Bid/Ask Spread in Job Market Narrowing; July Non-Farm Payrolls Will Surprise to the Upside

It’s most definitely Deja vu all over again. The re-emergence of heated debates these days around full-employment, NAIRU, Fed policy, tapering, and the mirage of bipartisanship in a Senate that still includes Mitch McConnell, not to mention reading the symbols on our alethiometer to forecast upcoming jobs reports, feels particularly reassuring (comforting, even) given how insanely surreal and unprecedented the past 5 years or so have been.

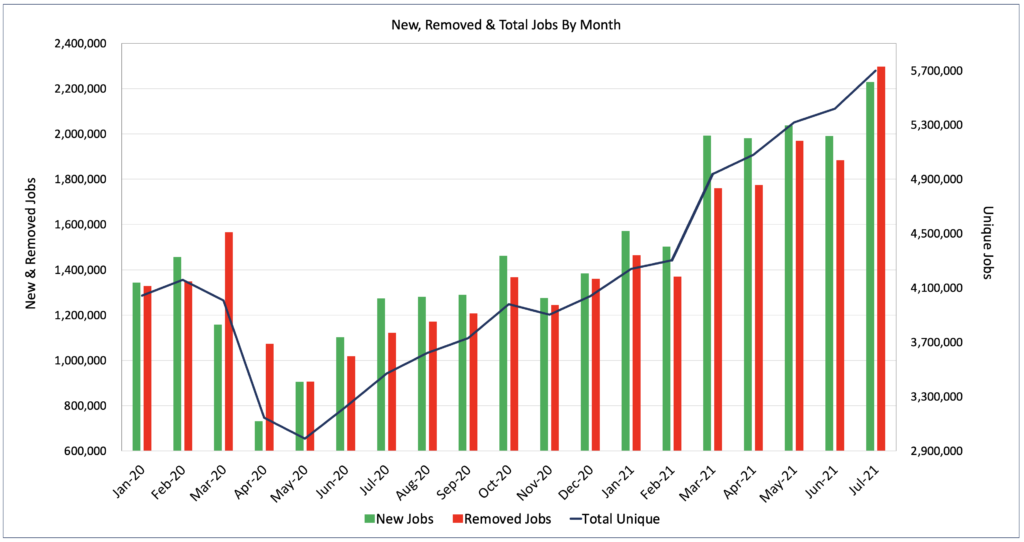

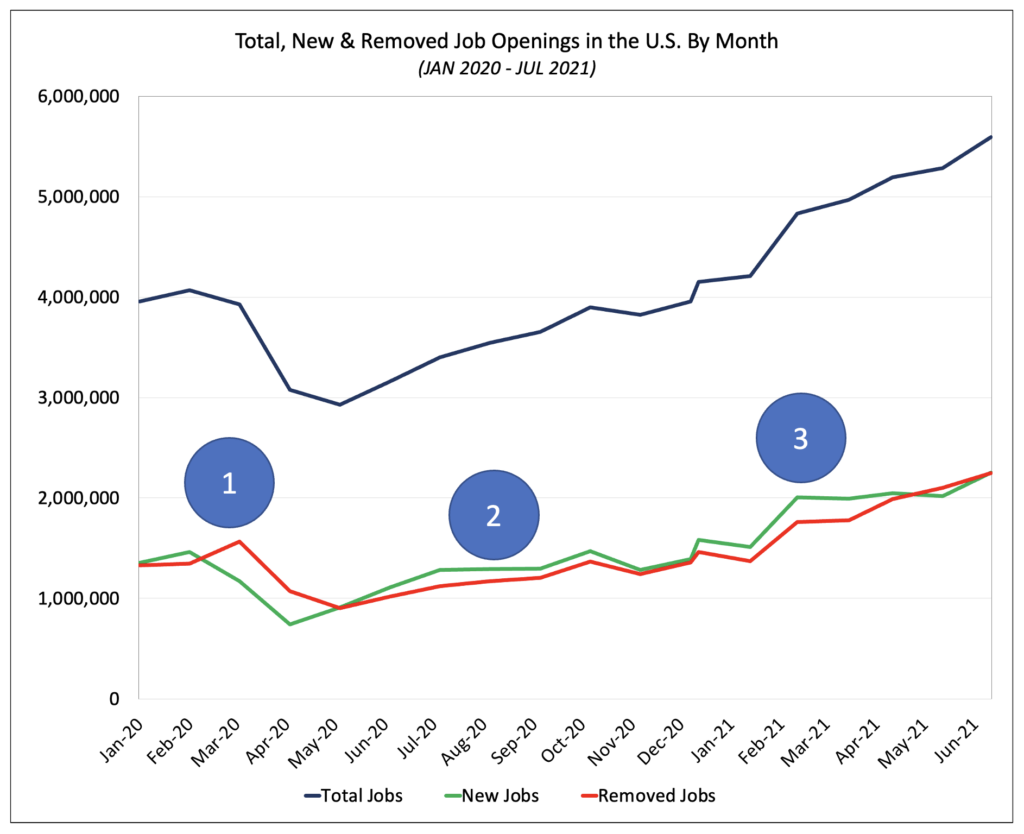

So here we are again, circa 2012-2014, in an economy recovering from massive trauma, with LinkUp’s job market data still providing a reliable fixed rope by which to help navigate the dizzying peaks and harrowing troughs of the labor market over the past 18 months. What’s not surprising about our July data is the fact that labor demand rose another 5% with total U.S. job openings from global employers climbing to 5.7 million. Additionally, new job postings for openings in the U.S. posted by global employers on their corporate career portals rose 12% to 2.23 million.

Most significant in July’s data, however, is the fact that the number of job openings removed from corporate websites soared 22% to 2.3 million. And it’s that single data point that holds the key to July’s jobs report (which we’ll return to that later in this post).

As background, LinkUp is the global leader in delivering accurate, real-time, and predictive job market data and analytics. Through proprietary technology, LinkUp indexes millions of job listings every day directly from employer websites around the world. From this unique and predictive jobs dataset, LinkUp provides valuable insights into the global labor market and delivers a range of job market data solutions to our clients in the corporate, human capital, and financial sectors.

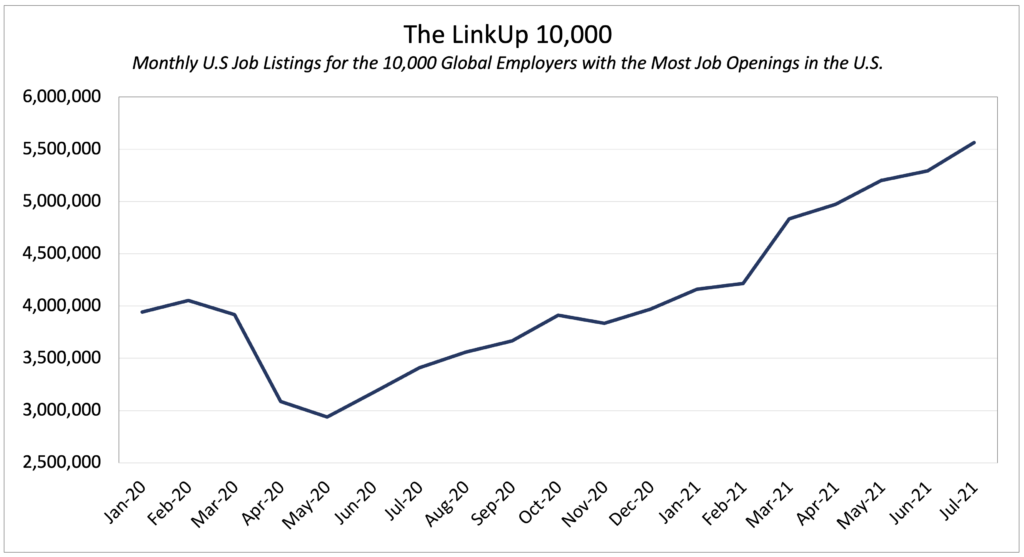

Also on the demand side, The LinkUp 10,000 has risen 41% since January of 2020, 89% since May of 2020, and 34% since January of this year.

Because we are constantly adding new companies and the jobs they post on their company website to our dataset, we’ve created a number of indices and analytics to normalize the data to account for that upward bias. One such metric is The LinkUp 10,000 which, both daily and monthly, counts the number of job openings from the 10,000 global employers that have the most job openings in the U.S.

So during the first half of the year, demand was clearly not a factor in the underwhelming 3.2M jobs added to the U.S. economy YTD. And contrary to what most pundits are espousing, the disappointing job gains are not the result of a ‘tight’ labor market or an economy that has reached ‘full employment.’

Far from it.

According to July’s Employment Situation Report published by the Bureau of Labor Statistics, there were 9.5 million people unemployed at the end of June. An additional 6.4 million Americans wanted a job but were not counted as unemployed because they hadn’t looked for work in the previous 4 weeks. And 4.6 million people in June were under-employed – working part-time but wanting to work full-time.

So more than 20 million people in the country are not presently working full-time but are, for the most part, available to re-enter the workforce or take full-time jobs under the right circumstances. And while the immediate health risks associated with Covid are to blame for a material portion of the circumstances temporarily preventing people from re-entering the workforce, a far larger set of factors, more deeply-rooted and complicated, have created a massive bid-ask spread between employers and employees that has resulted, to this point, an intractably illiquid job market.

We wrote extensively about this bid-ask spread last month in our June NFP forecast, but outside of the immediate and obvious health risks associated with Covid, those broader set of factors creating the spread can be divided into 3 categories:

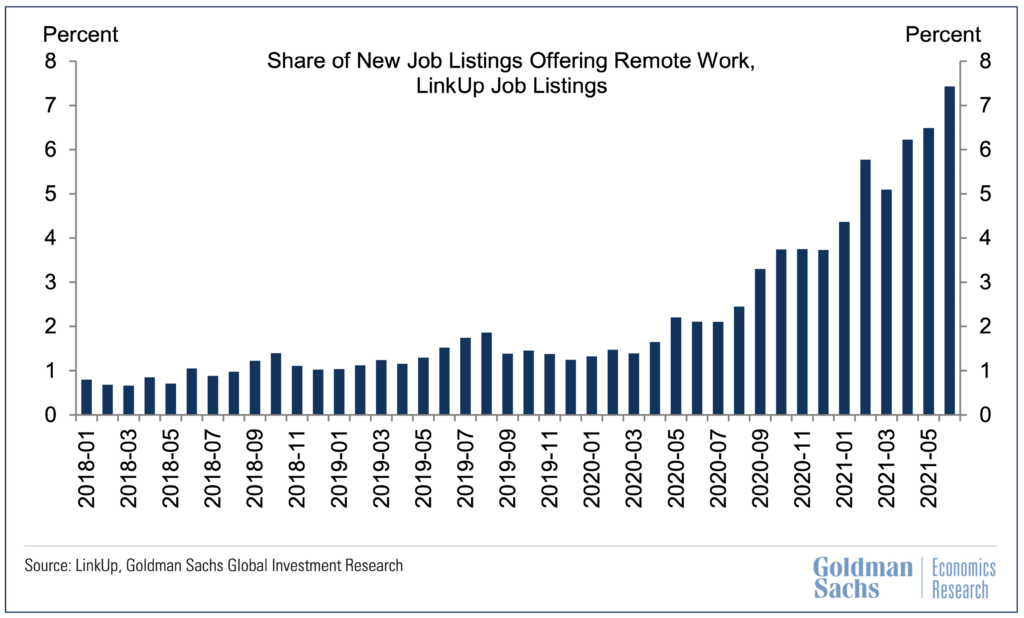

- Directly instigated by Covid (i.e., remote work, childcare challenges, schooling, etc.)

- Indirectly accelerated by Covid and a protracted quarantine (i.e., The Great Resignation, work-life balance, etc.)

- Unrelated to but magnified or spotlighted in sharp relief by Covid (i.e., stagnant wages, corporate culture, etc.)

To be clear, there are persistent systemic, structural, and policy-related factors that also contribute to a less than perfectly efficient job market, but those issues, while perhaps exacerbated to some degree during a major shock to the system like Covid, have long undergirded the labor market and their impact ebbs and flows at a slower pace than any 12-24 month window (healthcare, housing, education, childcare, racism, anti-trust/business concentration, immigration, automation, technology, globalization, etc.).

And there is one last issue worth highlighting – the so-called ‘Skills Gap’ – that is largely a fiction but is often touted by businesses (and amplified by the media and self-interested parties) as an impediment to finding workers but is little more than an excuse for not raising wages.

We highlighted all of these factors in somewhat more detail in last month’s post, and as we summarized:

…coming out of lockdown after the stress and trauma of a pandemic, combined with the isolation and/or self-reflection of being quarantined for such an extended period of time, that there has been a massive, collective, nation-wide reassessment of priorities, passions, careers, work-life-balance, the kind of company people want to work for, and what people want to do with their lives.

The world is vastly different for everyone than it was 18 months ago and a meaningful chunk of the workforce is simply not willing to go back to the same job they had before the pandemic. At the very least, they’re not willing to go back to their old job at the same salary. It’s almost as if we’re watching a stealth revolution of sorts – a collective, nationwide strike against all the inequities and injustices that have built up over so many years.

We’ll see how fleeting or sustained this strike is but for certain it will end eventually, one way or another. Either rapidly or slowly over a torturous, drawn-out process, some sort of equilibrium will be reached. One side or the other (or both) will make the necessary concessions around wages and working conditions and the multitude of other factors that come into play when a job opening is filled with a new hire.

Based on the evidence to date, combined with how quickly labor demand is accelerating and how critical employees are to most businesses, my guess is that on balance, employees are going to come out of this ahead and those gains will have been long overdue.

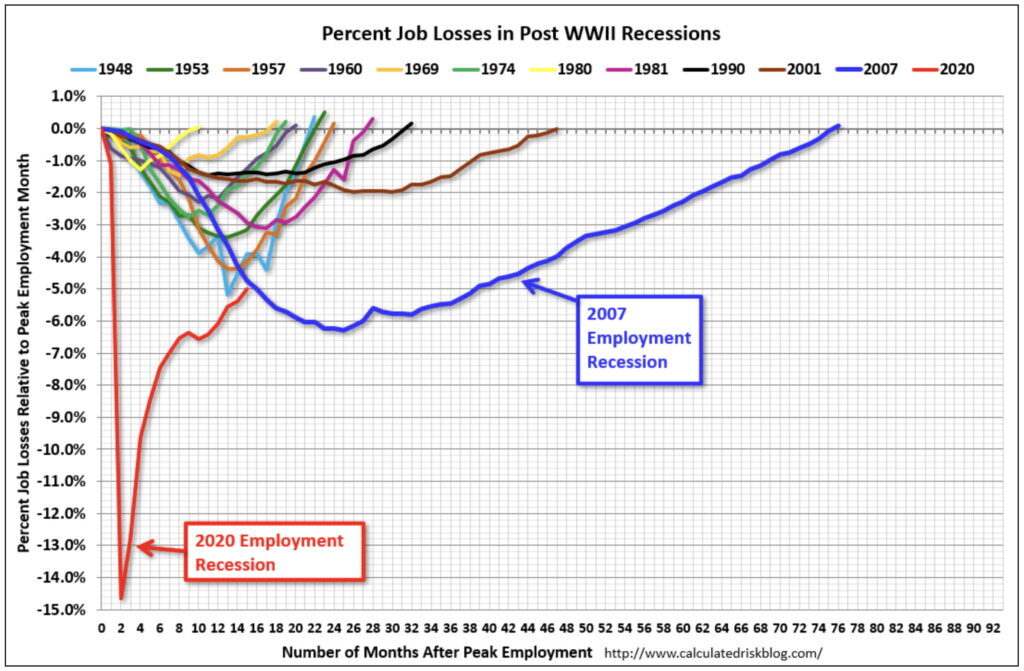

In that post, we also predicted that by the end of the year, the U.S. economy will have recovered all of the jobs lost during the pandemic. And based on July’s data, we maintain our conviction around that assessment.

And that’s where the sharp rise in July’s ‘Jobs Removed’ comes into sharp focus.

Because we only index jobs directly from company websites and have developed sophisticated and proprietary technology over more than a decade of doing this, we know precisely how many job openings companies post on their corporate website, when those openings are posted, and when they are removed. And because companies tend to be quite disciplined in taking job postings down then they are filled (to save hiring managers and HR departments from getting unnecessarily inundated with applications and to avoid ill-will on the part of job seekers who would otherwise waste time applying to jobs that have already been filled), a job removed from a company website stands as a very good proxy for that job having been filled.

As a side note, there are times when a single company or many companies will remove jobs from their website individually or en mass without those jobs having been filled. On a single-company basis, there are obviously times when the decision to make a hire is, for any number of reasons, reversed and the opening is removed because the employer has no intention of filling the role. But absent large, company-wide factors (i.e., layoffs) or regional factors (i.e., hurricanes) or macro trends (i.e., recession), those individual decisions rarely add up to be material at a national, macro level across the entire economy.

The instances when jobs are removed at scale when not tied to a hire include those events just cited as examples – a recession or a company that has already or will be laying off employees or is shutting down a division, a product line, or a specific facility, location, or factory, for example (and our data contains strong predictive attributes around such events).

So most of the time, Jobs Removed serves as a solid proxy for jobs having been filled with a new hire.

Therefore, in a ‘normal’ job market, where there is sufficient equilibrium between supply and demand, new jobs and removed jobs in our dataset tend to move in tandem – which makes perfect sense. Companies that have a job to fill create a job description, post an opening, attract qualified applicants by using fantastic job sites like Getwork, interview those candidates, and eventually make a hire – a process that on average, over the past few decades and across the entire U.S. economy, takes 45 days. Once a hire is made, the employer removes that opening from their corporate career portal.

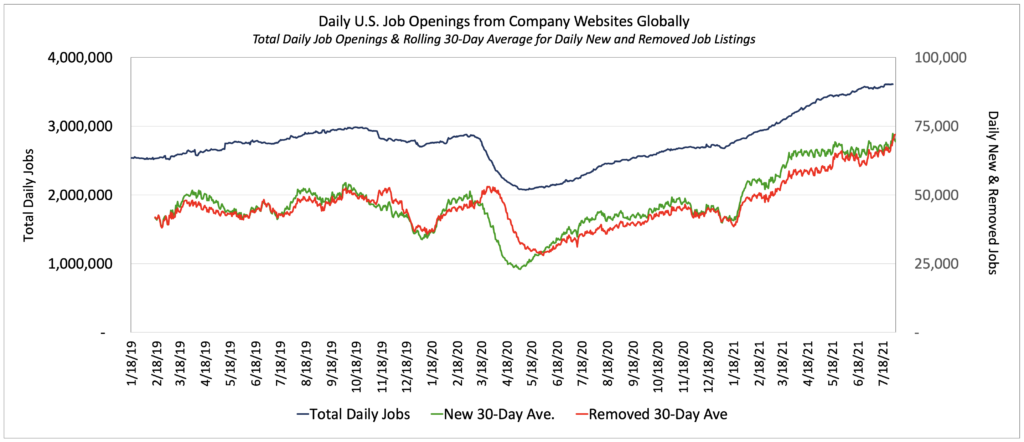

As the chart below clearly indicates, new job postings (in green) and removed job openings (in red) are closely in sync most of the time.

But far more noteworthy are the times when new and removed jobs are out of sync. It is those times where interesting things are taking place in the job market. As the chart above also indicates, two of the most dramatic such periods occurred in the past 18 months – between March and April of last year as Covid rocked the economy and between January and May of this year as the previously described bid-ask spread largely froze the job market.

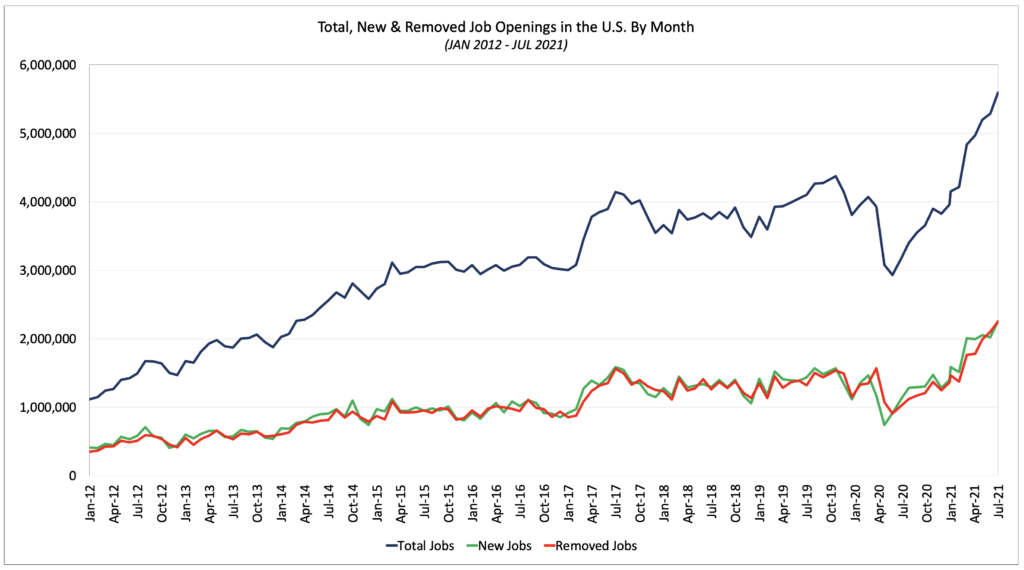

In looking at our data since 2012, it becomes apparent how infrequently new and removed jobs diverge so significantly.

Looking more closely at new and removed jobs since January, 2020, it is worth noting precisely what’s been happening. In February (Marked 1 in the graph below), as the pandemic tsunami hit the global and national economy, companies aggressively curtailed hiring. Of course, hiring around the country didn’t stop completely and employers still posted new job openings in those months, but new job postings dropped 50% from a peak of 1.45M in February to 730,000 in April. At the same time, companies rapidly began removing job openings that had previously been posted because they had no intention of filling those roles during the pandemic but over time, the number of jobs removed also started dropping due to the massive slow-down in overall hiring activity.

Between April and the end of last year (marked 2 in the graph below), hiring slowly returned – beginning in certain sectors as the nation reacted to the crisis and companies responded to rapidly shifting demands, and then eventually spreading across other parts of the economy as we all adapted to circumstances. In that period, hiring velocity slowed down and jobs removed lagged noticeably behind New Jobs, but the upward slopes were similar and as the recovery continued, new and removed jobs converged by year-end.

In the first part of this year, however, new and removed jobs were once again out of sync (marked 3 in the graph above) due to the rapid acceleration in labor demand and the reluctance on the part of employees to re-enter the workforce for all the reasons cited previously. To be clear, hiring picked up significantly, and the economy added 1.5M jobs in Q1 and 1.7M in Q2, but the gap between new job openings (green) and new hires (red) persisted between January and April of this year as the bid-ask spread between employers and employees took its toll.

Since April, new and removed jobs have converged yet again with new jobs remaining flat since February and removed jobs steadily increasing over the past 5 months as more and more jobs are getting filled.

In putting this all together and returning back to the pervasive sense of deja vu, we have to once again post the single greatest jobs chart ever (it’s billed by its creator Bill at CalculatedRisk as the ‘Scariest Jobs Chart’ ever, but it’s also the greatest).

Although it feels wildly premature to call it such at this point, the post-pandemic recovery has been both massive and rapid and we expect it to continue into the foreseeable future as equilibrium is sustained in the job market. We suspect that that equilibrium will be maintained mostly by employers raising wages, accepting and increasing adoption of remote work, and making all the other reasonable accommodations necessary to attract employees.

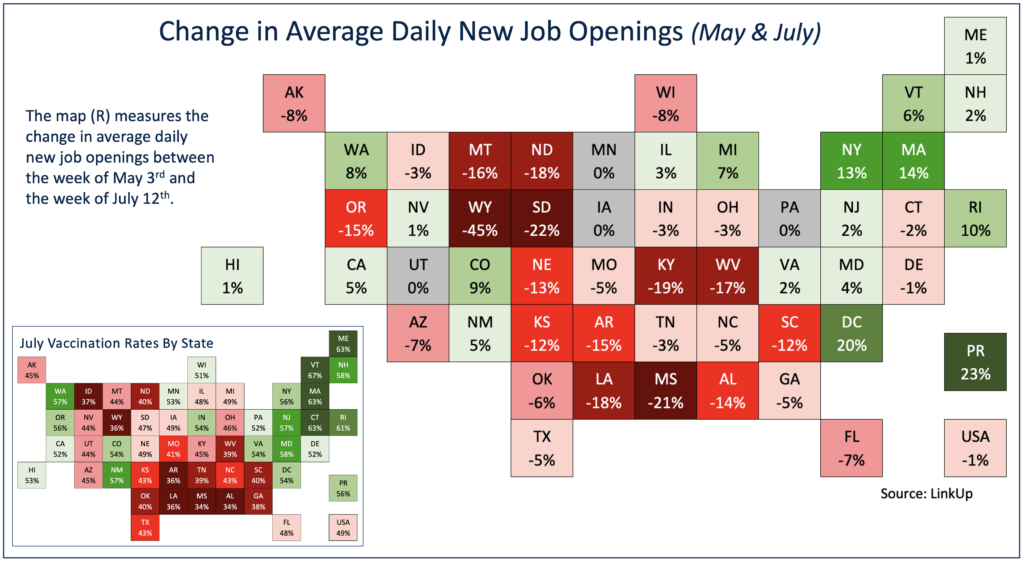

But as we mentioned at the outset, forecasting non-farm payrolls always involves an element of reading the symbols on our alethiometer. Nothing has changed since 2012 in that regard and the circumstances these days are arguably more complex and unprecedented than ever before. The backdrop of how smoothly and efficiently employers and employees can reach a clearing price, so to speak, at a macro level remains highly uncertain and of course, vaccination rates have slowed, the delta variant is spreading rapidly, and epsilon is apparently even more horrific.

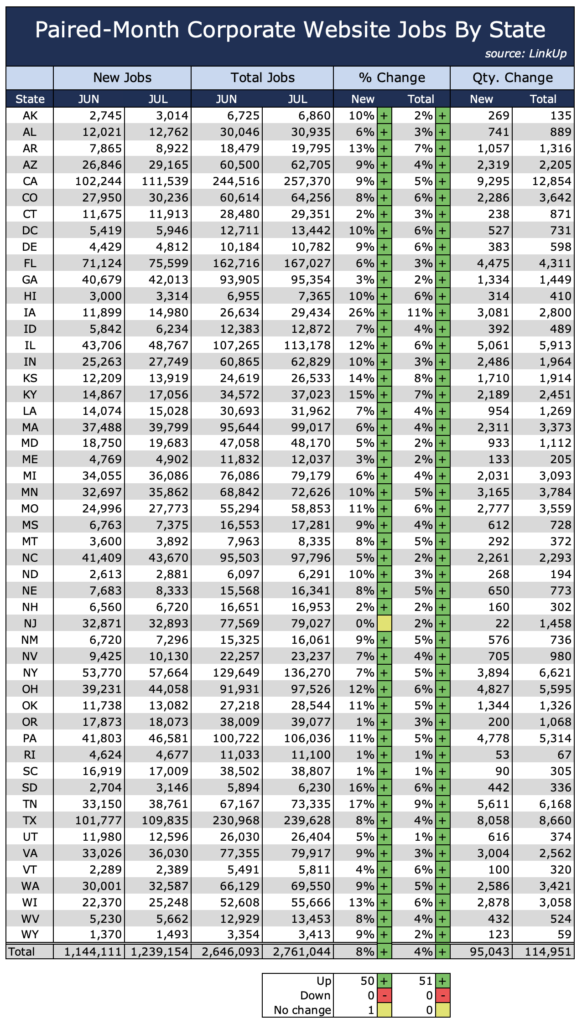

But on the other, other hand, as we noted at the top, new, removed, and total jobs picked up sharply in July. In looking at our paired month data, which compares job gains for a common set of companies that were hiring in both June and July, new and total jobs rose 8% and 4% respectively.

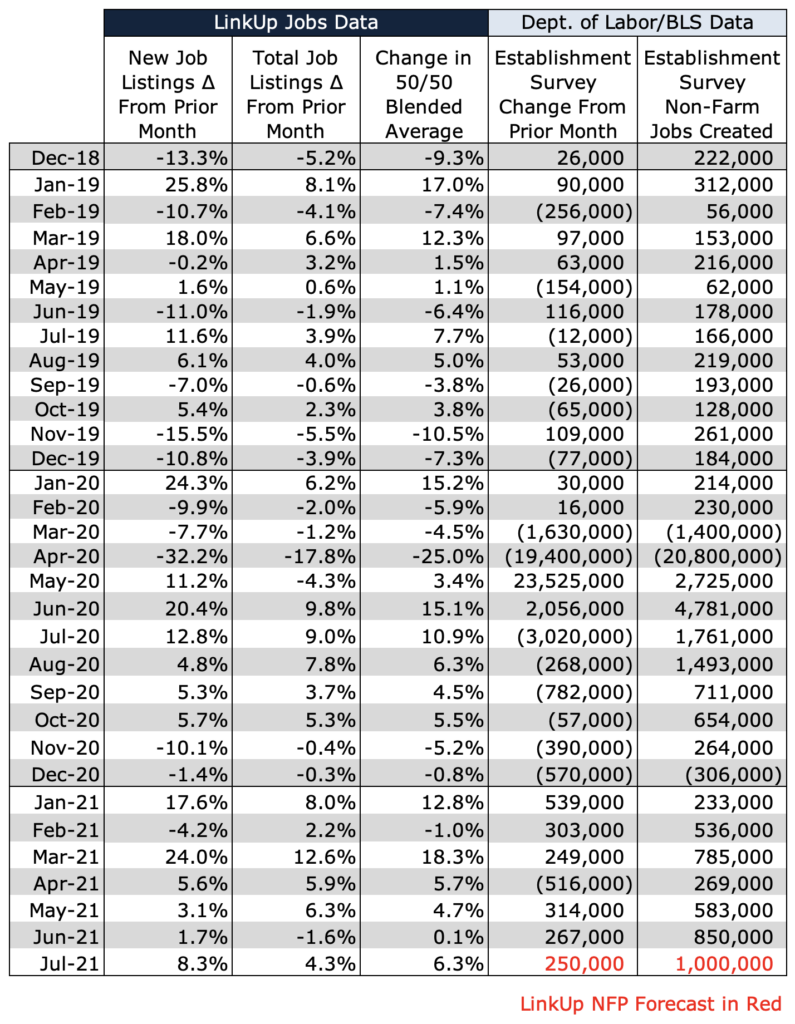

So for July, we are forecasting a net gain of 1,000,000 new jobs, solidly above consensus estimates.

All we need now to return full-circle to the post-Great Recession era is for Winds of Winter to finally be published.

Insights: Related insights and resources

-

Blog

10.07.2022

September 2022 Jobs Recap: Job listings down 3.2% as hiring velocity slows

Read full article -

Blog

05.10.2021

April 2021 Jobs Recap: A spring in our step with yet another month of growth

Read full article -

Blog

04.11.2020

Total Jobs On LinkUp.com Have Dropped 25% Since March 16th

Read full article -

Blog

04.09.2020

The LinkUp 10,000 Dropped Another 1% Again Yesterday

Read full article -

Blog

08.30.2018

With Signs Pointing to Weakening Job Market, Job Gains Will Disappoint Again In August

Read full article -

Blog

09.01.2016

LinkUp Forecasting Net Gain of 220,000 Jobs In August

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.