters games without knowing the rules. Such massively complex algorithms will be integral in creating robots capable of responding to the real world, rather than predefined roles with limited flexibility.

DeepMind’s work has also been hard at work tackling more under-the-radar projects. They’ve produced a litany of academic research, though little of this work has been picked up by mainstream media. DeepMind’s research lab, which employs hundreds of highly-paid PhD graduates, has published over 1,000 papers.

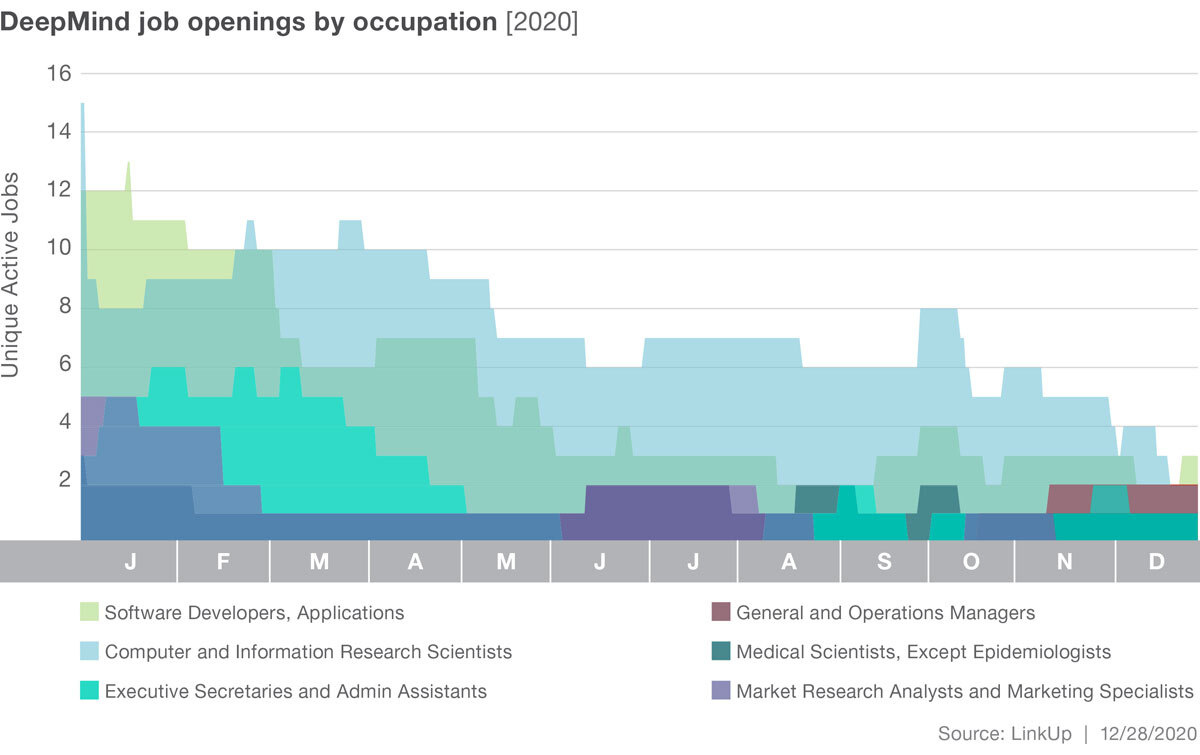

As their work on protein folding brings DeepMind back into the news cycle, we took a look at our job data to see whether or not DeepMind’s job opening have changed. Overall, their job listings dropped 73% in 2020. This is unsurprising given the massive plummet witnessed across the labor market overall, but noteworthy for a company on the cusp of major innovations. In keeping with pandemic-spurred trends, job listings dropped significantly in the front half of the year. DeepMind’s listings remained relatively stagnant for the latter half of 2020, which seems unusual for a company in the midst of a major initiative like AlphaFold.

Examining DeepMind’s job openings by occupations, we see the company’s shifting priorities reflected. Their top occupations include Software Developers, Applications; Computer and Information Research Scientists; and General Occupations and Managers.

The trajectory of jobs will be interesting to watch as, for now, DeepMind’s main customer is it’s owner. Currently lacking other profitable markets for their technology, Alphabet is paying DeepMind to lend its AI research and talent to Google’s services and infrastructure. So far, Google has utilized DeepMind’s technology for managing its data centers’ power grids and improving its voice assistant’s AI. Without a market for DeepMind’s AI outside of what it can do for Google, it’s likely their significant annual losses will continue.

For the moment, Alphabet seems content to play the long game. According to recent filings, Google waived the repayment of a further $1.3 billion in debt – a decision underscores their commitment to investment in DeepMind. Reportedly, projects in progress range from increasing the reliability of wind power to accelerating ecological research in the Serengeti. On a recent earnings call, Alphabet CEO Sundar Pichai said he was “very happy with the pace at which our R&D on AI is progressing.” Pichai emphasized the drive to remain industry leaders in the AI space, regardless of potential for short-term profit.

AI was on LinkUp’s shortlist of things to watch in 2020; though much of the year was consumed by more urgent stories. But we’re excited to revisit this fascinating topic this year, and to continue to monitor developments with DeepMind and others in the field.

Insights: Related insights and resources

-

Blog

04.06.2022

FOMO over FANGMAT stocks

Read full article -

Blog

02.17.2021

Bumble IPO generates buzz (but not necessarily jobs)

Read full article -

Blog

01.04.2021

Boston Dynamics has Hyundai doing the robot

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.