We Are Definitely In a Full Employment Environment

April Jobs Report Will Obliterate Any Doubts About Wage Inflation & June Rate Hike.

Now that Season 6 of Game of Thrones has started up, I can finally stop relying on politics as a backdrop for our monthly non-farm payroll (NFP) forecasts and labor market commentary. And like the first 2 fantastic episodes of the season, there is certainly no shortage of storylines to draw from. In fact, there are so many chaotic story lines swirling around the U.S. economy at the moment that things more closely resembles Westeros than at any point since the carnage of the Great Recession. While it wouldn’t surprise me if a few dragons appeared in the skies, we do have our own Lucifer in the Flesh, The First of His Name and The Most Miserable Son of a Bitch. And in addition, just like GoT, every time one part of the story seems to get resolved, more questions emerge, uncertainty keeps growing, and fear and trepidation continue to plague the nation.

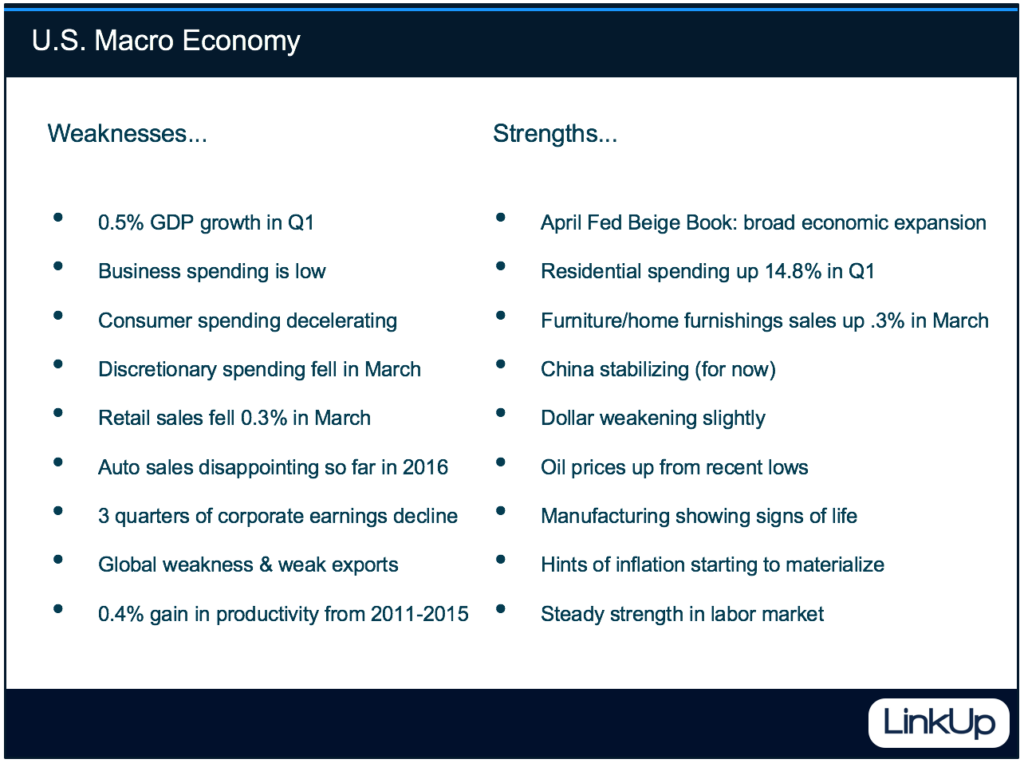

On top of the standard list of questions these days such as whether or not 2016 will follow the pattern of recent years with weak Q1 GDP growth followed by decent subsequent growth later in the year and how nervous the U.S. should be about persistent global weakness, a list of far more vexing and impactful questions has begun to materialize. A few such questions are…

1) What has happened to U.S. productivity growth?

2) Are we in an environment of Full Employment?

And of course, there’s always the same question that has persisted for years in one form or another….

3) WWJD (What Will Janet Do)

As an amateur economist at best, I’m forced to rely on far more qualified economists to answer the first question, but as to the second, I can state with a high degree of confidence and supporting data, including LinkUp’s proprietary labor market data, that the answer is most definitely yes. And because the answer to #2 is yes, combined with our bullish NFP forecast for April (net gain of 315,000 jobs), the answer to #3 is a quarter-point raise in June. But before jumping into the first question, it’s worth highlighting the current, chaotic state of the U.S. economy.

I won’t even begin to try to speculate on what GDP growth will be for the remainder of the year, what the likelihood of a recession is in the next 12 months, or what further insanity is in store in this preposterous Presidential election cycle and what impact that might have on the economy and the markets, but the question of how it is possible that the U.S. economy and the U.S. labor market continue to chug along, the bright star among global economies, despite exhibiting the lowest productivity gains in any 5-year period since 1978-1982 is a fascinating one that will likely have deeply serious implications for decades.

The first and easiest (and perhaps laziest) answer, and one that undoubtedly has ample merit, is “Measurement Error.” It is hard to argue the absurdly challenging task of accurately measuring productivity in a post-industrial, service/technology/information/knowledge-based economy. And while that challenge has always existed, many economists believe Measurement Error is becoming increasingly problematic in tracking productivity.

The second explanation, also with much merit, posits that productivity is low due to the fact that we are very early in the investment cycle and that productivity growth will accelerate dramatically in the years to come. Proponents of this view point to a similar period of low investment between 1993 and 1998, which was then followed by explosive growth in productivity in the 2000’s. To be sure, corporate earnings in recent years have been extraordinarily elevated and balance sheets have been awash in cash due to low wages and a dearth of investment in plant and equipment. But investments in technology, research & development, and software ticked up in Q1 and perhaps we’re in for another period of soaring productivity in the next decade along the lines of what we saw over a decade ago.

Another explanation might be the severe lack of government investment over the past decade or so, perhaps even longer. On top of anemic private sector investment, public sector investment has been virtually non-existent since the Great Recession when an insanely misguided austerity fever gripped the nation. Cuts in public dollars invested in education, training, research, large scale projects, public-private partnerships, public works, infrastructure, and transportation, to name just a few, have undoubtedly had a negative effect on the nation’s productivity, and the numbers we are seeing now most likely reflect some of that impact.

And finally, Paul Krugman makes a tremendously compelling case that expanding monopoly power in the U.S. is not only raising profits at the expense of wages, but also reducing competition and the incentive to make investments in innovation and productivity. Not only is such a period of Secular Stagnation, an environment marked by high profits and low investment (which is particularly questionable in a period with such a ridiculously low cost of capital) with persistently sluggish growth except during asset bubbles, perilous for the future of the U.S. economy, but Krugman also contends that it creates a serious impediment to achieving or sustaining full employment.

…a serious impediment, but not an impossibility.

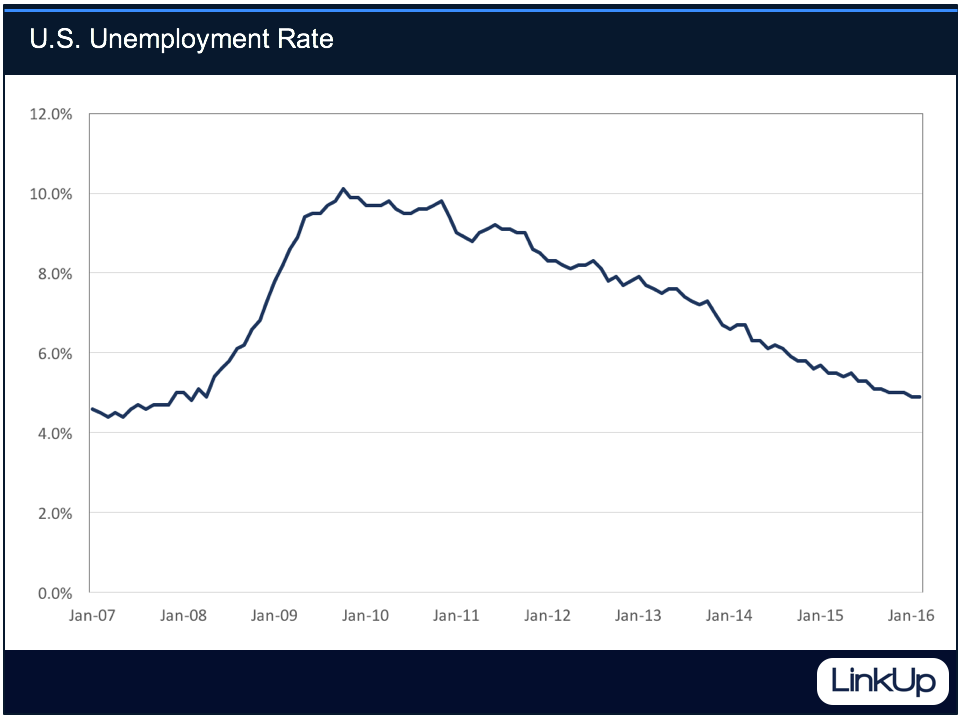

For if one accepts that Full Employment is reached at that level of employment above which inflation is triggered, then we are most definitely at Full Employment. Despite the fact that Fed Chair Janet Yellen recently stated that Full Employment might not be reached until unemployment drops below 4.8% (key word might), there is absolutely no doubt that the current level of employment has started triggering wage inflation. But again, before we get into the debate around whether or not we have hit Full Employment, it’s worth highlighting some data points around the current state of the U.S. labor market.

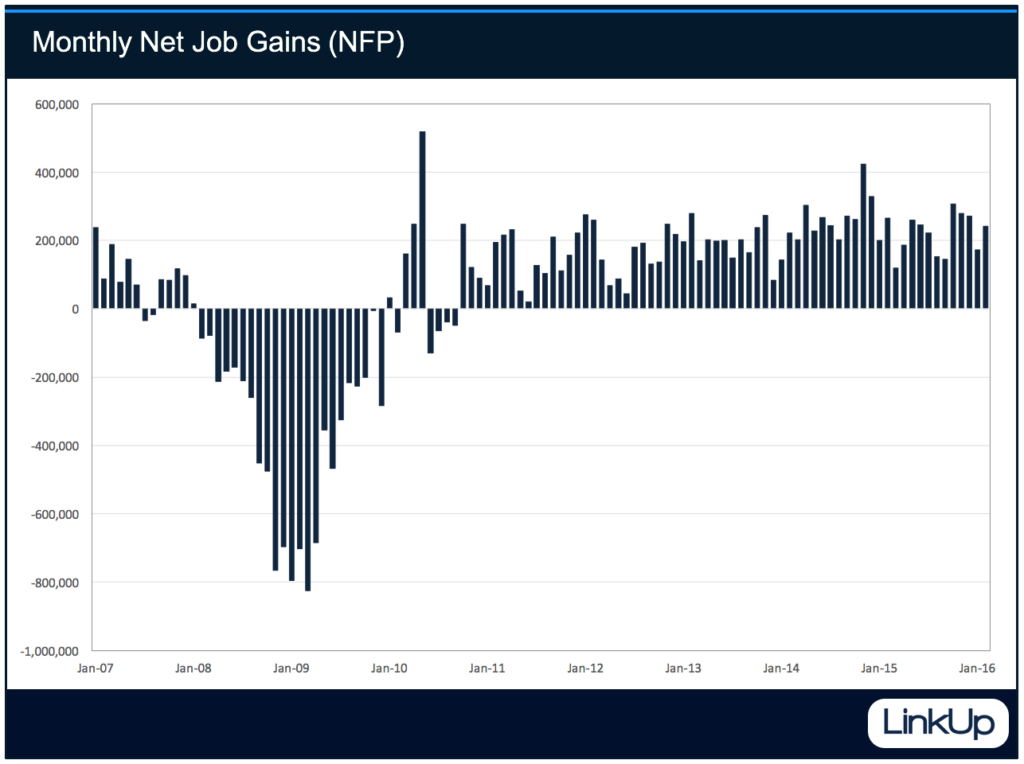

Since September of 2010, we’ve had 66 straight months of positive monthly net job gains.

As a result, unemployment has dropped steadily from 10.1% in October of 2009 to 5.0% in March.

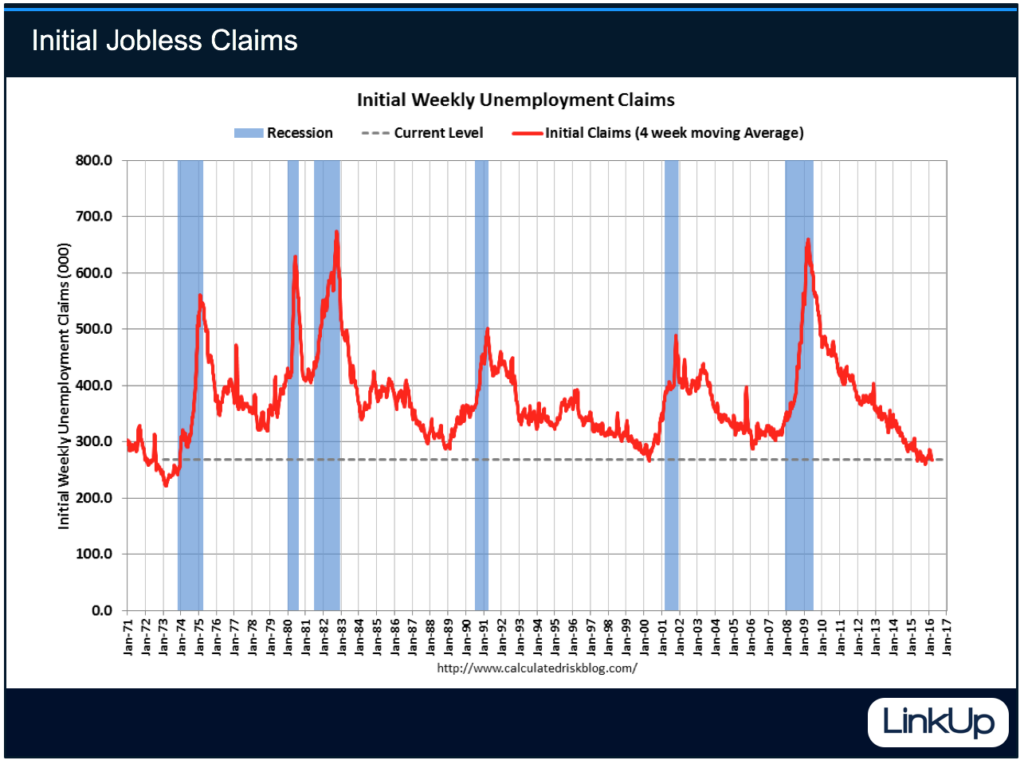

Initial jobless claims are the lowest they’ve been since 1973. (And thanks to Calculatedriskblog.com for some awesome charts – it’s an outstanding site for economic/finance/market data, charts, and commentary).

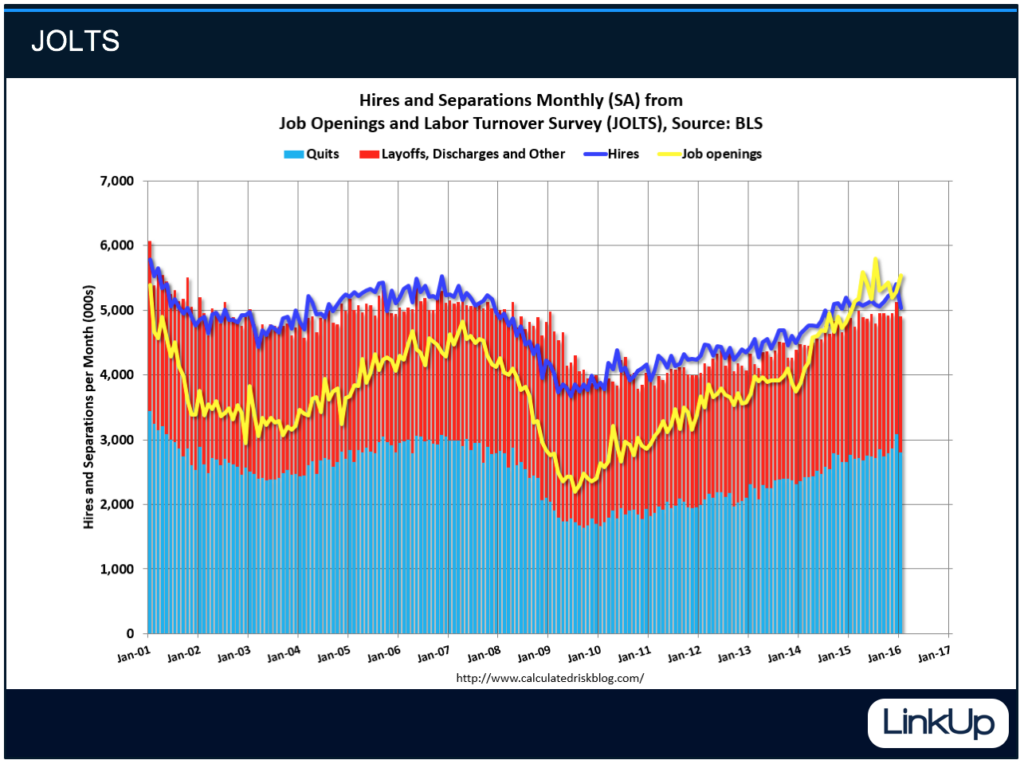

Quits are rising, layoffs are at a 40-year low, and job openings are at an estimated 5.5 million (although that last number is suspect because government figures still do not account for excessive duplication in their job openings data sources).

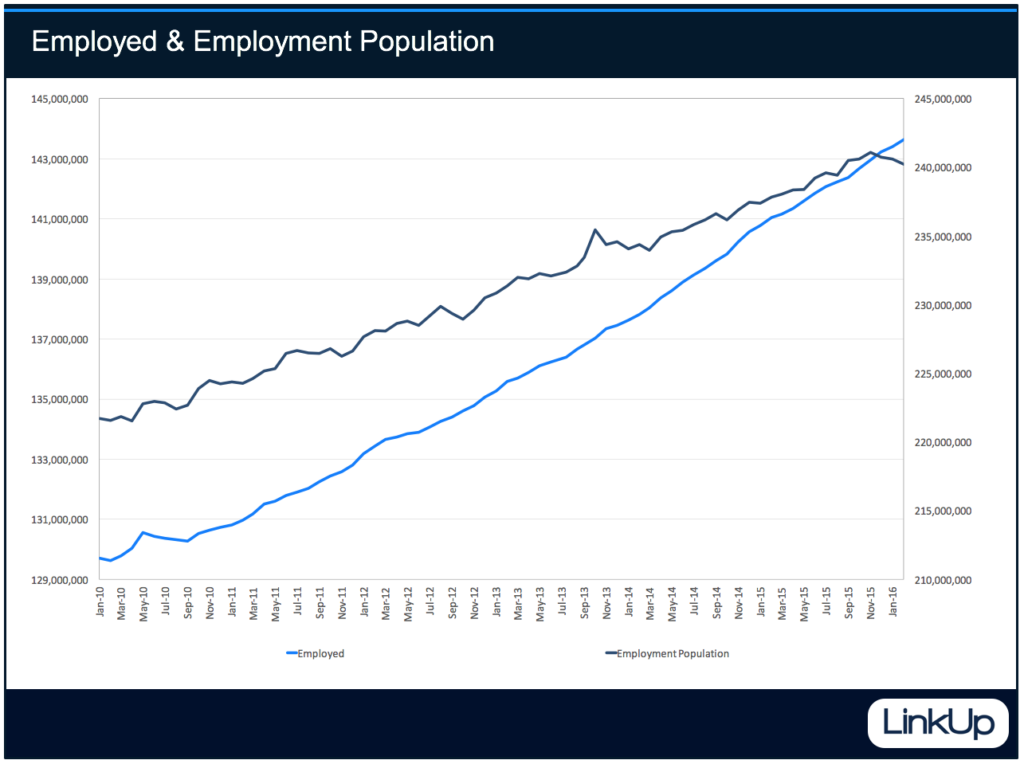

And for the past few years, the number of employed people has grown faster than the employment population.

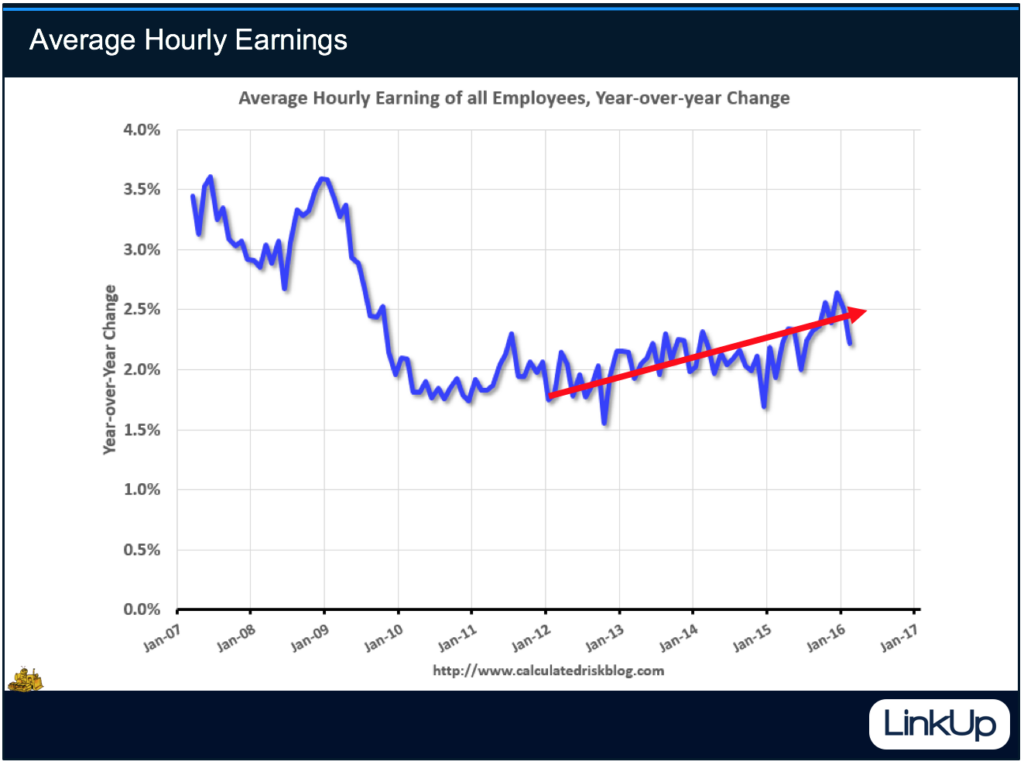

All of this has caused wages to start to increase.

And while the rise in wages has been faint and slow, they are rising. In Q1, in fact, ADP reported that wages for workers in their job for at least a year rose 4.6%, up from a rise of 4.1% in Q4 2015. Add to that the fact that more and more companies are voluntarily raising the wages of their lowest-paid employees and cities and states around the country are raising their minimum wage. Today, just 3.3% of the U.S. workforce is paid the Federal minimum wage of $7.25 an hour, down from 6% in 2010 and the lowest level since 2008.

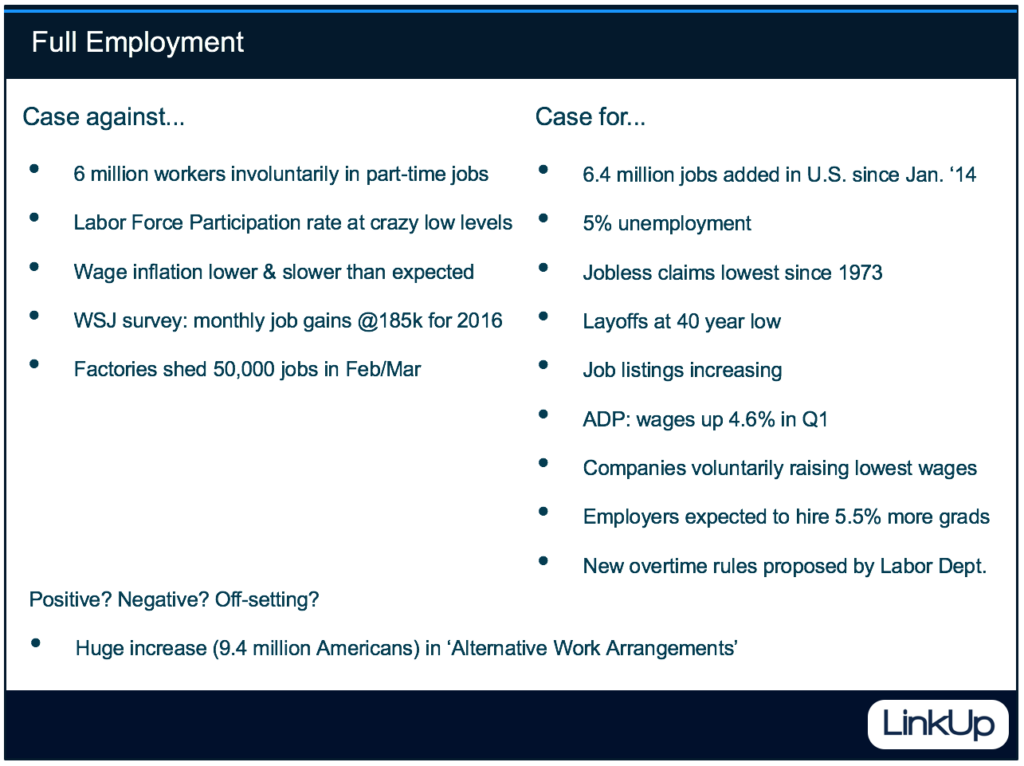

But while the case for Full Employment is overwhelmingly strong, there are a few nagging details surrounding the labor market such as the 6 million people involuntarily working in part-time jobs because they cannot find full-time work and a record low labor force participation rate. Those factors definitely raise questions about whether or not the slack in the labor market has been completely eliminated.

But the low labor force participation rate can be at least partially explained by retiring baby boomers (which is also potentially contributing to low productivity in the U.S.), and the number of involuntary part-time workers is rapidly shrinking. As a great article in the Wall Street Journal recently pointed out, companies are finding that not only does turning what had been a part-time job into a full-time job increase its appeal and make it easier to fill, that full-time worker creates a far better ROI even with the increase in cost.

Similarly, the increase in the past 10 years of 9.4 million people in ‘Alternative Work Arrangements’ such as driving for Uber may or may not reflect slack in the labor market. The growing gig economy might, in fact, reflect a permanent shift for a growing number of people who, for one reason or another, might not take a full-time job even if one were available. Rising wages might reduce that number, but at best, it’s uncertain how much and how that number changes for a given magnitude of wage inflation.

So despite some legitimate questions about how much slack remains in the labor market, that slack, to the extent that it exists at all, is very much at the margin, and there is no doubt whatsoever that continued strength in the labor market is creating upward pressure on wages and salaries. Conclusive evidence already exists, it’s getting stronger and more visible every month, and it’s likely to accelerate with more consecutive months of net job growth.

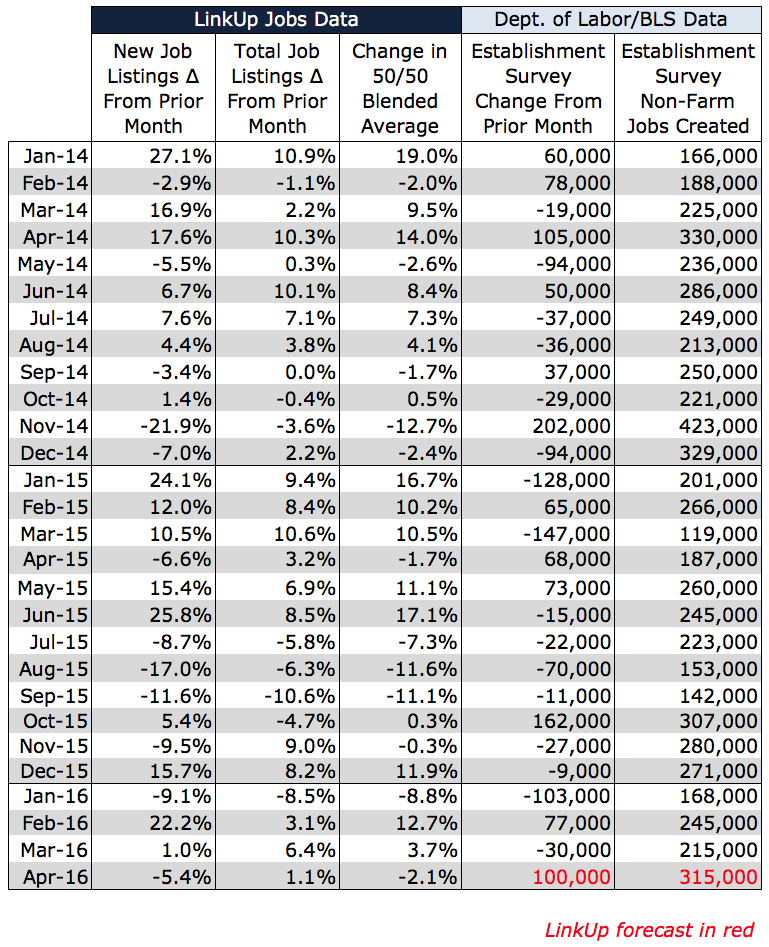

And whatever doubts anyone might still have, they’ll be completely obliterated with Friday’s jobs report for April. Based on LinkUp’s labor market data for February, in which new job openings from company websites rose 22% and total job openings rose 3%, we are forecasting net job gains for April of 315,000 jobs.

Nothing new, but we are once again the outlier among economists surveyed by Bloomberg.

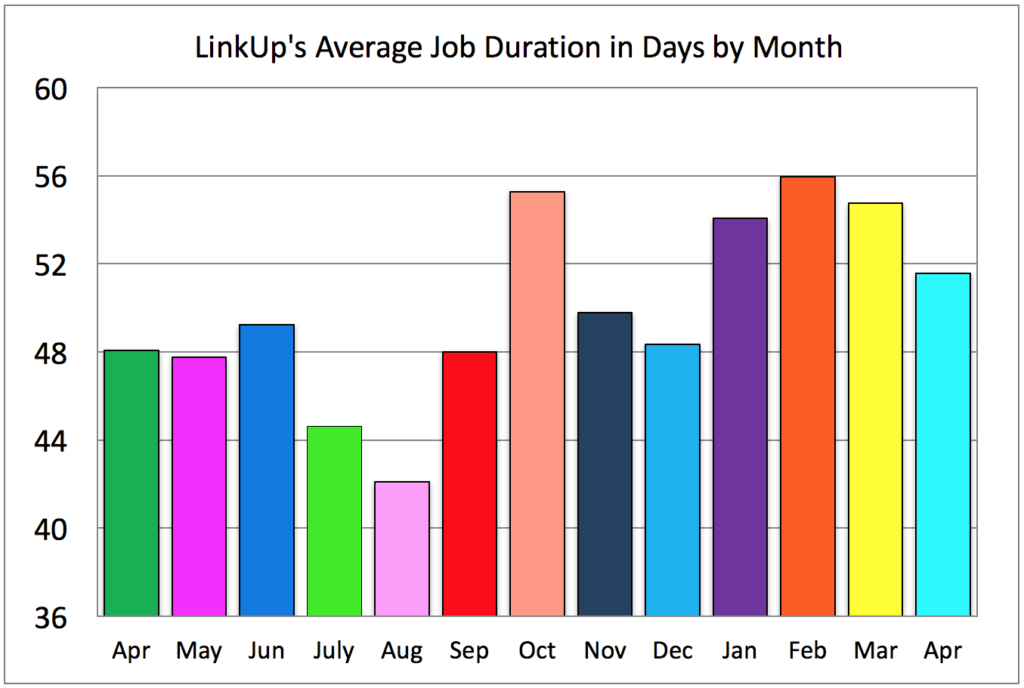

The approximately 60-day lag between February listings and April job gains is driven by what we are seeing in our Job Duration data which is down from 56 days in February but still remains above where it was in 2015. The increase in average job duration in our job search engine (which contains roughly 3.2 million jobs indexed directly from 50,000 company websites which creates a very clean data signal because we eliminate expired listings, duplicate listings, and job board pollution) from last August reflects the fact that companies are finding it harder to fill openings in a tightening labor market. I’d further speculate that the decline in job duration since February is the result of more people entering the workforce, a higher number of quits, people moving from part-time to full-time work, rising wages, and an increase in overall labor market fluidity or ‘liquidity.’

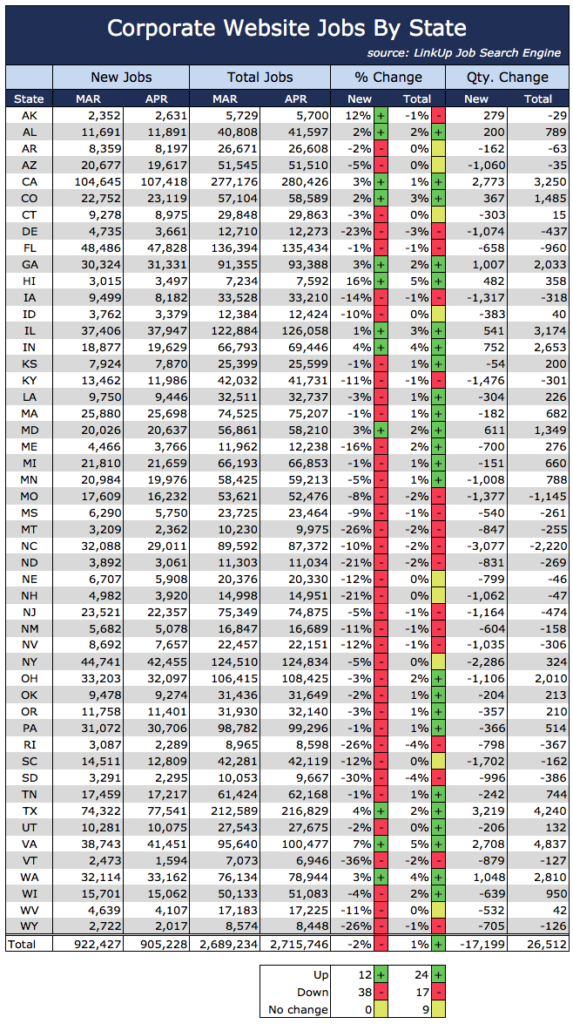

In April, new jobs by state fell 2% and total jobs rose 1%, but we’ll get another reading for April next month when we pull data comparing April to May, so it’s too early to forecast precisely what job growth will look like in June. At a minimum, it’s safe to say that monthly job gains should remain solid through at least the end of Q2.

And if trends over the last few years hold up in 2016, and there is every reason to believe they will, job gains in Q2 should come in somewhere between 700,000 – 800,000 jobs.

Such sustained levels of job growth (even after a likely downward revision of March’s NFP to somewhere below 200,000 jobs) would further drive up wages. Given declining corporate profits and low productivity, companies would most likely pass along the increased costs to their customers, resulting in fairly rapid inflation. That in turn, would likely result in a June rate hike by the Fed.

And while I’m in the mode of predicting the future, I’ll jump back to my obsession with Game of Thrones with a prediction that it will be Bran and his ability to see the past that will unlock the truth behind R+L=J.

We will be hosting a webinar on Full Employment on Wednesday, May 18th, at 1:00PM CST. Or watch the Full Employment webinar.

Oh, and one more thing…

Insights: Related insights and resources

-

Blog

01.03.2019

The Wage Inflation Narrative Is About To Be Upstaged By A Nasty Jobs Report

Read full article -

Blog

05.31.2018

The Phillips Curve Is Not Dead; Beware (or Cheer) The Paulsen Inflection Point

Read full article -

Blog

03.26.2018

LinkUp Forecasting Net Gain of 235,000 Jobs In March; Wage Inflation Will Accelerate in Months Ahead

Read full article -

Blog

08.17.2016

Full Employment

Read full article -

Blog

08.05.2016

Despite the Chaos Syndrome, LinkUp Is Forecasting That The U.S. Added 215,000 Jobs In July

Read full article -

Blog

06.01.2016

Solid May Jobs Report & Full Employment Environment Will Push Fed To Raise Rates In June

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.