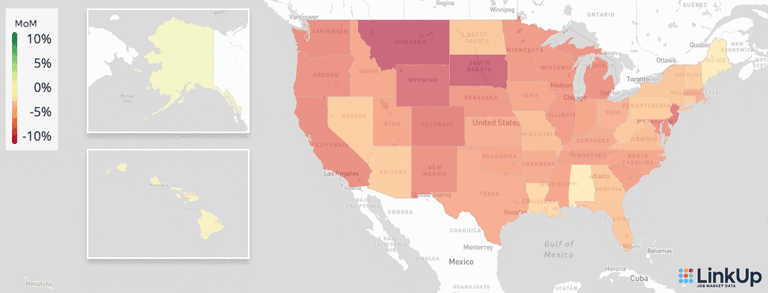

December 2023 Jobs Recap: Continued Labor Cooling

LinkUp’s job data for December 2023 marks a continued decline in labor demand; could mean a turbulent 2024. It’s an open question whether cooling indicates a return to pre-pandemic norms or an imminent deep freeze.

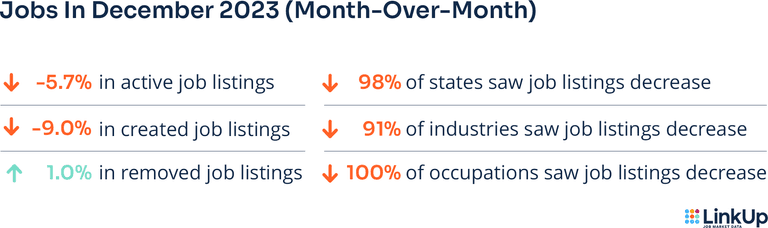

Key Takeaways:

Created Job Listings down 9% MoM and 31% since September, as we reach a full employment environment wary of over-extending itself.

100% of Occupations charted a decrease in job listings, extending the trend of labor demand decline across the economy as a whole.

Alarming Acceleration in the delta between removed and new openings signals gradual decline in labor demand has become a steeper drop-off. The delta grew from 180,000 job openings in September to 315,000 in December.

General uncertainty is running high as the labor market definitively emerges from the post-COVID boom and tense global forces converge on an election year. Whether the decline of recent months will nosedive into a broader recession in 2024, or wage growth will continue to slow in support of the Fed’s 2% inflation goal, it’s simply too early to say.

It may be that we’ve reached a full employment environment reminiscent of pre-COVID conditions and job growth will normalize at a steady and familiar rate. Or the inflation and rate hikes of the last year may have finally caught up with labor, leaving the economy vulnerable to weakening.

In any case, LinkUp’s job data is the best indicator anywhere in the world of real time labor demand in the United States. Read on for a full breakdown of last month’s labor demand data.

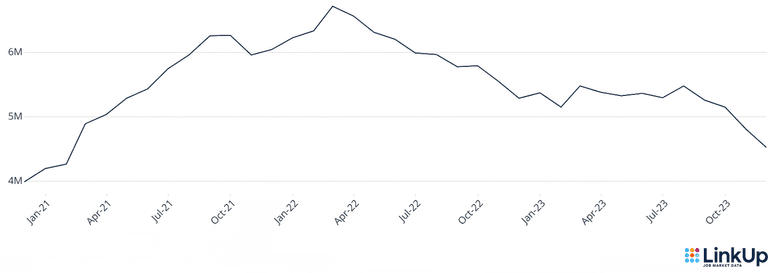

U.S. Job Listings by Month | January 2020 - December 2023

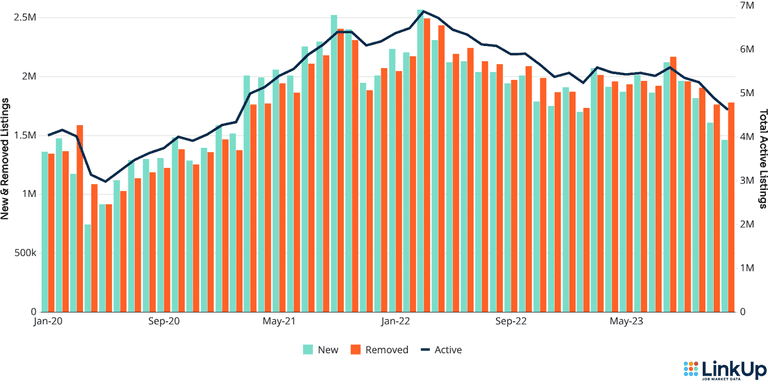

CLOSED DURATION

The entire U.S. economy tracks hiring velocity by measuring closed duration, or the average number of days that companies post job listings on their websites before removing them. As the average number of days a job listing remains live increases, hiring velocity slows.

Closed duration has continued to rise from 46.0 days in November to 50.2 days in December; a 9.1% increase. This is the third consecutive month our data shows a slow down.

Closed Duration of U.S. Jobs | January 2020 - November 2023

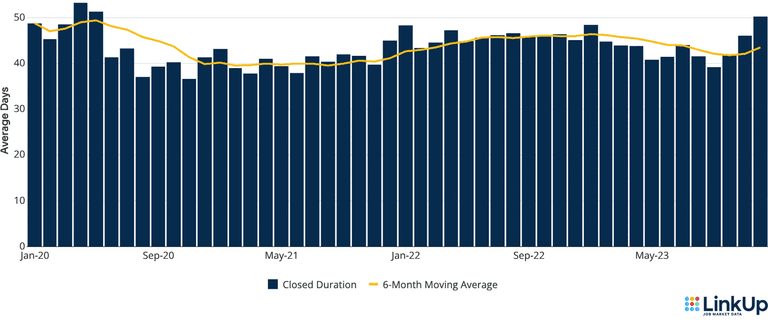

JOBS DATA BY STATE

With the exception of one state, all other U.S. states and Puerto Rico, had a decline in job listings. Alaska was the only state experiencing a minor increase of 0.6%. The five states with the largest drop in job demand included:

Montana (-12.1%)

South Dakota (-9.6%)

Wyoming (-8.8%)

New Jersey (-8.3%)

Colorado (-8.0%)

Percent Change in Active Job Listings (Month-Over-Month) | December 2023

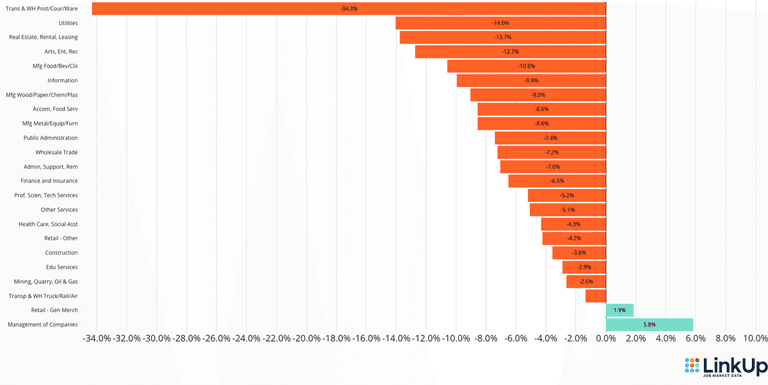

JOBS DATA BY INDUSTRY (NAICS)

91% of industries showed a decline in job listings compared to last month. Management of Companies & Enterprises (+5.8%) and Retail - General Merchandise (+1.9%) were the only industries that experienced growth. As for the top 5 industries that dropped in demand were:

Transportation & Warehousing Postal/Couriers/Warehousing (-34.3%)

Utilities (-14.0%)

Real Estate, Rental, Leasing (-13.7%)

Arts, Entertainment, Recreation (-12.7%)

Manufacturing Food/Beverage/Clothing (-10.6%)

Job Listings by Industry (NAICS) | December 2023

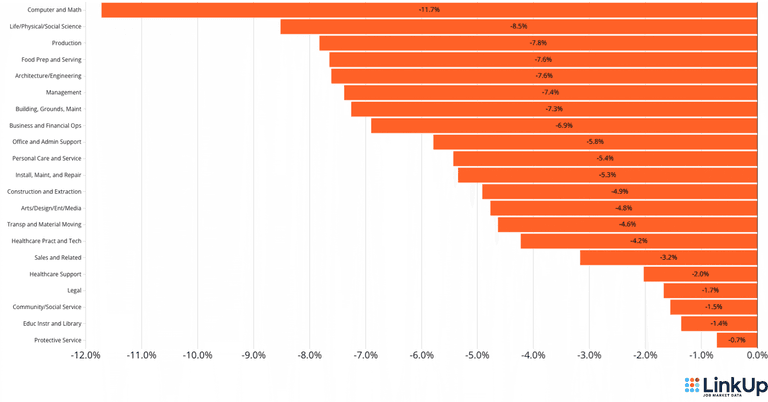

JOBS DATA BY OCCUPATION (O*NET)

In December 2023, the occupations with the largest decline were:

Computer and Mathematical (-11.7%)

Life, Physical, and Social Science (-8.5%)

Production (-7.8%)

Food Preparation and Serving Related (-7.6%)

Architecture and Engineering (-7.6%)

LINKUP 10,000

The LinkUp 10,000 is a daily and monthly analysis that shows the number of job openings from 10,000 global employers with the most U.S. job openings in LinkUp’s dataset.

The LinkUp 10,000 showed a steep drop into December 2023. Since December last year, job listings from the top 10,000 global employers have declined by 14.3%, while last month it declined by 5.8%.

Monthly LinkUp 10,000

If you’d like more granular economic data or would like to look deeper into specific industries, occupations or companies, trial our job data or request a sample.

COMPANIES ADDED

LinkUp collected job listings on 818 new employer websites during the month of December 2023. Every month we index new companies to our LinkUp job listing database and have been steadily increasing with the current 6 month moving average.

Contact us if you are interested in obtaining the complete list of recently added companies.

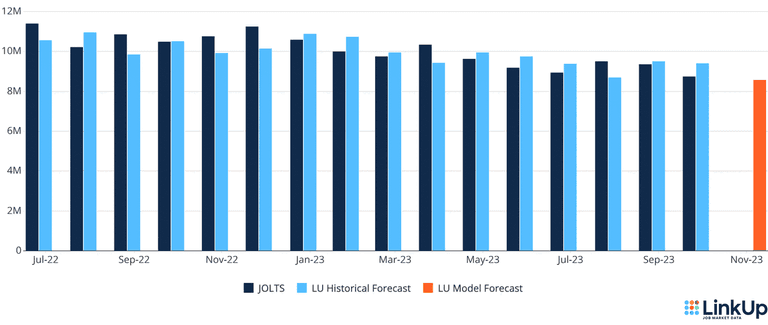

LINKUP MONTHLY FORECASTS

Stay tuned for our monthly forecast of the BLS JOLTS report which drops next Wednesday, ahead of the release of JOLTS data from the Bureau of Labor Statistics (BLS). The data includes estimates of the number and rate of job openings, hires, and separations for total jobs from private employers, by industry and by establishment size class.

Also, each month we publish a nonfarm payroll report forecast ahead of the BLS release, which is based on our RAW LinkUp job listing data. The NFP report is based on total U.S. job vacancies and provides insight into anticipated growth or decline in job listings.

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

01.03.2024

LinkUp Forecasting Net Gain of 50,000 Jobs in December

Read full article -

Blog

12.13.2023

LinkUp's November 2023 JOLTS Forecast

Read full article -

Blog

12.07.2023

November 2023 Jobs Recap: Job Growth Falls from Plateau to Decline

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.