Auto Parts driving earnings

As we prepare for a large swath of companies to report earnings in the next few weeks, LinkUp decided to take a look at jobs data to see if we could find an indication of what to expect.

As we prepare for a large swath of companies to report earnings in the next few weeks, we decided to take a look at our job data to see if we could find an indication of what to expect. To start, we selected a handful of stocks whose 10 day average of active jobs have shown movement either up or down over the past 30 days. Examining job listings could give us some indication of how earnings will go for a few standout symbols.

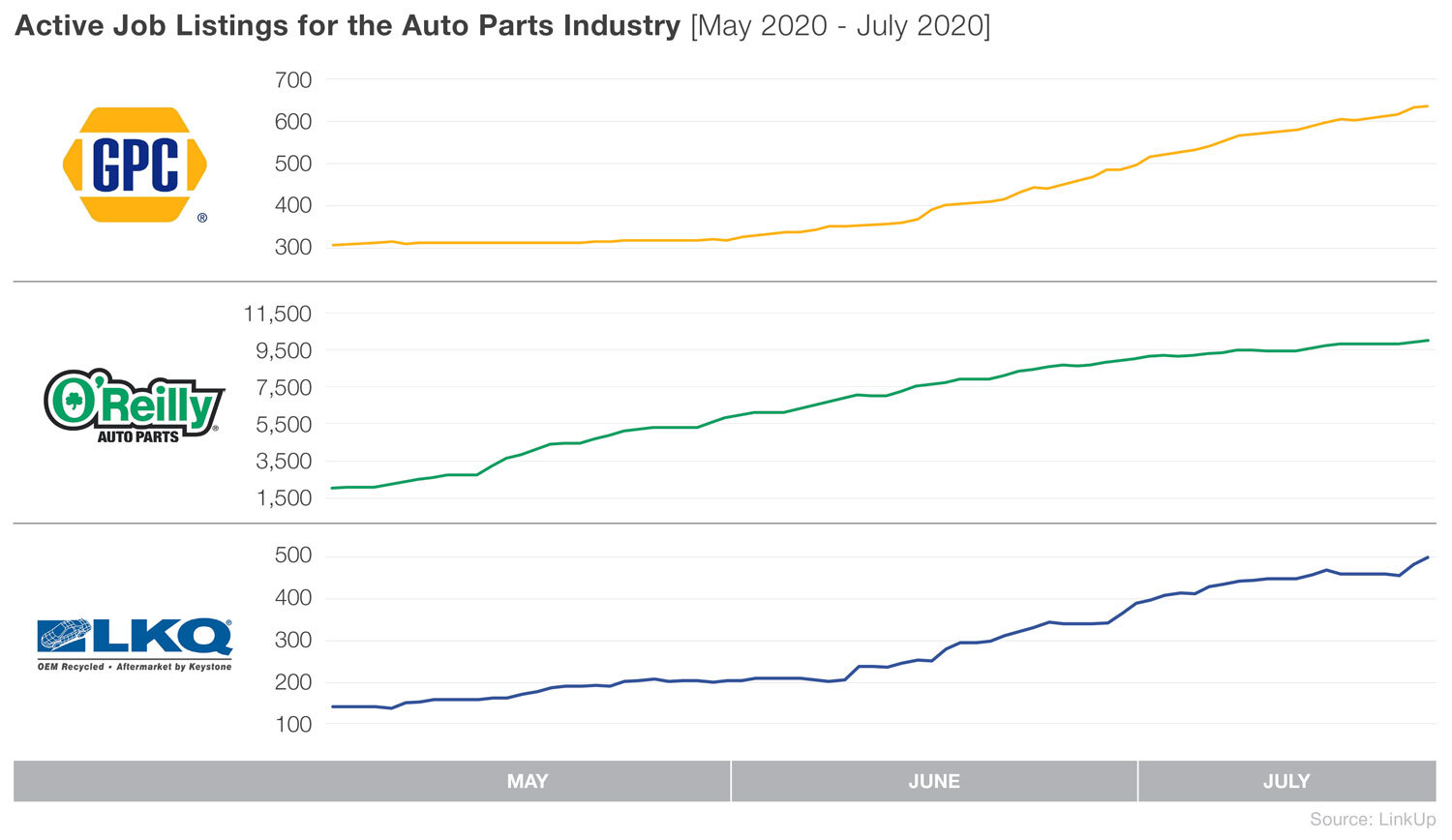

At first glance, it appears demand is increasing in the auto parts industry. We see O’Reilly Automotive (ORLY), LKQ Corporation (LKQ) and Genuine Parts Company (GPC) increasing their job listings at a very rapid pace. This could indicate a high demand since both ORLY and GPC are largely retail driven and require people in stores to sell products. LKQ also has retail operations to support, along with wholesale business.

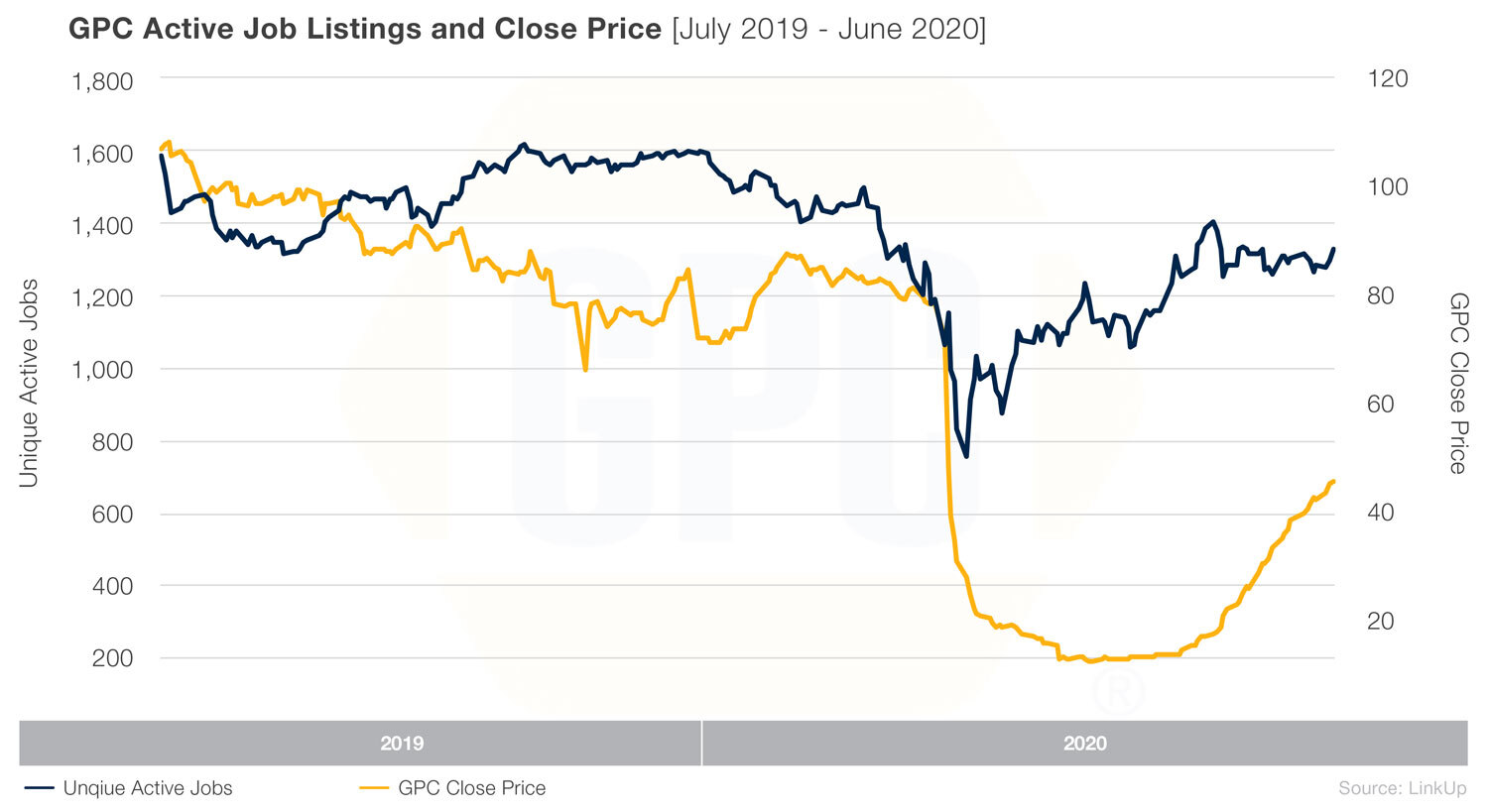

Taking a closer look, we can see that GPC shows fairly strong correlation between jobs and stock price over the past year. Recently though, we have seen correlation between these two factors decrease, as stock price has stayed steady but jobs have nearly doubled. Based on the history of GPC jobs to price correlation, this number could likely revert to its mean. This would suggest that GPC is due for an increase in price that may be seen when earnings are reported.

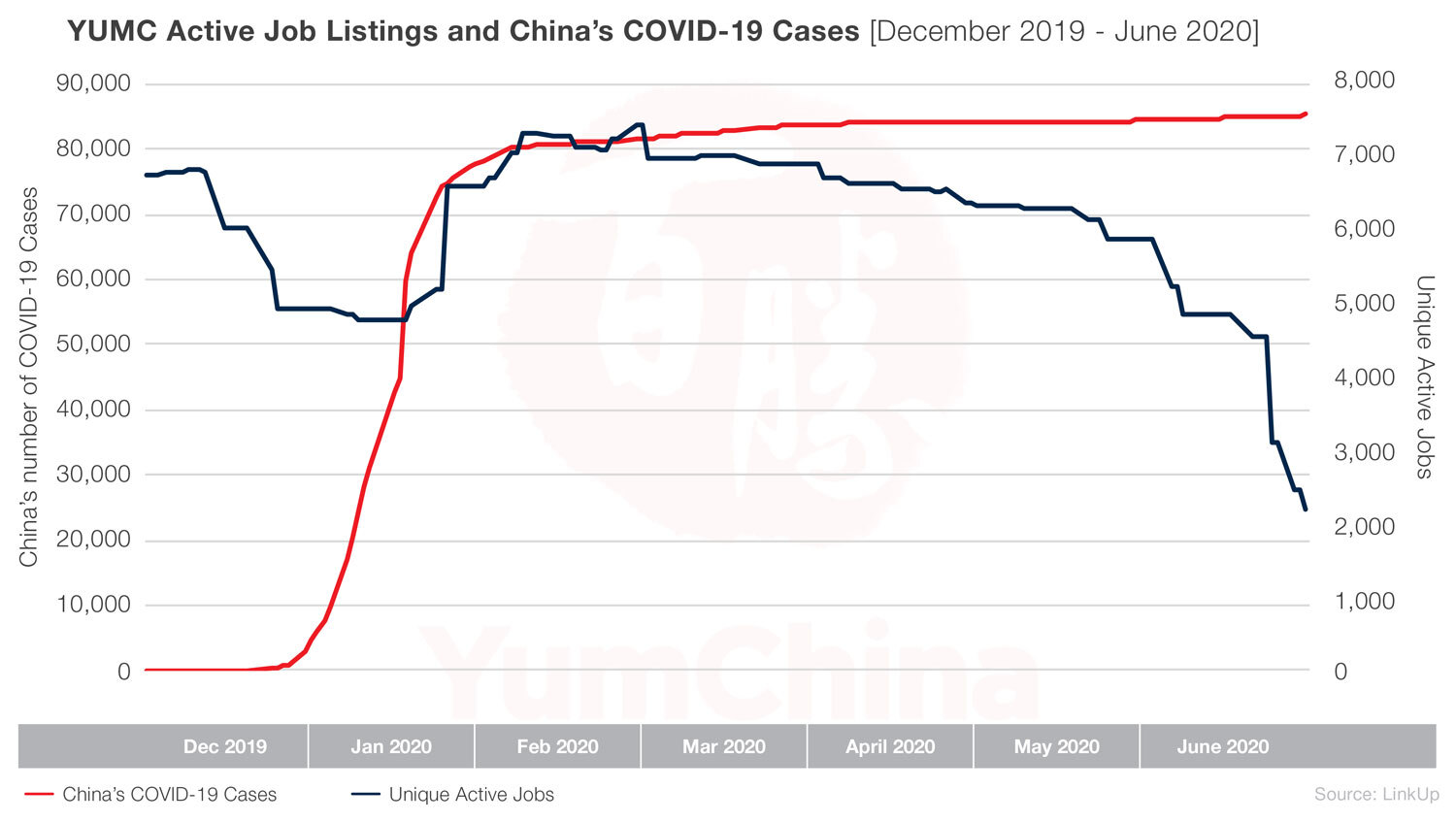

Looking at the other end of our indicator, we see both fast-food titan Yum China Holdings Inc (YUMC) and American software company ServiceNow Inc (NOW) have both drastically decreased their job postings. In these two cases specifically, it’s important to note that a decrease in job postings does not alway spell bad news for a company’s outlook.

In the case of NOW, the reduction in job postings could signal efforts to decrease expenses in service of a better profit margin. While it is unlikely this move would play out ahead of their upcoming earnings call, it is certainly something to monitor for in the future.

On the other hand, a decrease in YUMC job listings could spell trouble. With retail heavy operations, this could be a sign of decreased demand. COVID-19 took a significant toll on retail operations, as evidenced by YUMC job postings during COVID-19 in China. YUMC increased postings as the outbreak continued to gain steam, but looking forward we can see they may still be struggling. Though cases have begun to plateau in China, their job postings have decreased significantly.

We look forward to providing continued analysis as the current earnings season unfolds and companies give investors the first full look into the pandemic’s impact on their balance sheets.

Interested in the job data behind this post? Contact us to learn more about LinkUp job market data.

Insights: Related insights and resources

-

Blog

05.20.2022

Revealing job market right now in retail

Read full article -

Blog

04.20.2022

Netflix stock falls, following their jobs trend

Read full article -

Blog

02.28.2022

Jobs Data on Dollar Tree Ahead of Earnings Report

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.