Accountants and tax preparers beware: The bots may be coming for you!

It’s no secret that AI will change the employment landscape in the future, but oftentimes the focus is on low-wage, low-skill jobs. There’s more to the story. Many high-skill jobs could be impacted as well. A prime example is finance.

It’s no secret that AI will change the employment landscape in the future, but oftentimes the focus is on low-wage, low-skill jobs. There’s more to the story. Many high-skill jobs could be impacted as well. A prime example is finance.

You may have recently visited your tax preparer, but will you do the same annual trek in five years, or, will AI fulfill your needs? Accounting is another profession primed for impact by fintech. Will companies maintain entire teams of accountants, or will they whittle those down to a skeleton crew thanks to bots that can do significant portions of the job faster, cheaper and more accurately?

According to the infamous NPR calculator that predicts how likely it is a machine will do a particular job in the future, tax preparers have a 98.7 percent chance of being automated. Accountants and auditors fare only slightly better, with a 93.5 percent chance of being automated.

These numbers are loose predictors for 20 years out. Research for the near future is a little muddier. In fact, O*Net classifies accountants as a Bright Outlook Occupation, which they define as expected to grow rapidly in the next several years or will have a large number of job openings.

Because we’re in the business of job listings, we decided to dig into our own job data to better understand what hiring looks like today and what it has looked like in recent years.

Historical trends

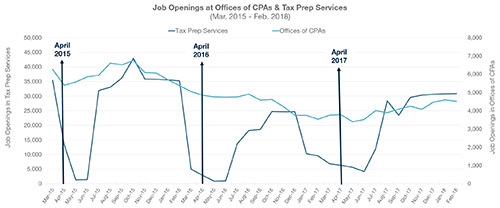

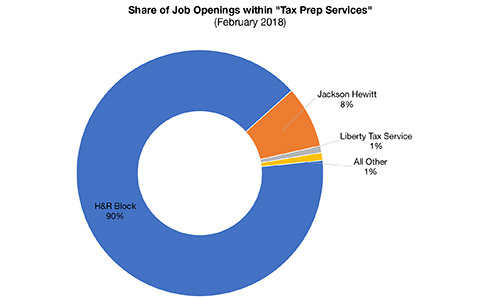

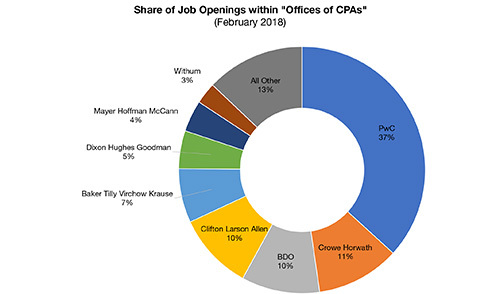

There are two industries that primarily employ accountants: Offices of Certified Public Accountants (NAICS code=541211) and Tax Preparation Services (NAICS code=541213). Companies classified as Offices of CPAs tend to offer professional audit, tax and consulting services. Examples are PricewaterhouseCoopers (PwC) and CliftonLarsonAllen. Companies in the Tax Prep Services industry focus only on annual tax preparation. Examples include H&R Block, Jackson Hewitt and Liberty Tax Service.

While both industries have seen a decline in overall job openings in the last three years, the cyclical pattern of job openings in each industry is very different. Offices of CPAs have a fairly stable pattern of job openings with minimal spikes throughout each year. Big firms such as PwC tend to support the auditing and tax needs of companies throughout the year and therefore do not have the annual April 15 deadline that tax preparation companies do. On the other hand, Tax Prep Services have to staff up every year for the annual tax deadline. For the past three years, it appears the big push to hire CPAs or tax preparers starts around October of the previous year.

Current job offerings

H&R Block dominates the share of job openings in the Tax Prep Services industry, representing 90 percent of all current job openings. On the other hand, the CPAs industry is much more fragmented, with PwC representing only 37 percent of all job openings.

Growth vs. momentum

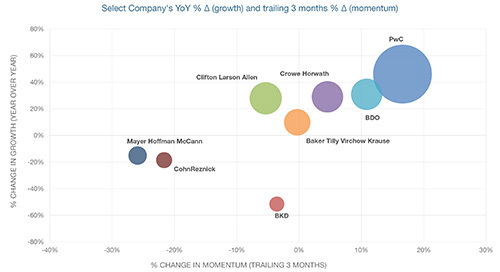

Since the Offices of CPAs industry has more competition and is less cyclical in hiring, it makes sense to look at growth versus momentum. PwC not only has the largest share of job openings, it also has been increasing those job openings in terms of long-term growth and short-term momentum. Several of the small firms, such as Mayer Hoffman McCann, Cohn Reznick and BKD, have declining job growth and momentum.

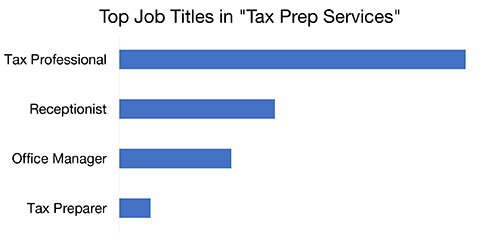

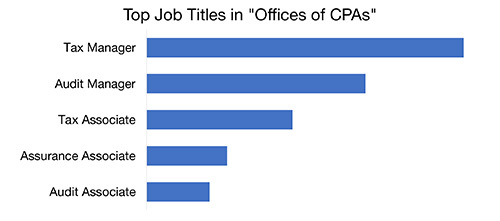

Top job titles by industry

For the top job titles with job openings, both industries are looking for front-line staff as well as managers of that staff. In the Tax Prep Services industry, front-line workers are referred to as Tax Professionals, Receptionists or Tax Preparers. Management is referred to as Office Managers. In the CPAs industry, front-line workers are called Tax Associate, Assurance Associate or Audit Assurance. Management is referred to as Tax Managers or Audit Managers.

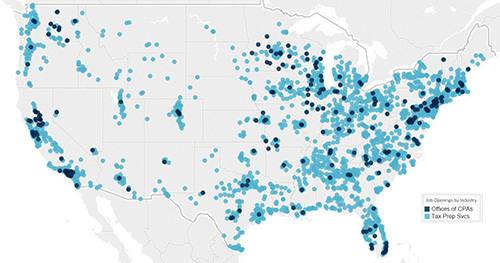

Location of job openings in the U.S.

Both industries have job openings throughout the U.S. As expected, hiring concentrations of job openings are located around major cities.

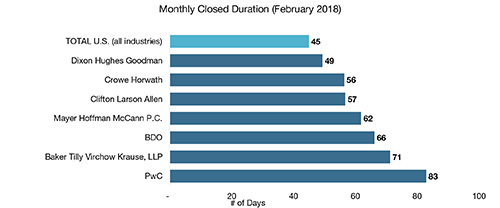

Job Duration for Offices of CPAs

Job Duration measures how quickly a company can fill its open positions. Among the companies in the Offices of CPAs industry, Dixon Hughes Goodman filled its open positions in February the fastest, at an average of 49 days, while PwC filled its positions the slowest, at an average of 83 days. However, all the top companies in this industry filled jobs slower last month than the U.S. average, which is 45 days. (Note: Due to the high number of job openings in the Tax Prep Services industry and the larger turnover, we aren’t showing duration for firms such as H&R Block or Liberty Tax Service.)

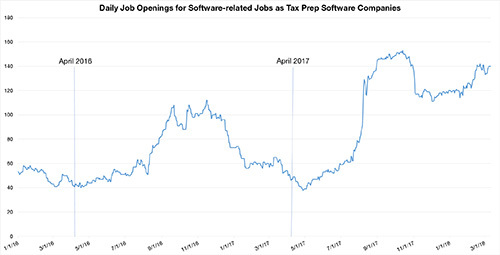

Job openings among companies that sell tax software

In addition to offering in-person tax preparation, several of the Tax Prep Services companies offer software tools for tax payers to file taxes themselves. Chart 7 shows daily job openings within the Software category at several of the top tax prep software providers, including: Intuit (TurboTax), Xero, H&R Block, Credit Karma and Jackson Hewitt. The pattern shows increases in software-related job openings in the fall (about November) and sharp declines in job openings around April for the last two years.

While it’s clear these professions aren’t going away in 2018, there does appear to be reduced hiring, particularly in cyclical tax-related jobs. Just as in any profession facing an evolution, it’s best for companies in this sector to embrace technology to stay ahead of the curve rather than getting lapped by the robotic competition.

If you're interested in learning more about the job data behind this post, feel free to contact us.

Insights: Related insights and resources

-

Blog

05.03.2022

NVIDIA jobs jump too

Read full article -

Blog

09.01.2021

Get a Shot and Wear a Mask to Save Lives and Help the Job Market. Jabs and Jobs!

Read full article -

Blog

06.03.2021

LinkUp Forecasting Net Gain of 850,000 Jobs In May 2021

Read full article -

Blog

12.18.2020

Cannabis Jobs Report: the green wave

Read full article -

Blog

12.05.2019

Labor Market "Canary In the Coal Mine" May Have Died In November; LinkUp Forecasting Weak Job Growth of Just 80,000 Jobs

Read full article -

Blog

06.05.2019

LinkUp Forecasting Robust Job Gains of 290,000 for May

Read full article