Better-Than-Consensus Jobs Report Friday Could Lead Fed to Go Either Way on Rates

LinkUp forecasting gain of 275k jobs which could give Fed confidence to cut with low risk of resurgent inflation OR it might lead Fed to raise rates preemptively; Our base case is Fed holding steady.

The WSJ published a great article today (Traders Are Betting More Aggressively Ahead of Economic Data) about analysis that Alexander Kurov, a finance professor at West Virginia University, did on the larger and larger bets that bond traders are putting on key economic indicators ahead of government data releases. The analysis showed that 12 of 30 major economic indicators move the Treasury market and that of those 12, traders are betting correctly on 7, typically about 6 hours ahead of their release.

The article notes, however, that “traders seem to struggle with wagering ahead of a few of the most-watched releases, however, particularly the biggest reports on jobs and inflation: nonfarm payrolls and the consumer-price index. Those still spark big moves in bond yields, but the advanced moves don’t tend to prove prescient. Those two reports provide investors with their most-direct look at the potential course of interest rates, which play a determining role in setting bond prices. They can also be noisy. Analysts said that increases the risk of posting big bets ahead of time. ”

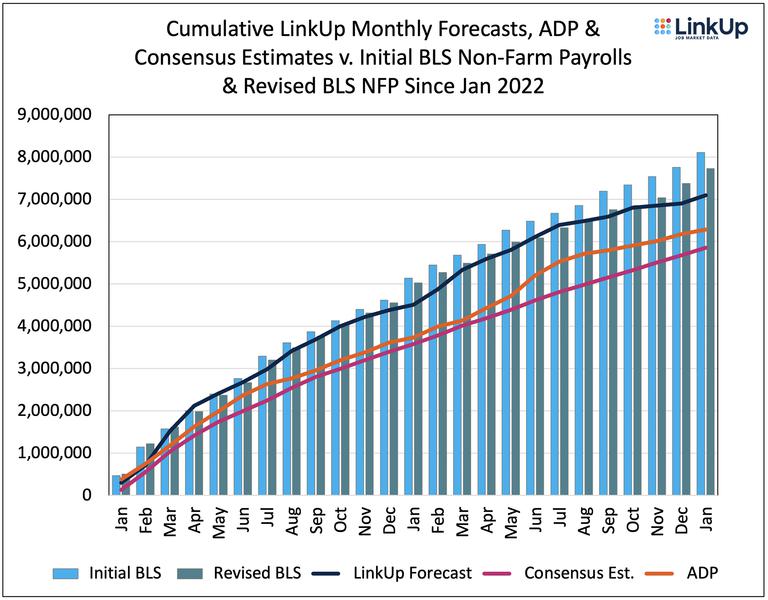

There’s no doubt that nonfarm payrolls (NFP) have long been noisy and have gotten less reliable in the Covid era. JOLTS data even more so. But as we highlighted in a post just last week, there are better alternatives to survey-based data (such as job openings sourced every day directly from company websites around the world) that provide a deeper, far more accurate, real-time understanding of what is actually going on in the labor market. It’s that alternative job market data that has served as the basis for accurate forecasts of the soft landing that’s occurred in the U.S.

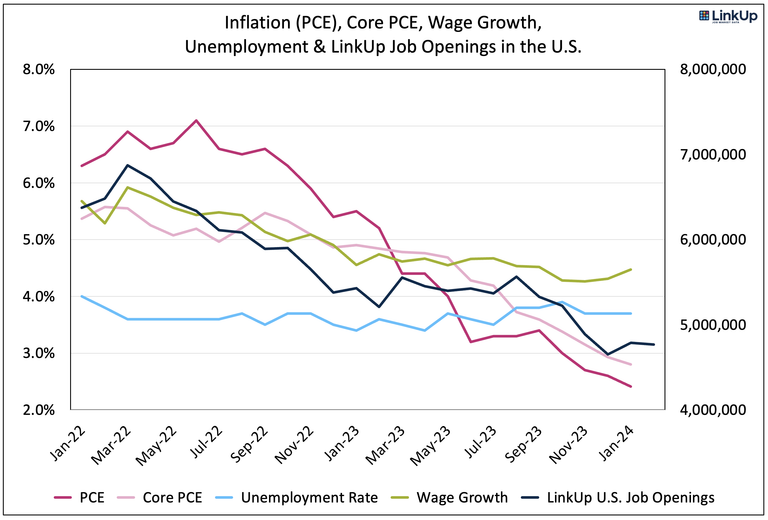

Lest anyone still question the soft landing, last week’s inflation data should have obliterated any remaining doubts.

Even for those who focus solely on Core PCE, the data is only infinitesimally less conclusive.

Soft landing aside, the fundamental takeaway from the chart above is that accurate labor demand data serves as the key barometer of equilibrium between demand and supply in the job market, a barometer that provides insight not only into both job gains and wage inflation, the latter arguably the key driver of broader inflation, but also the economy as a whole.

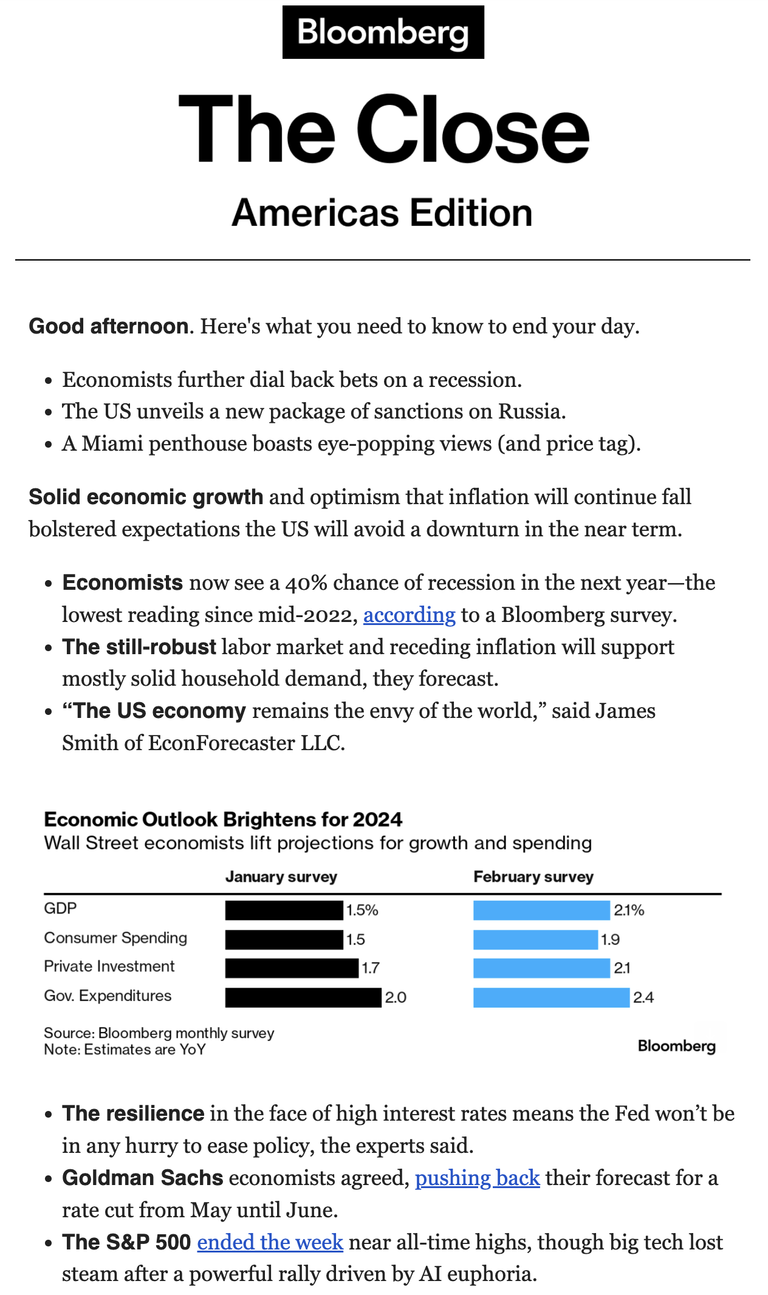

Since January of 2022, the strength and resilience of the U.S. job market has not only surprised just about everyone, it’s served as the primary engine powering the entire economy. It might have taken longer than expected for people to start recognizing how powerful that engine is, but Bloomberg’s ‘The Close’ from February 23rd is a perfect encapsulation of what a force the job market is, the myriad ways it’s impacted pretty much everything, and how much consensus views have brightened in just the first two months of the year.

As The Close notes, recession fears have receded further, the economy keeps chugging along, job market strength continues to bolster consumer demand, the U.S. is outperforming the rest of the world, economists have raised projections for GDP, consumer spending, private investment, and government expenditures, expectations for Fed cuts are being pushed back, and the markets remain at record highs.

Not a bad set of circumstances given that only a year ago, 100% of economists surveyed believed a recession would hit before 2023 was over.

Now imagine adding into the mix another blowout jobs report along the lines of what we’re forecasting Friday for February - a net gain of 275,000 jobs. Such a number might give the Fed confidence that it could cut rates with a low risk of resurgent inflation or it might cause the Fed to preemptively raise rates.

While everyone’s outlook on the economy would brighten even further with job gains higher than the consensus estimate of 200,000, predicting what the Fed would do in response and how the markets would therefore react is anyone’s guess.

Hence the conclusion of the WSJ article cited at the outset:

And some warn that the path of rates is likely more winding than it seems. The pandemic era has upended a lot of Wall Street predictions about the economy’s direction. Traders that are overly confident that they know the future could be in for surprises.

“The Fed has been data-dependent many times, but I don’t think the data has ever been as difficult and volatile for them to read,” said Chris McAlister, global head of derivatives trading at Prudential.

With all that, we’re sticking with prediction #8 in our 10 predictions for 2024:

8. The Fed will cut later and less often than the markets expect

Insights: Related insights and resources

-

Blog

03.01.2024

LinkUp Forecasting a Net Gain of 275,000 Jobs In Next Week's Jobs Report for February

Read full article -

Blog

02.28.2024

Walgreens vs. Amazon: A Dow Jones Story

Read full article -

Blog

02.27.2024

The Minneapolis Fed Should Start Paying Closer Attention To Goldman Sachs Research

Read full article -

Blog

02.21.2024

Follow the Job Data, Not the Headlines

Read full article -

Blog

02.20.2024

Big Software Push at Disney

Read full article -

Blog

02.16.2024

Mapping the AI Revolution with LinkUp (Part III)

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.