June 2023 Jobs Recap: Labor Demand Breakdown

Labor demand heats up in June 2023 with increases across all industries and occupations.

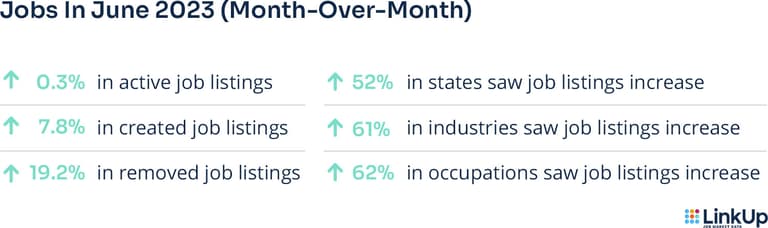

Summer must be heating up, because in June we saw a 7.8% increase in the amount of job listings created after falling short for the last two months. This includes 52% of U.S. states that saw a job listings increase and 61% of U.S. industries saw a boost too.

However, LinkUp job data also saw a surge of 19.2% in removed job listings. Could this mean more layoffs in the U.S.?

CLOSED DURATION

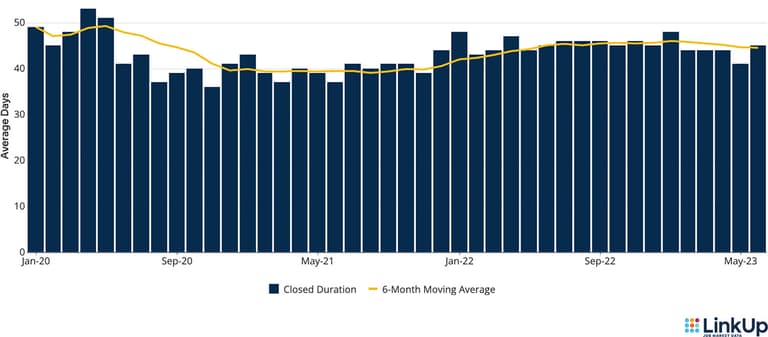

Closed duration, or the average number of days job listings are posted on company websites before they are removed, tracks hiring velocity across the entire U.S. economy. As the average number of days a job listing remains live increases, hiring velocity slows.

The closed duration has mostly plateaued for the last year and a half. In June, job listings remained open for an average of 45 days in comparison to 41 days in May, an increase of 9.8%.

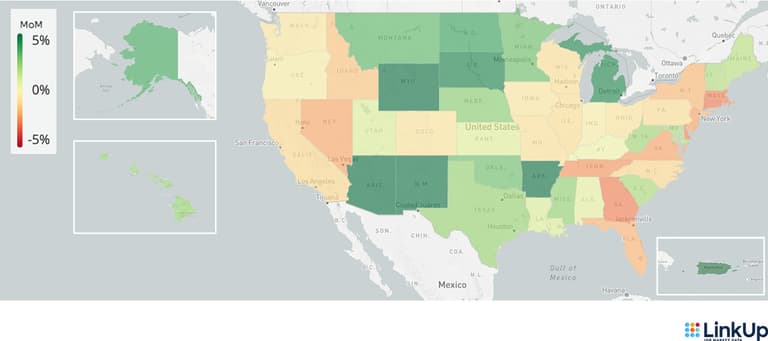

JOBS DATA BY STATE

In June, 52% of the U.S. had an increase in labor demand and Arizona was the largest contributor. The states that experienced the most demand included:

Arizona (+19.9%)

Wyoming (+6.4%)

Puerto Rico (+5.9%)

Arkansas (+5.4%)

New Mexico (+4.9%)

As far as a decline in active job listings, we saw the most change on the East Coast with:

Rhode Island (-3.0%)

Connecticut (-3.0%)

Delaware (-2.9%)

Massachusetts (-2.8%)

Georgia (-2.8%)

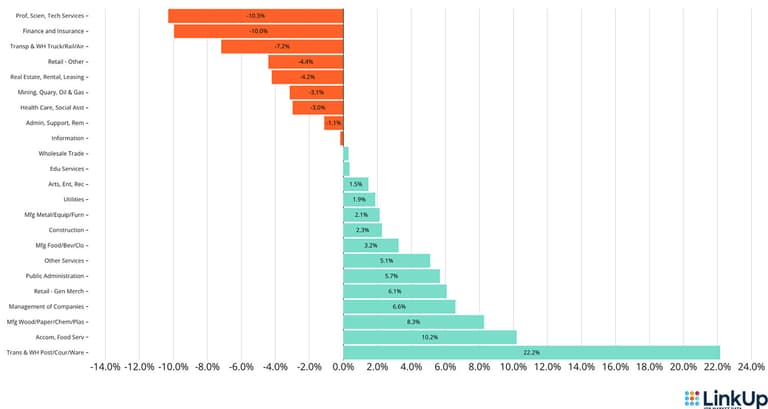

JOBS DATA BY INDUSTRY (NAICS)

U.S. industries had a 61% increase in job listings in comparison to May. The following industries experienced the biggest boost:

Transportation & Warehousing (Postal/Couriers/Warehousing) (+22.2%)

Accommodation & Food Services (+10.2%)

Manufacturing (Wood/Paper/Chemicals/Plastics) (+8.3%)

Management of Companies and Enterprises (+6.6%)

Historically, LinkUp data continues to show a steady decline in job listings for Professional, Scientific and Technical Services, which has been slowing down since January 2022. In total, the industry’s job listings have declined by 55.6%. There’s been a similar trend in Finance and Insurance, too. Just this time last year, Finance and Insurance had 413K listings in comparison to this year 204K—a 50.6% decline.

A couple of industries that have gained momentum since June 2022 are Accommodations & Food Services and Public Administration. Accommodations & Food Services started to take off in December 2022 (+20.8%), while Public Administration has more than doubled in active job listings since October 2022 (+120.5%). It’ll be interesting to see where these industries are going.

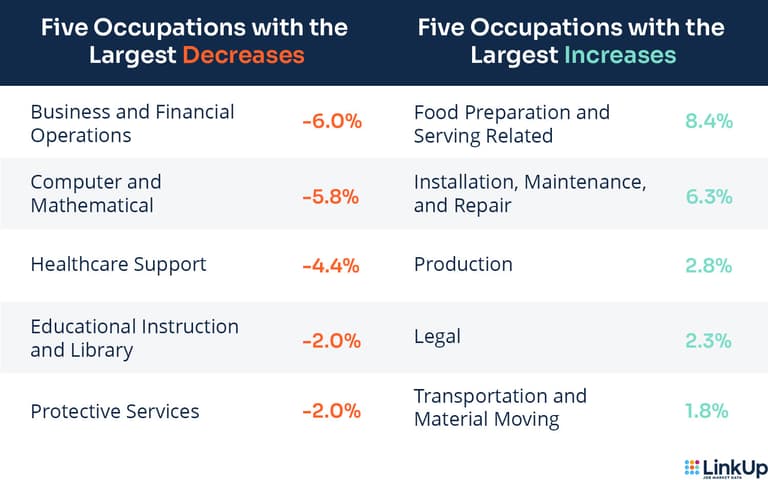

JOBS DATA BY OCCUPATION (O*NET)

Now, let’s look at active U.S. job listings from the perspective of occupations.

Compared to this time last year, LinkUp data shows growth for only two occupations:

Food Preparation and Serving Related (+13.7%)

Personal Care and Service (+4.3%)

On the other hand, occupations that saw the greatest decline in the last 12 months are:

Computer and Mathematical (-49.6%)

Arts, Design, Entertainment, Sports, and Media (-42.1%)

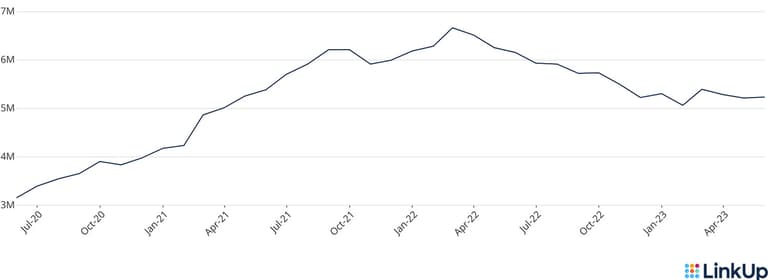

LINKUP 10,000

The LinkUp 10,000 is an analytic published daily and monthly that captures the total U.S. job openings from 10,000 global employers in LinkUp’s jobs dataset with the most U.S. job openings.

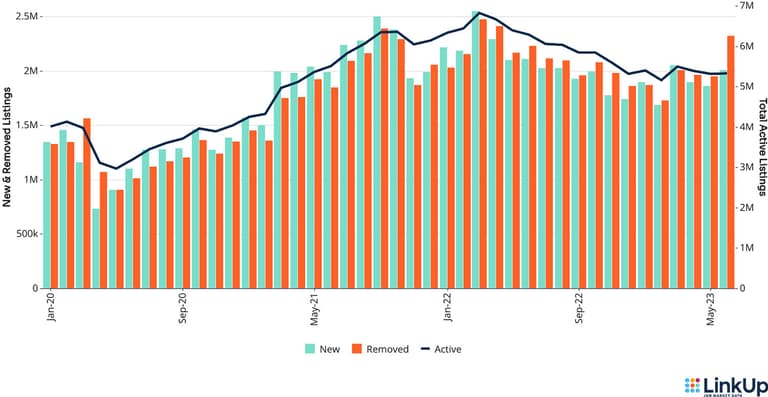

Since this time last year the LinkUp 10,000 shows a 15.0% decline, however job listings have plateaued, sitting just above 5 million. From May to June, we saw only a +0.3% change.

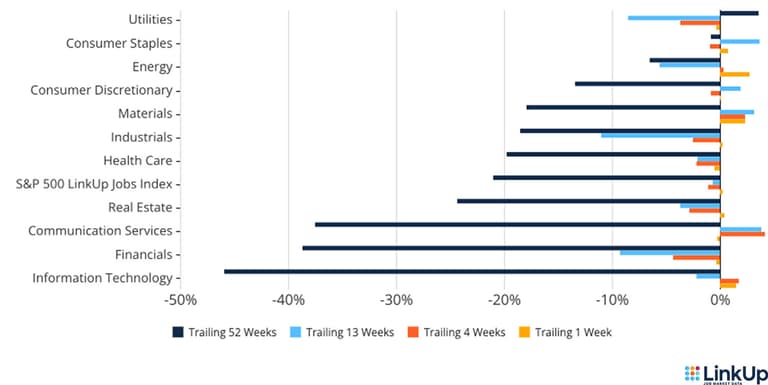

S&P 500 LINKUP JOBS INDEX

The S&P 500 LinkUp Jobs Index is designed to measure open jobs posted by the companies in the S&P 500 and is published on the S&P website. It can be viewed in aggregate or by sector.

The S&P 500 LinkUp Jobs Index shows listings were down 1.2% over the past 4 weeks, with an increase to:

Communication Services (+4.2%)

Materials (+2.3%)

Information Technology (+1.7%)

Sectors experiencing the largest drop in demand were:

Financials (-4.4%)

Utilities (-3.7%)

Real Estate (-2.9%)

DATA DISCLAIMERS

LinkUp’s monthly data recaps incorporate revisions to previously-reported monthly data with the purpose of reporting the most accurate and up-to-date data points. For more information on what circumstances may impact data revisions, visit our Data Support Center.

Insights: Related insights and resources

-

Blog

04.10.2025

LinkUp Forecast: March JOLTS report by the BLS

Read full article -

Blog

04.09.2025

March 2025 Jobs Recap: Labor demand up from February, but underlying volatility spells long term trouble.

Read full article -

Blog

04.07.2025

This Week in Jobs Data: 23andMe Bankruptcy, OpenAI Hiring Surge, TikTok Slowdown, and DC Job Cuts

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.