A Balanced Job Market Continues to Chug Along, Powering the U.S. Economy

Awash in a muddle of macro data signals, the job market remains the singular harbinger of what's to come and what icebergs might lie ahead for the U.S. economy

We’ll be issuing our June non-farm payrolls forecast tomorrow when we have complete job openings data for June, but given the holiday this week, we wanted to publish our commentary on the general state of the economy and the job market in advance of our NFP forecast. And given the events over the past week or so, there is certainly no shortage of material to weigh in on regarding what’s going on these days.

Leaving aside for the time being the chaos resulting from Thursday night’s debate, Friday’s positive inflation numbers came in very much as expected and reinforced the broader narrative that’s been underlying the economy for at least the past year: the economy continues to gently slow down while remaining in solid shape.

Regardless of where one falls on the soft landing spectrum, it’s clear that the U.S. economy is somewhere in a T+1:12 timeline, where T+x denotes the number of months since the soft landing touch down occurred. We’re solidly planted in the T+12 camp and with every passing month and nearly every data release, it’s becoming increasingly difficult to imagine anyone still holding out in the T-x camp.

But with the soft landing receding further and further in the rear-view mirror, the operative question, of course, is what lies ahead as far as the economy and the Fed are concerned. And on that front, as Lisa Abramowicz noted on Bloomberg Friday morning, “everything is a muddle.”

That muddle is the result of lots of mixed signals emanating from the economy (GDP, consumer spending, the job market, housing, business orders, etc.) and the wide range of possible interpretations of what those signals might indicate as far as both what’s driving the economy as well as the underlying health of the economy in general.

Is inflation declining as a result of supply-side improvements (as some Fed officials believe) or elevated-rate-induced demand destruction? If the former, how sustainable are those improvements, and if the latter, at what pace and with what lag is demand being curtailed? Is the economy merely downshifting or about to slam into a wall?

The broad range of perspectives on the potential answers to those questions, in turn, creates a severe degree of uncertainty about what the Fed is likely (or unlikely) to do going forward. Is the glass half empty or half full? And if it’s unclear, when and how might it become clear and how will the Fed react (or be forced to react)?

Not surprisingly, it’s largely the case that as inflation steadily moderates and, in all likelihood, will continue to do so going forward, it’s the job market that will be the key indicator of where the economy is heading and the determining factor for how and when the Fed moves.

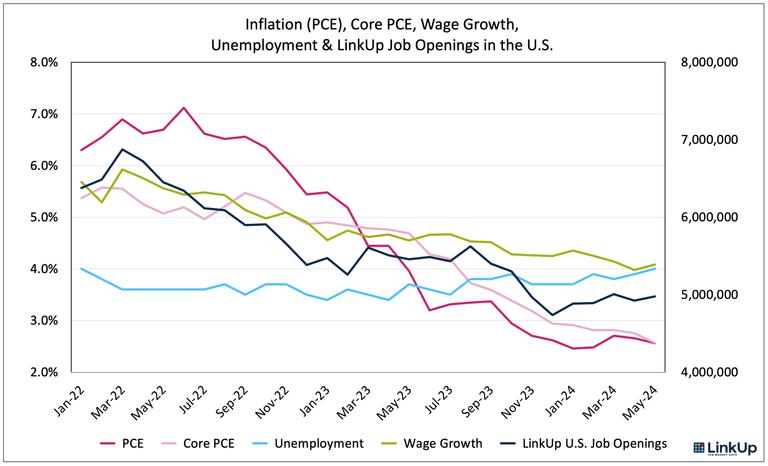

And while there are mixed signals emanating from the job market as well (e.g., strong job growth but declining openings, chronic divergence between the household and establishment surveys, cooling wage growth but strong real incomes, historically low but rising claims, low but rising unemployment), the broader narrative remains solidly intact - a balanced job market in a full employment environment continues to power the U.S. economy, albeit at a gradually moderating force.

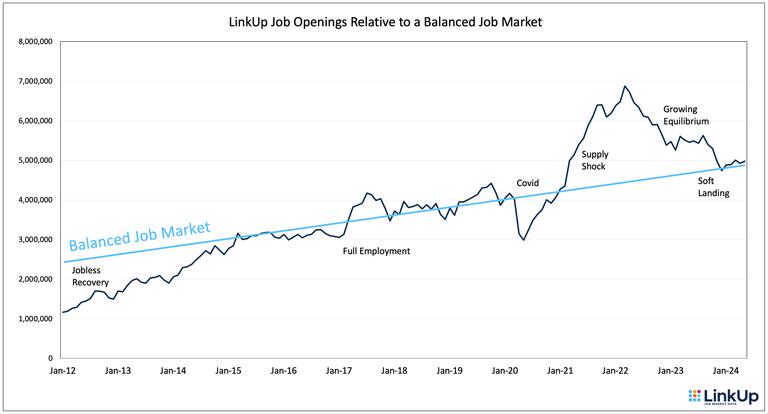

As the chart below indicates, plotting what we’d denote as a perfectly balanced job market (light blue) against LinkUp’s job openings in the U.S. (dark blue) sourced directly from employer websites globally, the U.S. job market has been in perfect balance since January 2024, a fact we’ve been articulating for months.

With the huge ballast provided by a perfectly balanced job market chugging along in a full employment environment, there’s no need to be overly distracted by noisy data points, especially when they’re consistently giving off conflicting, counter-balancing, and ambiguous signals. As we pointed out earlier this month in a post we titled after a Seinfeld episode “Everything About the Economy Is Even-Steven,” it’s critical to keep the big picture squarely in view:

Everything is positive but muted - growth, jobs, wages, business, consumers, spending, inflation, sentiment, etc. - all of which points to massive inertia in favor of the status quo.

Even Steven - everything in balance, drifting along in a quite pleasant, steady state.

The U.S. job market, the massive keel serving as ballast keeping us on our present course (and continuing to drive Fed policy and, therefore, global markets), remains in near-perfect equilibrium in a full employment environment.

It’s the presently balanced environment that we expected in our 10 predictions for 2024 back in January when we forecasted average monthly job gains of 130,000 for the year. That number will, most assuredly, bounce around a bit - especially given the growing volatility of BLS revisions, and while immigration has given job growth a boost above that level even while maintaining a neutral impact on wages, we expect steady, modest, neutral, positive monthly job gains for the balance of the year.

That, in turn, combined with ebbing inflation and persistent real wage growth, will generate positive, muted, sustained numbers across the entire economy (e.g., GDP, consumer spending, corporate earnings, etc.).

Of course, with the Captain Obvious statement of the summer, things will change at some point - as confident as we are in the inertia around the steady course of SS American Job Market, there are plenty of icebergs to be mindful of.

In fact, there are too many to list them all but pertaining to the U.S. job market itself, Goldman Sachs noted in a June 17th research piece that while the job market ‘remains firm on average,’ three soft spots (household survey weakness, May’s slight uptick in unemployment, declining quits) are cause for concern and therefore necessitate close monitoring of the labor market as a whole.

As Goldman’s Chief Economist, Jan Hatzius, highlighted in a note on the same day:

The labor market stands at a potential inflection point where a further softening in labor demand would hit actual jobs, not just open positions, and could therefore push up the unemployment rate more significantly. We thus continue to expect two Fed rate cuts this year (in September and December) despite the hawkish June dot plot.

We’ll refrain from weighing in on the likelihood of Fed cuts in September, but the sentiment is clear - everything comes back to not just the job market (what MIT economist David Autor calls ‘the central institution of any society’), but even more granularly to labor demand itself.

So as they say, watch this space (as in tomorrow).

P.S. - Regarding the debate, we’d note Prediction 11 in our 10 Predictions for 2024: neither Biden nor Trump will be their party’s nominee in November. Leaving aside the likelihood of that happening, the singular takeaway from Thursday’s debate is the irrefutable fact that neither candidate has any business running for President.

P.S.S. - For anyone interested in absolutely the best discussion I’ve heard/read around long-term and more recent, immediate-term inflation and its impact on U.S. consumers in general and consumer sentiment in particular, I’d highly, highly recommend Ezra Klein’s June 7 podcast on the topic - The Economic Theory That Explains Why Americans Are So Mad. Brilliant analysis and further confirmation that $7 mayonnaise might end democracy.

Insights: Related insights and resources

-

Blog

06.21.2024

SMCI Adds Scores of Jobs Quickly as AI Hardware Demand Soars

Read full article -

Blog

06.19.2024

Job Openings Plummeted Months Ahead of Fisker Bankruptcy

Read full article -

Blog

06.14.2024

The Compass Subsidiary Tool shows what’s driving hires at big tech firms

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.