Answering sustainability questions with employment data

In recent years a large growth in the number of Environmental, Social and Governance (ESG) funds can be observed. The premise of this, on its face, is great for the world as a whole.

In recent years a large growth in the number of Environmental, Social and Governance (ESG) funds can be observed. The premise of this, on its face, is great for the world as a whole. Money starting to flow into companies that are trying to impact the world in a positive way is a win for everyone. Investors may see returns, managers collect fees, and environmental and social progress is made as a result of the capital inflows.

Regulators are now starting to implement rules to ensure funds that claim to be investing in ESG actually are, in fact, making sustainable investments.

The European Union recently implemented rules that can be found in Sustainable Finance Disclosure Regulation. These rules include:

- How their remuneration policies are consistent with the integration of sustainability risks

- Products that promote environmental or social characteristics

- Products that have sustainable investment as an objective

- Environmental, sustainability characteristics promoted by a product

- How sustainability indicators perform

- Actions taken to attain the sustainable investment objective during the reference period

- Sustainability indicators used to measure the attainment of the environmental or social characteristics promoted

LinkUp’s job listing dataset can help funds to meet some of these rules, as well as identify companies, both large and small, that are starting to make sizable investments into sustainability.

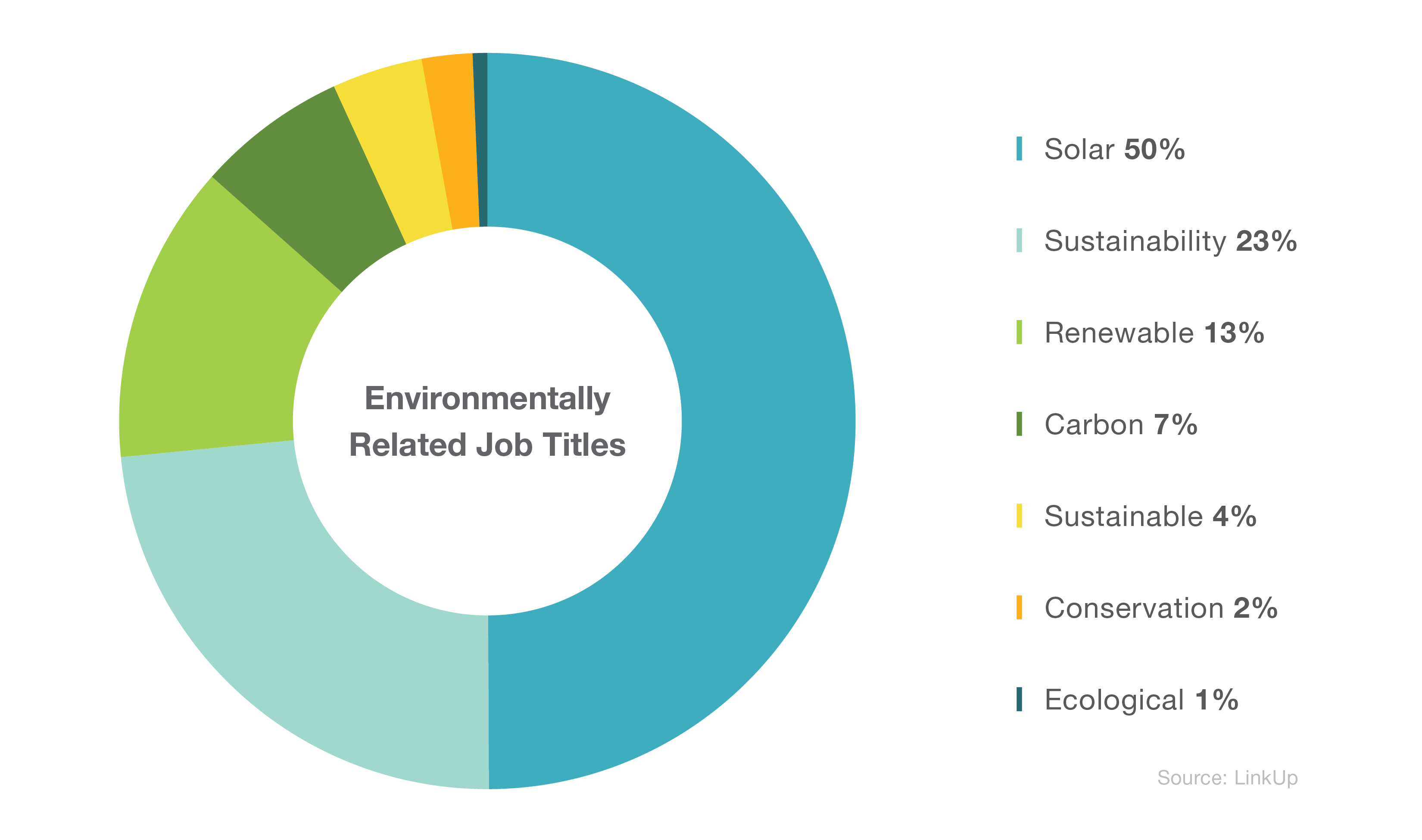

At the time of this writing LinkUp’s dataset has 71,000 jobs with titles that include at least one of the following keywords:

- sustainable

- sustainability

- carbon

- renewable

- solar

- conservation

- ecological

Using these jobs, we can identify companies that are investing human capital into sustainability-related roles.

Keeping in mind the above graph, it’s no surprise that jobs with titles related to solar are dominating our dataset.

Examining the jobs by location we can see that, interestingly, Camarillo is the location with the majority of these roles. Following Camariillo, we also see heavy clusters on the West Coast. It is also noteworthy that, although only US job listings are pictured, London had a large amount of solar jobs as well.

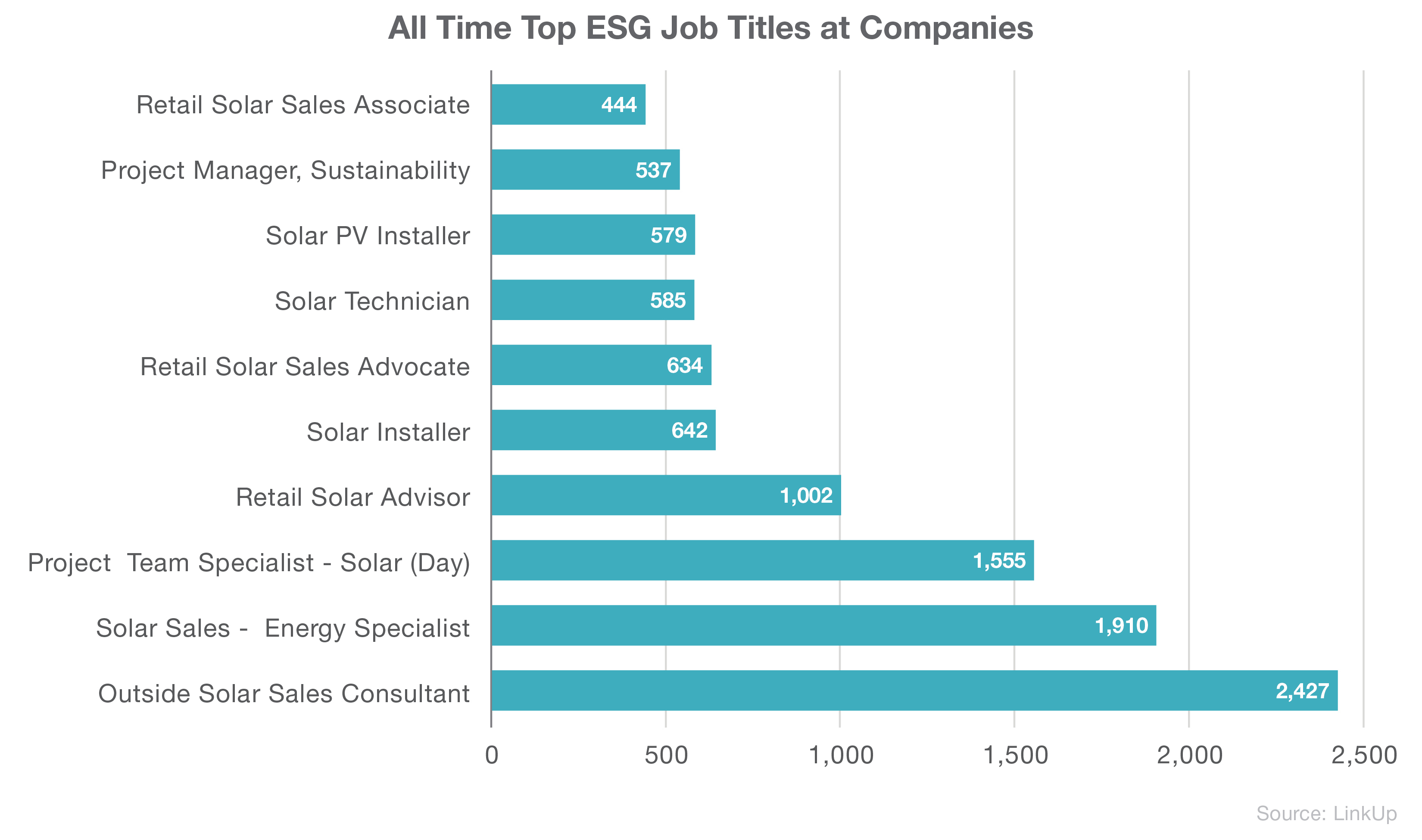

While this information gives a good indication of the sustainable hiring landscape overall, it doesn’t give us great insight into specific companies or how we might use those factors identified to find ESG opportunities. Drilling down to the company level, we’re able to learn more.

It is at this point that we can start to answer some of the questions regarding regulations discussed earlier. Examining company level data, we are able to identify businesses that are prompting environmental improvements with the jobs for which they hire.

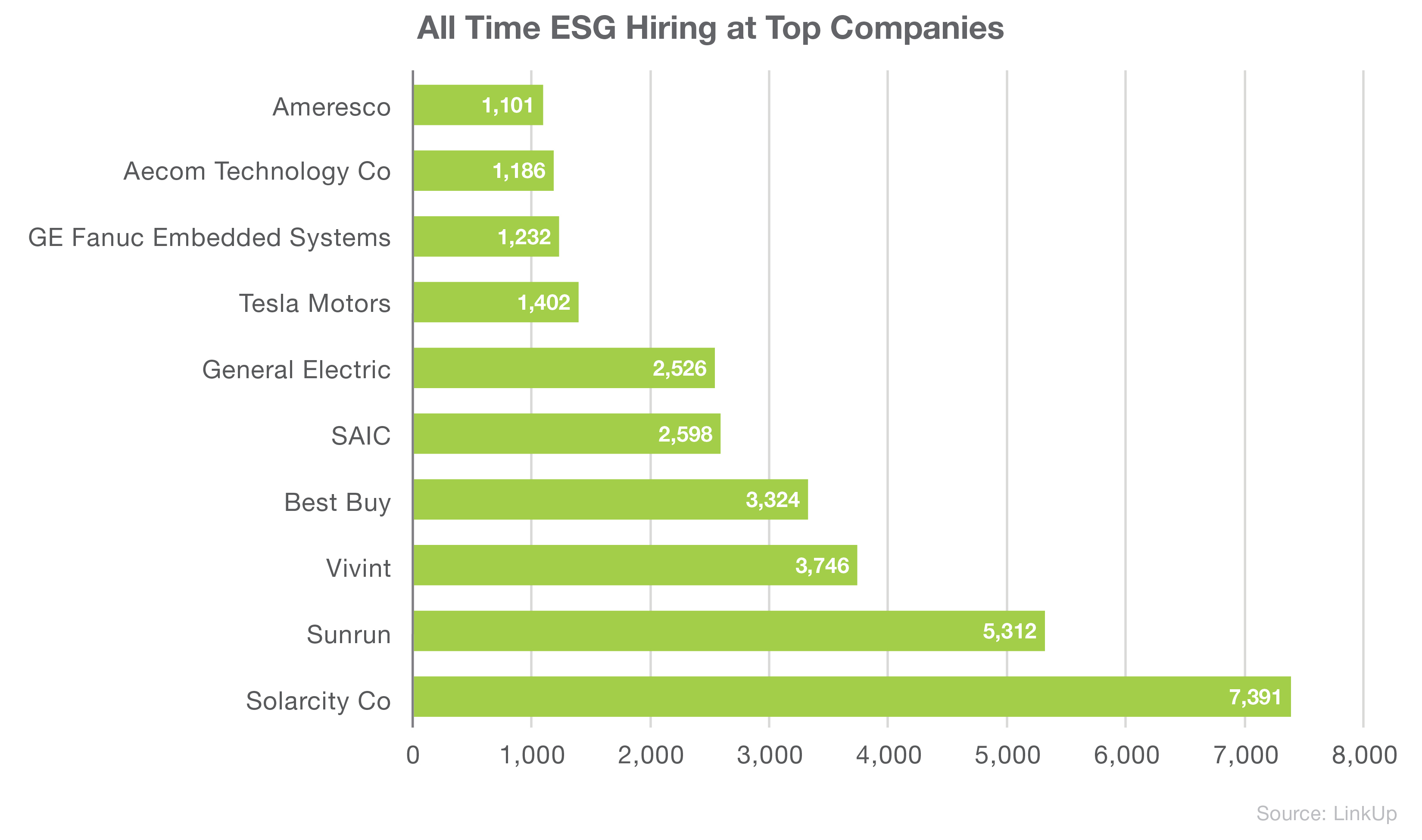

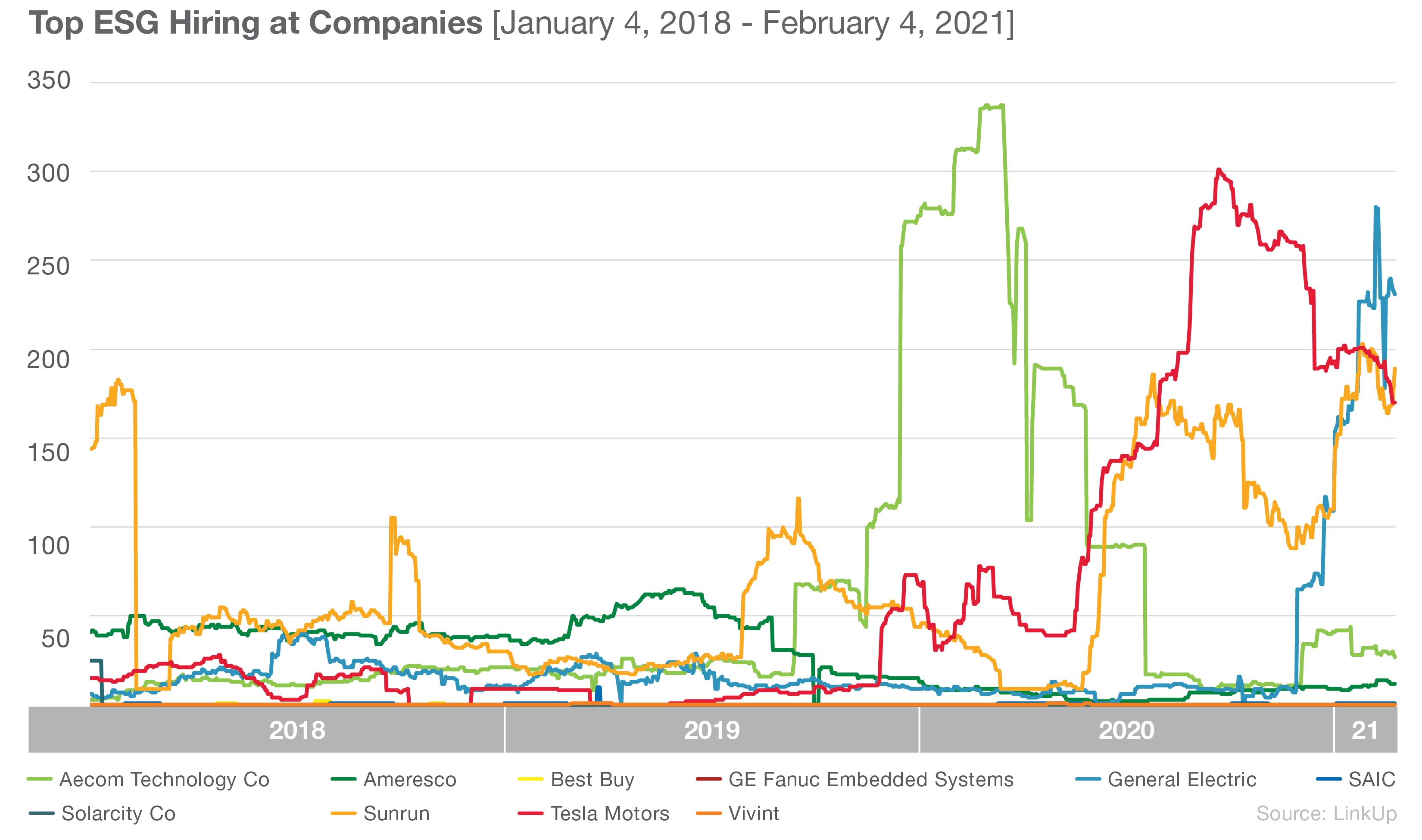

This is where things start to get interesting, and trend analysis can go into multiple directions. The graph below brings up two particular points of interest. The first being the question of what Best Buy is doing in terms of growing its sustainability-related roles. The second is what the growth of these roles will look like over time.

Momentarily shelving the Best Buy question, we will circle back to our original challenge of identifying and showing sustainable investments by these companies.

We see that the growth can be observed in the last couple of years for sustainability-related roles. Unsurprisingly, we see Tesla and Sunrun both doing large amounts of hiring lately in this area.

More unexpected is that GE sustainability hiring, at the moment, seems to be soaring. For those holding GE, this could be useful data on how they are trying to integrate sustainability into their business model. Looking at titles for their job listings, we can see a large number of listings seeking a “Sustainable Fuels Analyst.” This could be an indicator of a new type of engine powered by sustainable fuel that GM has in development. Another interesting point of data is that there are 50 postings for “Business Development Lead (Renewable Market Services Agreements)” which could possibly indicate an increased demand from these customers.

Circling back to our Best Buy question, evaluating what types of sustainable roles the company is hiring for could potentially give us insights into a new division. In Best Buy’s case, it seems they were hiring for solar specialists in and around 2016, but it appears they have stopped hiring for these titles. This could be an indicator that the solar market was becoming too competitive, and the company may have decided it was no longer worth pursuing.

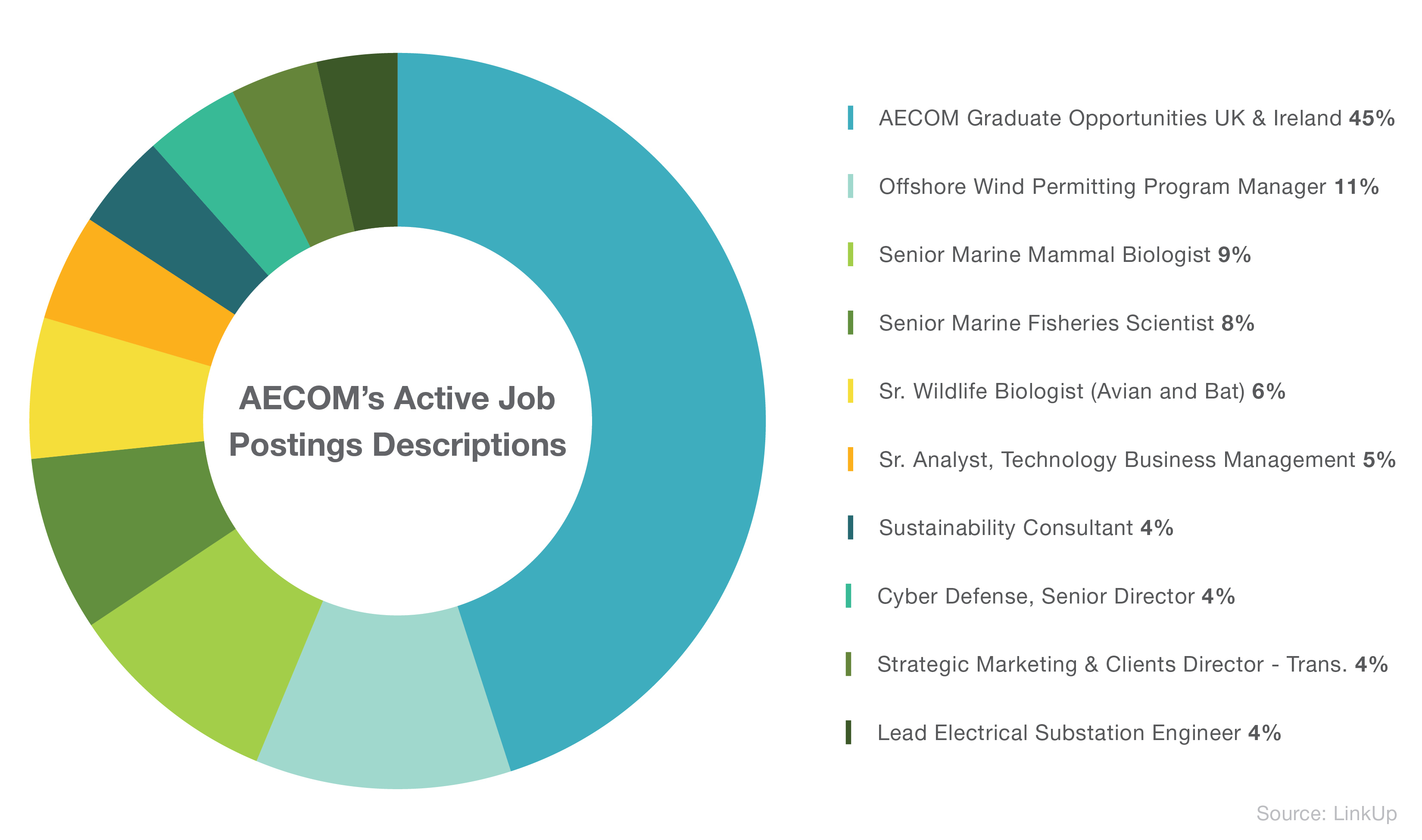

Drilling down another level, looking at active job postings descriptions, AECOM has large amounts of postings with ‘sustainable’ or ‘sustainability’ within the description; evidence of a company that may be making progress towards sustainability goals.

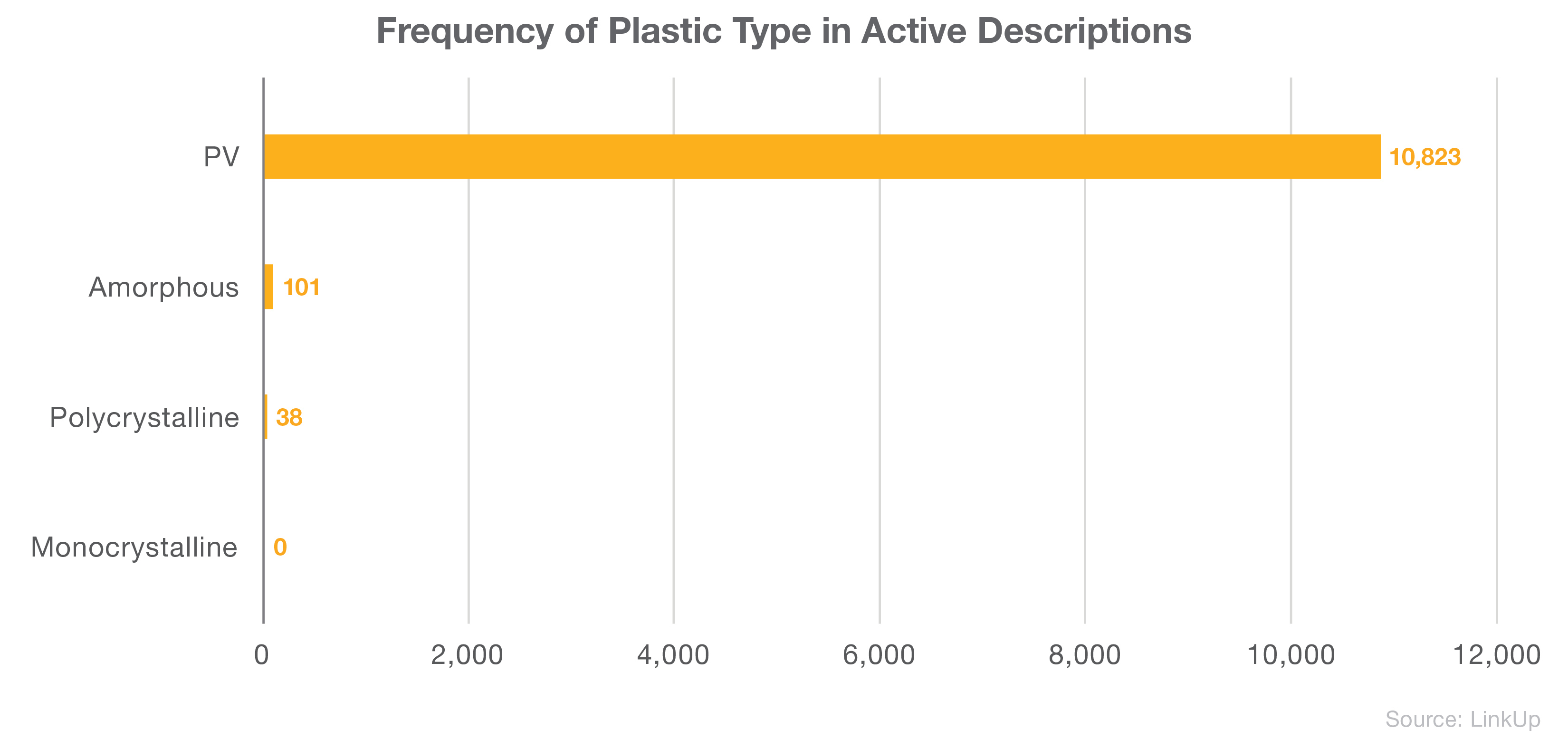

The same methodology can be used to search job descriptions to find growth in technologies, skills, or processes. For example, looking at active descriptions to see what type of solar material is most frequently mentioned could be an indicator of current market share.

Below, using the keywords ‘PV,’ ’amorphous,’ ‘polycrystalline,’ or ’monocrystalline,’ we can see that, as of today, PV seems to be the predominantly used technology.

This examination could also be done on a historical basis to see what growth looks like over time.

Interested in the data powering this post? Contact us to learn more.

Insights: Related insights and resources

-

Blog

01.11.2022

ESG investing on the rise

Read full article -

Blog

10.11.2021

EVs steering Ford’s future

Read full article -

Blog

01.29.2021

Meme stock melee: do GameStop jobs match their recent stock rally?

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.